Answered step by step

Verified Expert Solution

Question

1 Approved Answer

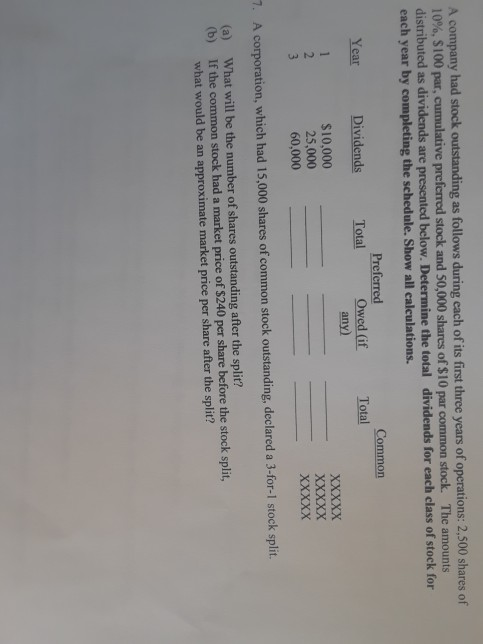

A company had stock outstanding as follows during each of its first three years of operations: 2,500 shares of 10%, $100 par, cumulative preferred stock

A company had stock outstanding as follows during each of its first three years of operations: 2,500 shares of 10%, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total dividends for each class of stock for each year by completing the schedule. Show all calculations. Common Total Year Preferred Total Owed (if any) Dividends XXXXX $10,000 25,000 60,000 XXXXX XXXXX 7. A corporation, which had 15,000 shares of common stock outstanding, declared a 3-for-1 stock split. (a) (b) What will be the number of shares outstanding after the split? If the common stock had a market price of $240 per share before the stock split, what would be an approximate market price per share after the split

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started