Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company has $200,000 of total assets, $160,000 of total habilities, and $40,000 of total stockholders' equity, which includes $15,000 of contributed capital from

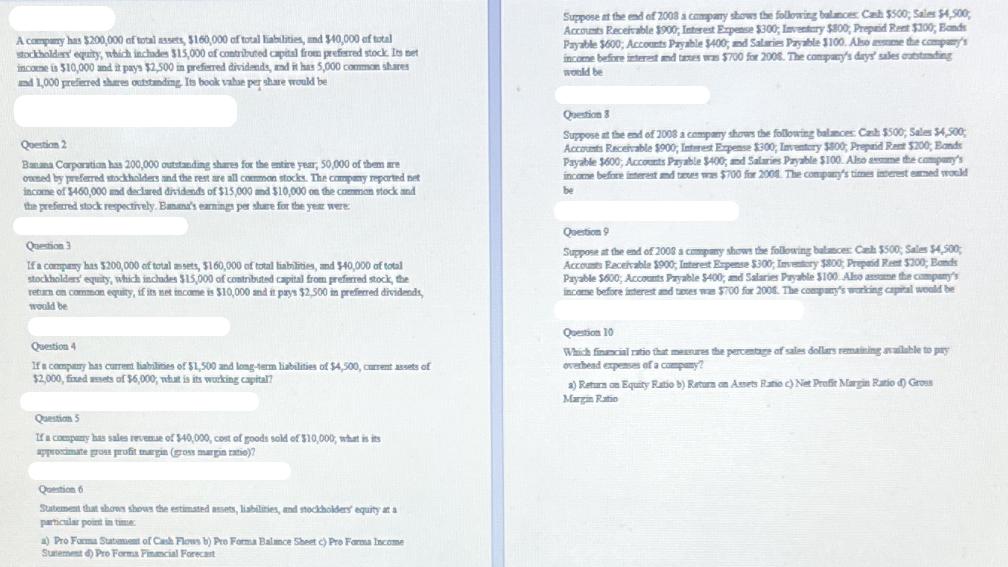

A company has $200,000 of total assets, $160,000 of total habilities, and $40,000 of total stockholders' equity, which includes $15,000 of contributed capital from preferred stock. Its net income is $10,000 and it pays $2,500 in preferred dividends, and it has 5,000 common shares and 1,000 preferred shares outstanding. Its book value per share would be Question 2 Banana Corporation has 200,000 outstanding shares for the entire year, 50,000 of them are owned by preferred stockholders and the rest are all common stocks. The company reported net income of $460,000 and declared dividends of $15,000 and $10,000 on the common stock and the preferred stock respectively. Emma's earnings per shure for the year were Question 3 If a company has $200,000 of total asets, $160,000 of total liabilities, and $40,000 of total stockholders' equity, which includes $15,000 of contributed capital from preferred stock, the return on common equity, if its net income is $10,000 and it pays $2,500 in preferred dividends, would be Question 4 If a company has current habilities of $1,500 and long-term liabilities of $4,500, current assets of $2,000, fixed assets of $6,000, what is its working capital? Question 5 If a company has sales revenue of $40,000, cost of goods sold of $10,000, what is its approximate gross profit margin (gross margin ratio)? Question 6 Statement that shows shows the estimated assets, liabilities, and stockholders' equity at a particular point in time: a) Pro Forma Statement of Cash Flows b) Pro Forma Balance Sheet c) Pro Farma Income Sunement d) Pro Forma Financial Forecast Suppose at the end of 2008 a company shows the following balances Cash $500, Sales $4,500, Accounts Receivable $900, Interest Expense $300, Inventary $800, Prepaid Rent $300, Bands Payable $600; Accounts Payable $400; and Salaries Payable $100. Also me the company's income before interest and taxes was $700 for 2008. The company's days' sales outstanding would be Question 3 Suppose at the end of 2008 a company shows the following balances: Cash $500, Sales $4,500; Accounts Receivable $900, Interest Expense $300, Inventory $800, Prepaid Rent $200, Bands Payable $600, Accounts Payable $400, and Salaries Payable $100. Also ame the company's income before interest and taxes was $700 for 2008 The company's times interest eamed would be Question 9 Suppose at the end of 2008 a company shows the following balances: Cal $500; Sales $4,500; Accounts Receivable $900, Interest Expense $300, Inventory $800; Prepaid Reet $200, Bands Payable $600, Accounts Payable $400, and Salaries Payable $100. Also assume the company's income before interest and taxes we $700 for 2008. The company's working capital would be Question 10 Which financial ratio that measures the percentage of sales dollars remaining available to pay overhead expenses of a company? a) Return on Equity Ratio b) Return on Assets Ratio c) Net Profit Margin Rario d) Gross Margin Ratin

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started