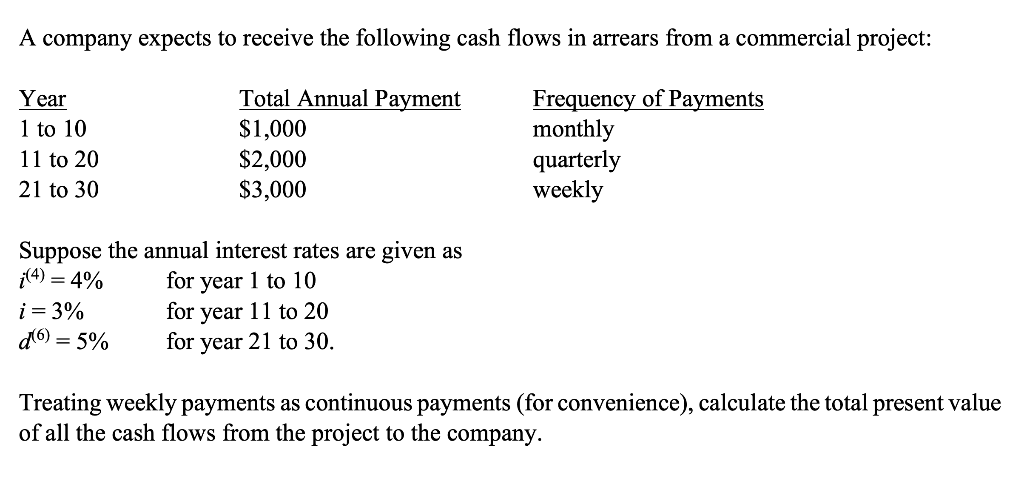

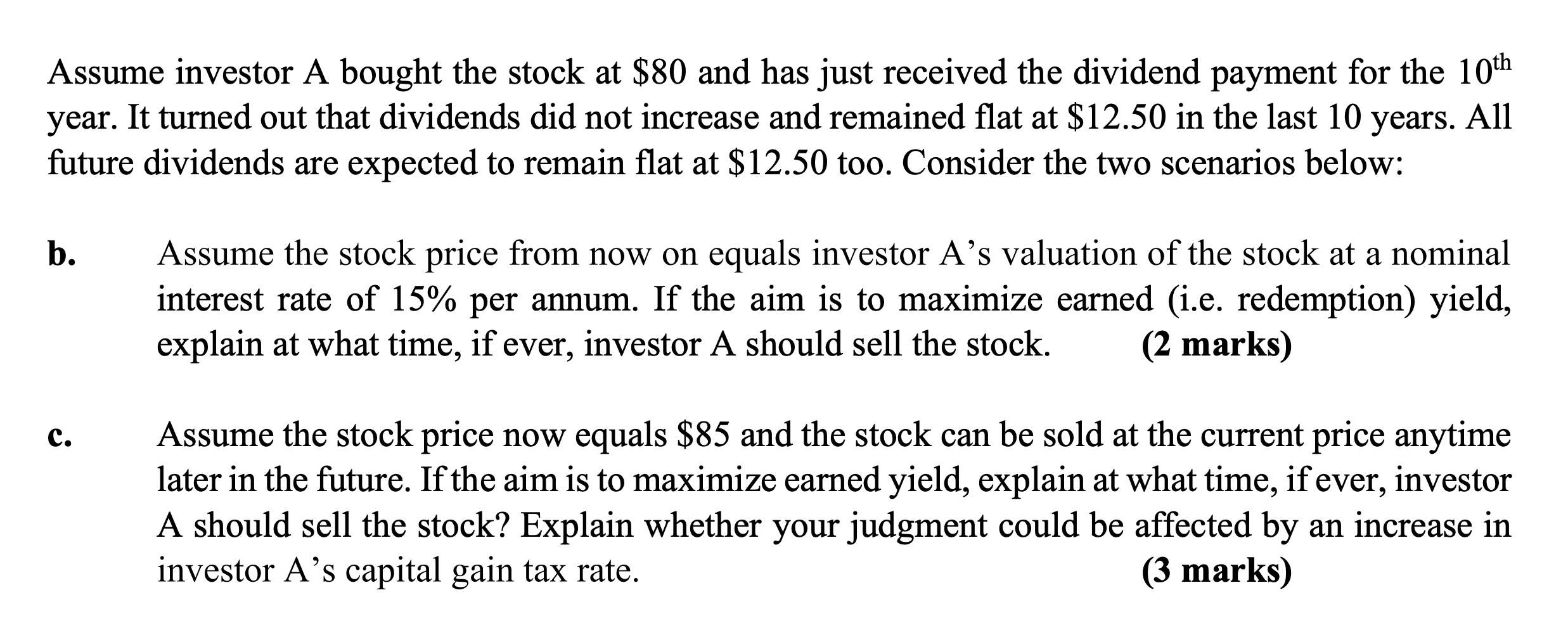

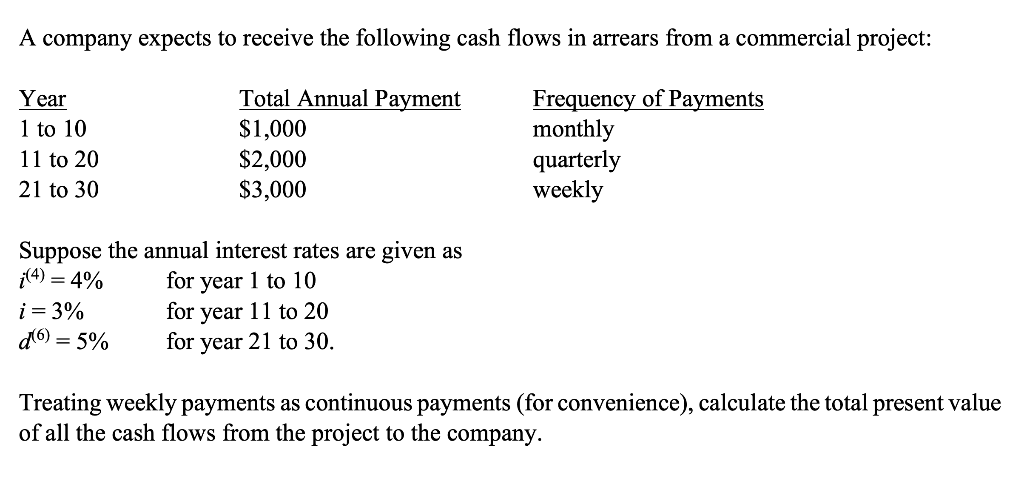

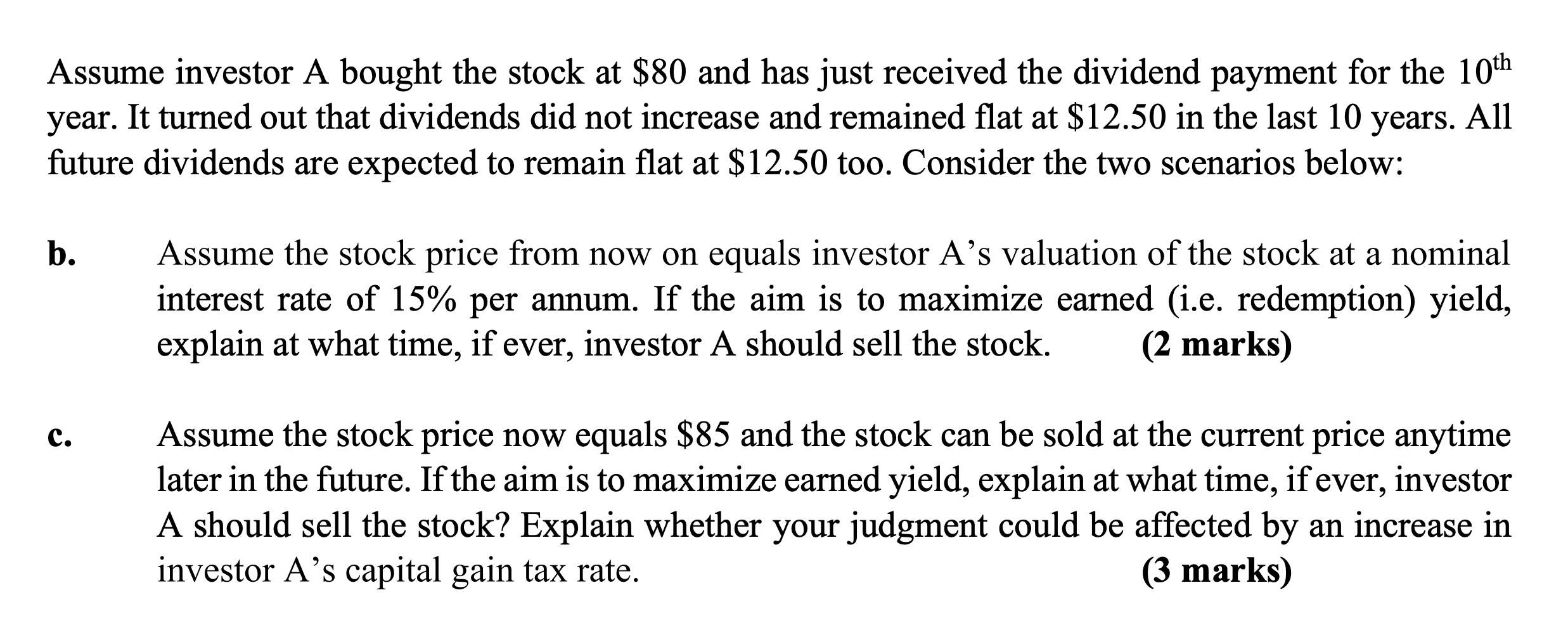

A company expects to receive the following cash flows in arrears from a commercial project: Year Total Annual Payment Frequency of Payments 1 to 10 $1,000 monthly quarterly 11 to 20 $2,000 21 to 30 $3,000 weekly Suppose the annual interest rates are given as (4) = 4% for year 1 to 10 i = 3% for year 11 to 20 (6) = 5% for year 21 to 30. Treating weekly payments as continuous payments (for convenience), calculate the total present value of all the cash flows from the project to the company. Assume investor A bought the stock at $80 and has just received the dividend payment for the 10th year. It turned out that dividends did not increase and remained flat at $12.50 in the last 10 years. All future dividends are expected to remain flat at $12.50 too. Consider the two scenarios below: b. Assume the