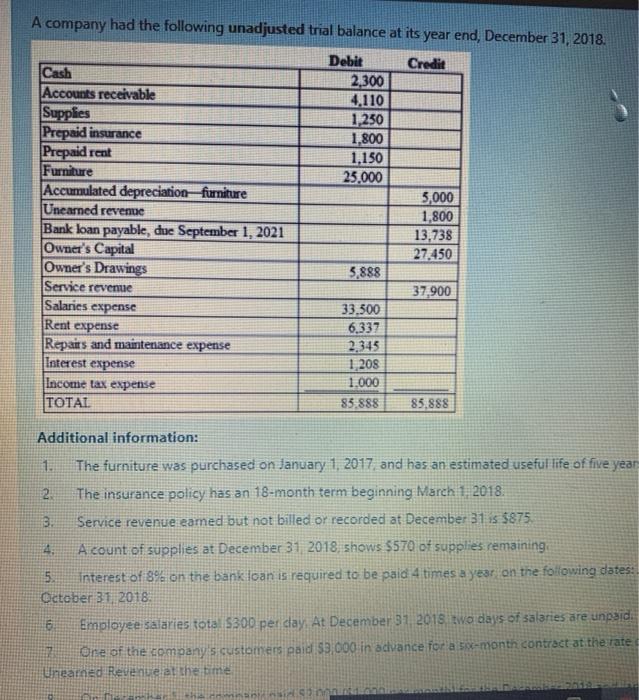

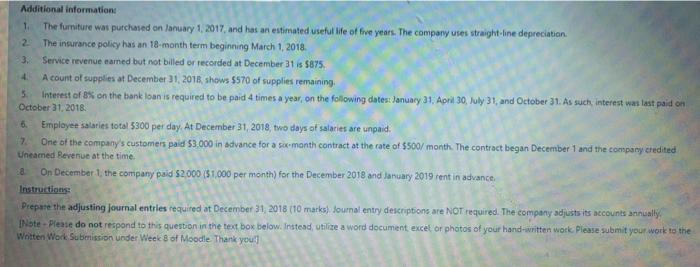

A company had the following unadjusted trial balance at its year end, December 31, 2018. Debit Credit Cash 2,300 Accounts receivable 4,110 Supplies 1,250 Prepaid insurance 1.800 Prepaid rent 1.150 Furniture 25.000 Accumulated depreciation furniture 5,000 Unearned reveme 1,800 Bank loan payable, due September 1, 2021 13,738 Ownet's Capital 27.450 Owner's Drawings 5.888 Service revenue 37,900 33.500 6,337 Repairs and maintenance expense 2.345 Interest expense 1 208 Income tax expense 1.000 . 85.888 85,888 Salaries expense Rent expense Ad tional information: The furniture was purchased on January 1, 2017, and has an estimated useful life of five year 2 The insurance policy has an 18-month term beginning March 1, 2018. 3. Service revenue eamed but not billed or recorded at December 31 is $875 A count of supplies at December 31 2018, shows 5570 of supplies remaining 5 5 interest of 89 on the bank loan is required to be paid 4 times a year on the following dates: October 31 2018 6 Employee salaries total 5300 per day. At December 31 2018 two days of salaries are unpaid. One of the company's customers paid $3,000 in advance for a sce-month contract at the rate Unearned Revenue at the time GER - 1. Additional information The furniture was purchased on January 1, 2017 and has an estimated useful life of five years. The company uses straight-line depreciation. 2 The insurance policy has an 18-month term beginning March 1, 2018 3. Service revenue canned but not billed or recorded at December 31 is $875. A count of supplies at December 31, 2018 shows 5570 of supplies remaining Interest of 8% on the bank loan is required to be paid 4 times a year, on the following dates: January 31, April 30, July 31, and October 31. As such interest was last paid on October 31, 2018 Employer salaries total 5300 per day. At December 31, 2018, two days of salaries are unpaid. 7. One of the company's customers paid 53.000 in advance for a six month contract at the rate of $500/month. The contract began December 1 and the company credited Uneamed Revenue at the time. On December 1, the company paid $2,000 (51.000 per month) for the December 2018 and January 2019 rent in advance Instructions: Prepare the adjusting Journal entries required at December 31, 2018 (10 marks) Journal entry descriptions are NOT required. The company adjusts its accounts annually INote - Please do not respond to this question in the text box below. Instead utilize a word document excet or photos of your hand-written work. Please submit your work to the Written Work Submission under Week 8 of Moodle. Thank you