Answered step by step

Verified Expert Solution

Question

1 Approved Answer

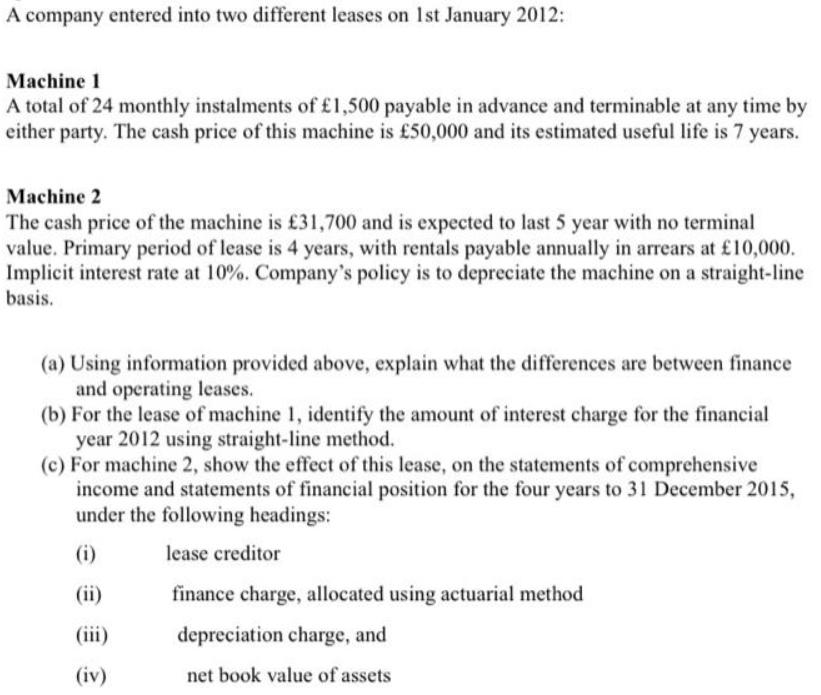

A company entered into two different leases on Ist January 2012: Machine 1 A total of 24 monthly instalments of 1,500 payable in advance

A company entered into two different leases on Ist January 2012: Machine 1 A total of 24 monthly instalments of 1,500 payable in advance and terminable at any time by either party. The cash price of this machine is 50,000 and its estimated useful life is 7 years. Machine 2 The cash price of the machine is 31,700 and is expected to last 5 year with no terminal value. Primary period of lease is 4 years, with rentals payable annually in arrears at 10,000. Implicit interest rate at 10%. Company's policy is to depreciate the machine on a straight-line basis. (a) Using information provided above, explain what the differences are between finance and operating leases. (b) For the lease of machine 1, identify the amount of interest charge for the financial year 2012 using straight-line method. (c) For machine 2, show the effect of this lease, on the statements of comprehensive income and statements of financial position for the four years to 31 December 2015, under the following headings: (i) lease creditor (ii) finance charge, allocated using actuarial method (iii) depreciation charge, and (iv) net book value of assets

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Finance leases A finance lease is a type of financing in which the leasing firm purchases an asset f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started