Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company had opening stock of 48,500 units and closing stock of 45,500 units. Profits based on marginal costing were RM315,250 and on absorption

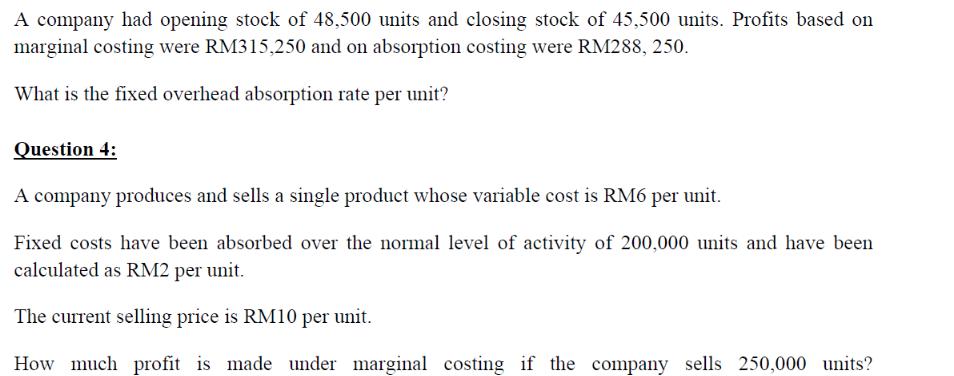

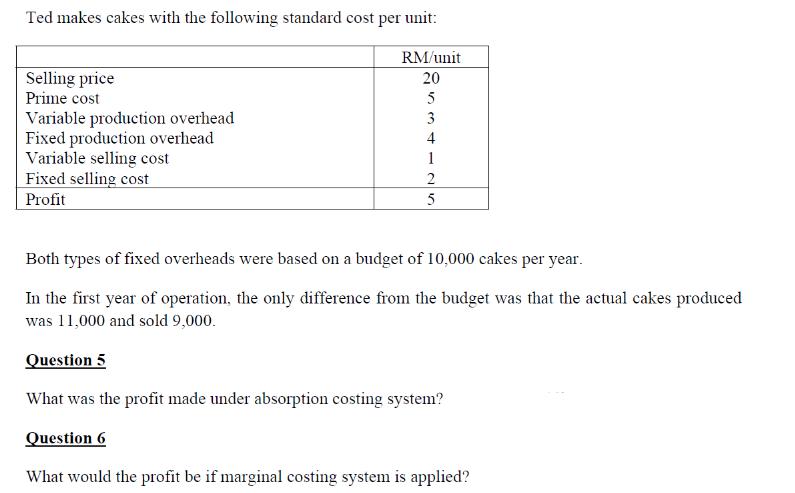

A company had opening stock of 48,500 units and closing stock of 45,500 units. Profits based on marginal costing were RM315,250 and on absorption costing were RM288, 250. What is the fixed overhead absorption rate per unit? Question 4: A company produces and sells a single product whose variable cost is RM6 per unit. Fixed costs have been absorbed over the normal level of activity of 200,000 units and have been calculated as RM2 per unit. The current selling price is RM10 per unit. How much profit is made under marginal costing if the company sells 250,000 units? Ted makes cakes with the following standard cost per unit: Selling price Prime cost Variable production overhead Fixed production overhead Variable selling cost Fixed selling cost Profit RM/unit 20 5 3 4 125 Both types of fixed overheads were based on a budget of 10,000 cakes per year. In the first year of operation, the only difference from the budget was that the actual cakes produced was 11,000 and sold 9,000. Question 5 What was the profit made under absorption costing system? Question 6 What would the profit be if marginal costing system is applied?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Question 4 To calculate the profit under marginal costing when selling 250000 units we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started