Answered step by step

Verified Expert Solution

Question

1 Approved Answer

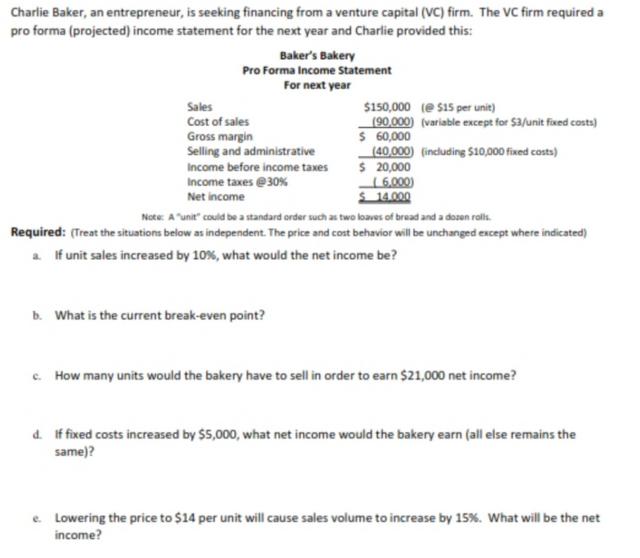

Charlie Baker, an entrepreneur, is seeking financing from a venture capital (VC) firm. The VC firm required a pro forma (projected) income statement for

Charlie Baker, an entrepreneur, is seeking financing from a venture capital (VC) firm. The VC firm required a pro forma (projected) income statement for the next year and Charlie provided this: Baker's Bakery Pro Forma Income Statement For next year Sales Cost of sales Gross margin Selling and administrative Income before income taxes Income taxes @30% Net income $150,000 (@$15 per unit) (90,000) (variable except for $3/unit fixed costs) $ 60,000 b. What is the current break-even point? (40,000) (including $10,000 fixed costs) $ 20,000 6,000) 14.000 Note: A "unit" could be a standard order such as two loaves of bread and a dozen rolls. Required: (Treat the situations below as independent. The price and cost behavior will be unchanged except where indicated) a. If unit sales increased by 10%, what would the net income be? c. How many units would the bakery have to sell in order to earn $21,000 net income? d. If fixed costs increased by $5,000, what net income would the bakery earn (all else remains the same)? e. Lowering the price to $14 per unit will cause sales volume to increase by 15%. What will be the net income?

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Average Monthly Return in The average monthly return in is calculated by taking the sum of all the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started