stock price from now on equals investor A's valuation of the stock at a nominal interest rate of 15% per annum. If the aim is to maximize earned (i.e. redemption) yield, explain at what time, if ever, investor A should sell the stock. (2 marks) C. Assume the stock price now equals $85 and the stock can be sold at the current price anytime later in the future. If the aim is to maximize earned yield, explain at what time, if ever, investor A should sell the stock? Explain whether your judgment could be affected by an increase in investor A's capital gain tax rate. (3 marks) A company expects to receive the following cash flows in arrears from a commercial project: Year Total Annual Payment Frequency of Payments 1 to 10 $1,000 monthly quarterly 11 to 20 $2,000 21 to 30 $3,000 weekly Suppose the annual interest rates are given as (4) = 4% for year 1 to 10 i = 3% for year 11 to 20 (6) = 5% for year 21 to 30. Treating weekly payments as continuous payments (for convenience), calculate the total present value of all the cash flows from the project to the company. Assume investor A bought the stock at $80 and has just received the dividend payment for the 10th year. It turned out that dividends did not increase and remained flat at $12.50 in the last 10 years. All future dividends are expected to remain flat at $12.50 too. Consider the two scenarios below: b. Assume the stock price from now on equals investor A's valuation of the stock at a nominal interest rate of 15% per annum. If the aim is to maximize earned (i.e. redemption) yield, explain at what time, if ever, investor A should sell the stock. (2 marks) C. Assume the stock price now equals $85 and the stock can be sold at the current price anytime later in the future. If the aim is to maximize earned yield, explain at what time, if ever, investor A should sell the stock? Explain whether your judgment could be affected by an increase in investor A's capital gain tax rate