Answered step by step

Verified Expert Solution

Question

1 Approved Answer

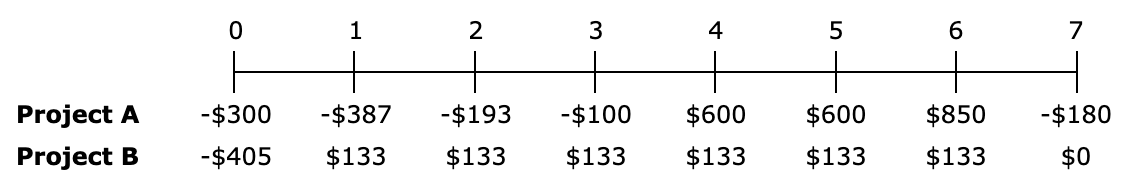

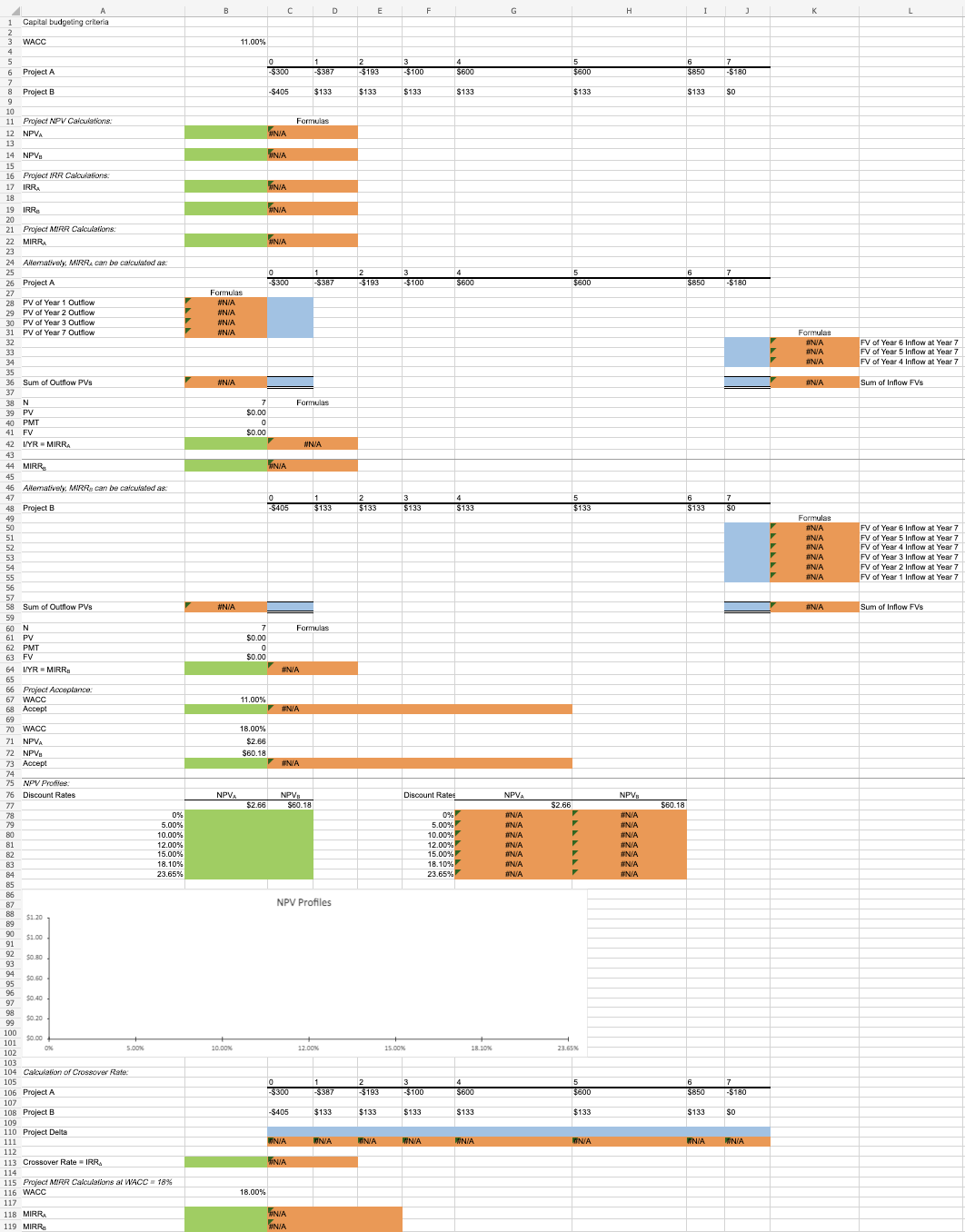

A company has a 11% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: The data has

A company has a 11% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows:

The data has been collected in the spreadsheet below. Reference the spreadsheet and perform the required analysis to answer all parts of the question below.

