Question

A company grant time-based RSUs to certain employees as part of our annual employee equity compensation review program as well as to new hire employees

A company grant time-based RSUs to certain employees as part of our annual employee equity compensation review program as well as to new hire employees and to non-employee members of our Board. RSUs are share awards that entitle the holder to receive freely tradable shares of our common stock upon vesting. RSUs vest over four years from the date of grant. The fair value of an RSU is equal to the closing price of our common stock on the grant date.

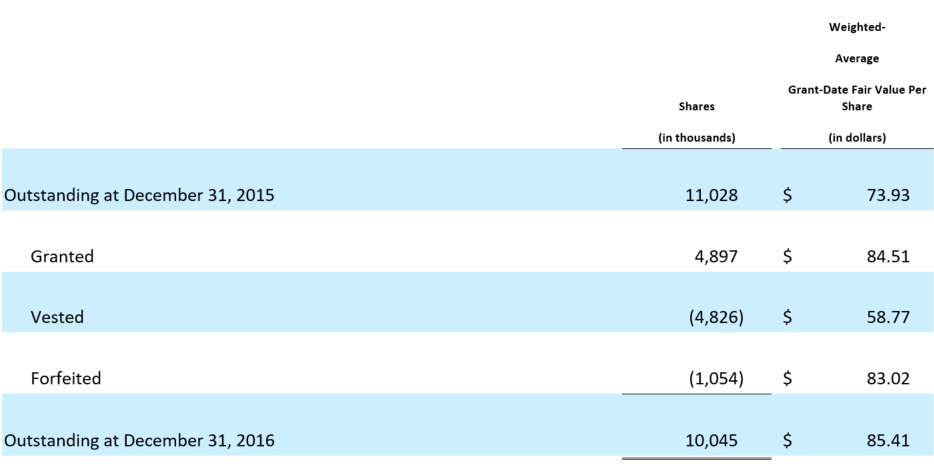

The following table summarizes our RSU activities and related information:

The weighted-average grant date fair value of RSUs granted was $84.51 per share for 2016, $103.19 per share for 2015, $86.75 per share for 2014. The total grant date fair value of our vested RSUs was $284 million for 2016, $249 million for 2015 and $182 million for 2014, and total fair value as of the respective vesting dates was $408 million for 2016, $666 million for 2015 and $535 million for 2014.

As of December 31, 2016, there was $577 million of unrecognized compensation cost related to unvested RSUs which is expected to be recognized over a weighted-average period of 2.4 years. How should Gilead account for the Restricted Stock Units (RSU)?

a. As a liability

b. As an equity grant

2- What amount would Gilead recognize as compensation expense assuming that the awards were issued evenly throughout the year (average outstanding = issued divided by 2) ?

3- What amount would Gilead recognize for forfeitures in 2016 assuming that Gilead accounts for forfeitures as they occur?

4- Based on the information provided, what is the total amount of outstanding RSUs at 12/31/2016?

5- What was the average gain per RSU that grantees realized on the vesting of RSUs in 2016?

6- What would the entries be for the 2016 RSU grants assuming that the awards were issued evenly throughout the year (average period outstanding is six months)?

a. There is no entry on issue of the RSU on the grant date other than a memo entry to record the grants.

b. Record of the fair value of the stock on the issue date

c. Record 1/8 of the fair value of the stock on the issue date

d. Record the fair value of the stock at the balance sheet date

e. A and b

7- What would the entry be for the RSU forfeitures in 2016 assuming that Gilead accounts for forfeitures as they occur?

a. A debit to compensation expense

b. A credit to compensation expense

c. A debt to paid-in-capital

d. A credit to paid-in-capital

e. A and d

f. B and c

Weighted- Average Grant-Date Fair Value Per Shares Share (in thousands) (in dollars) 11,028 $ 4,897$ (4,826) $ (1,054)$ 10,045 $ Outstanding at December 31, 2015 73.93 Granted 84.51 Vested 58.77 Forfeited 83.02 Outstanding at December 31, 2016 85.41 Weighted- Average Grant-Date Fair Value Per Shares Share (in thousands) (in dollars) 11,028 $ 4,897$ (4,826) $ (1,054)$ 10,045 $ Outstanding at December 31, 2015 73.93 Granted 84.51 Vested 58.77 Forfeited 83.02 Outstanding at December 31, 2016 85.41

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started