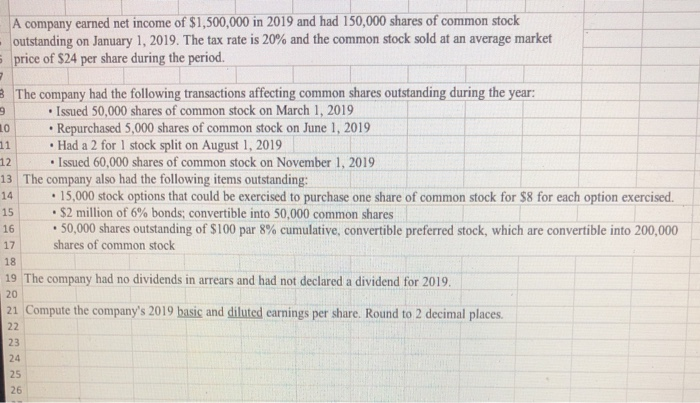

A company earned net income of $1,500,000 in 2019 and had 150,000 shares of common stock outstanding on January 1, 2019. The tax rate is 20% and the common stock sold at an average market price of $24 per share during the period. 3 The company had the following transactions affecting common shares outstanding during the year: Issued 50,000 shares of common stock on March 1, 2019 Repurchased 5,000 shares of common stock on June 1, 2019 Had a 2 for 1 stock split on August 1, 2019 Issued 60,000 shares of common stock on November 1, 2019 The company also had the following items outstanding: 15,000 stock options that could be exercised to purchase one share of common stock for $8 for each option exercised. - $2 million of 6% bonds, convertible into 50,000 common shares 50,000 shares outstanding of $100 par 8% cumulative, convertible preferred stock, which are convertible into 200,000 shares of common stock 19 The company had no dividends in arrears and had not declared a dividend for 2019. 21 Compute the company's 2019 basic and diluted earnings per share. Round to 2 decimal places. A company earned net income of $1,500,000 in 2019 and had 150,000 shares of common stock outstanding on January 1, 2019. The tax rate is 20% and the common stock sold at an average market price of $24 per share during the period. 3 The company had the following transactions affecting common shares outstanding during the year: Issued 50,000 shares of common stock on March 1, 2019 Repurchased 5,000 shares of common stock on June 1, 2019 Had a 2 for 1 stock split on August 1, 2019 Issued 60,000 shares of common stock on November 1, 2019 The company also had the following items outstanding: 15,000 stock options that could be exercised to purchase one share of common stock for $8 for each option exercised. - $2 million of 6% bonds, convertible into 50,000 common shares 50,000 shares outstanding of $100 par 8% cumulative, convertible preferred stock, which are convertible into 200,000 shares of common stock 19 The company had no dividends in arrears and had not declared a dividend for 2019. 21 Compute the company's 2019 basic and diluted earnings per share. Round to 2 decimal places