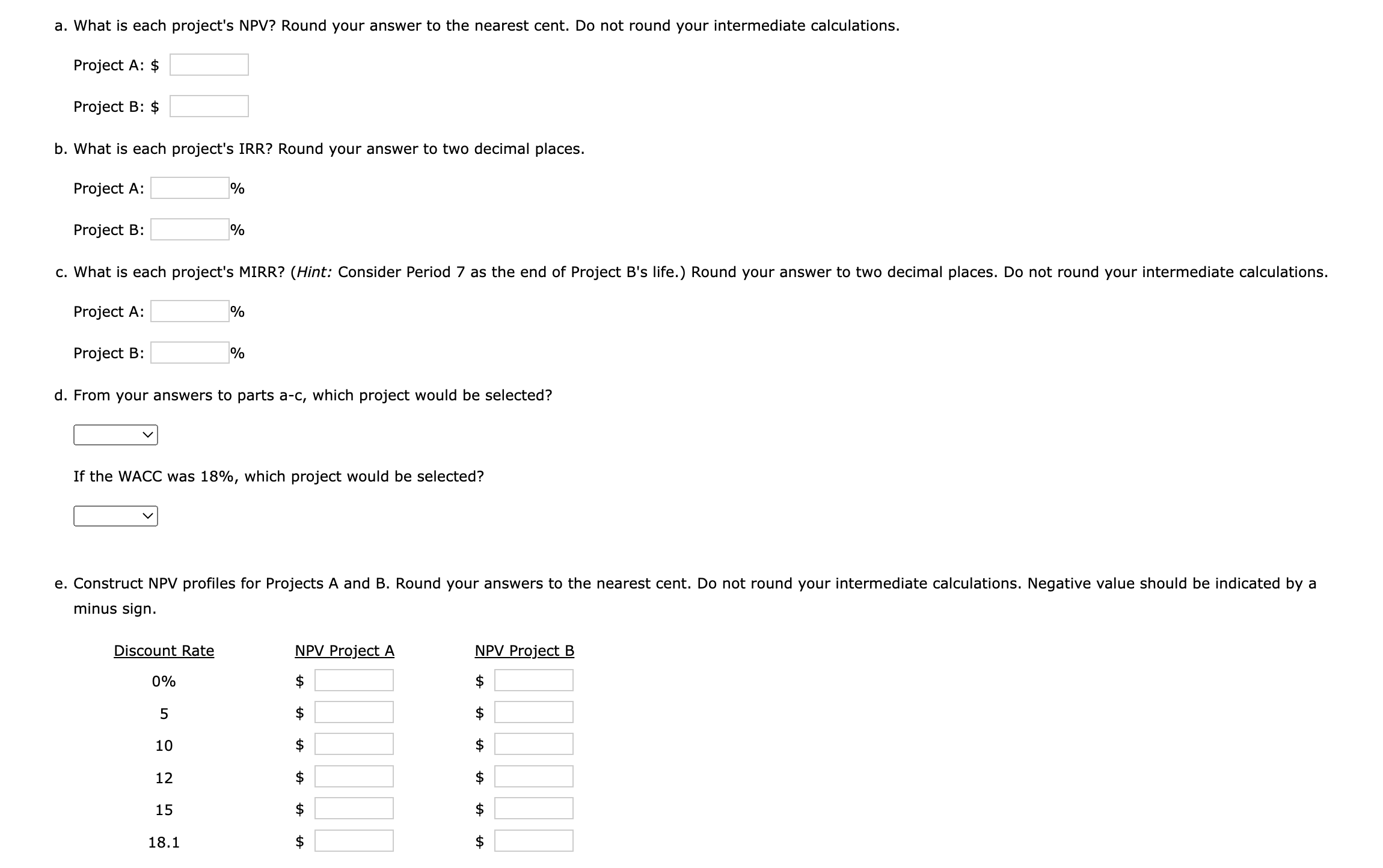

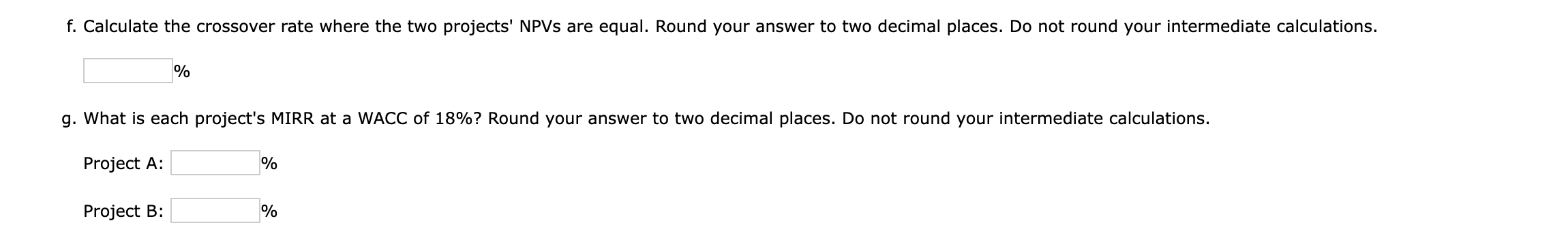

Project A Project B O 1 2 -$300 -$387 -$193 -$405 $133 $133 3 - $100 $133 4 $600 $133 5 $600 $133 6 $850 $133 7 H - $180 $0 1 Capital budgeting criteria WACC Project A 8 Project B 10 11 Project NPV Calculations: 12 NPVA 13 14 NPVB 15 16 Project IRR Calculations 17 IRRA 18 19 IRR 20 21 Project MIRR Calculations 22 MIRR 23 24 Allematively, MIRR, can be calculated as: 25 26 Project A 27 28 PV of Year 1 Outflow PV of Year 2 Outflow PV of Year 3 Outflow PV of Year 7 Outflow 30 31 33 34 35 36 Sum of Outflow PVs 38 N 39 PV 40 PMT FV 42 I/YR MIRRA 44 MIRR 48 Project B 53 54 55 56 AMASENDISS638RANAZK 57 58 59 60 N 61 PV 62 PMT 63 FV 65 64 I/YR MIRR Allematively, MIRR can be calculated as: 69 66 Project Acceptance 67 WACC Accept Sum of Outflow PVs 70 WACC 71 NPVA 72 NPVB 73 Accept 75 NPV Profiles 79 80 81 82 76 Discount Rates 77 83 84 85 87 88 90 94 97 98 og 50.80 $0.60 $0.40 50.20 100 101 102 103 104 Calculation of Crossover Rate: 105 106 Project A 107 $0.00 5.00% 0% 5.00% 10.00% 12.00% 15.00% 18.10% 23.65% 108 Project B 109 110 Project Delta 111 112 113 Crossover Rate = IRR 114 115 Project MIRR Calculations at WACC = 18% 116 WACC 117 118 MIRRA 119 MIRR Formulas #N/A #N/A #N/A #N/A #N/A #N/A NPV, 11.00% 10.00% 7 $0.00 $0.00 $0.00 $0.00 11.00% 18.00% $2.66 $60.18 $2.66 18.00% 0 -$300 -$405 #N/A #N/A #N/A #N/A #N/A 0 -$300 #N/A $405 #N/A Formulas #N/A #N/A -$300 -$405 #N/A Formulas #N/A #N/A NPVB $60.18 1 -$387 $133 Formulas $387 #N/A D NPV Profiles $133 12.00% -$387 $133 #N/A -$193 $133 E $193 $133 N/A -$100 $133 -$100 $133 15.00% $193 -$100 $133 $133 F Discount Rates 0% 5.00% 10.00% 12.00% #N/A $600 $133 18.10% 23.65% $600 $133 18.10% 4 $600 $133 #N/A G NPVA #N/A #N/A #N/A #N/A #N/A #N/A #N/A $2.66 $600 $133 $600 $133 23.65% 5 $600 $133 N/A H NPV #N/A #N/A #N/A #N/A #N/A #N/A #N/A $60.18 I 6 $850 -$180 $133 so 6 $850 -$180 $133 $850 -$180 $133 So #N/A #N/A V Formulas #N/A #N/A #N/A #N/A Formulas #N/A #N/A #N/A #N/A #N/A #N/A #N/A FV of Year 6 Inflow at Year 2 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 Sum of Inflow FVs FV of Year 6 Inflow at Year 7 FV of Year 5 Inflow at Year 7 FV of Year 4 Inflow at Year 7 FV of Year 3 Inflow at Year 7 FV of Year 2 Inflow at Year 7 FV of Year 1 Inflow at Year 7 Sum of Inflow FVs a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places. Project A: Project B: c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. Project A: Project B: d. From your answers to parts a-c, which project would be selected? Discount Rate % 0% If the WACC was 18%, which project would be selected? 5 10 12 15 % e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign. 18.1 % % NPV Project A NPV Project B $ f. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations. % g. What is each project's MIRR at a WACC of 18%? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: Project B: % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started