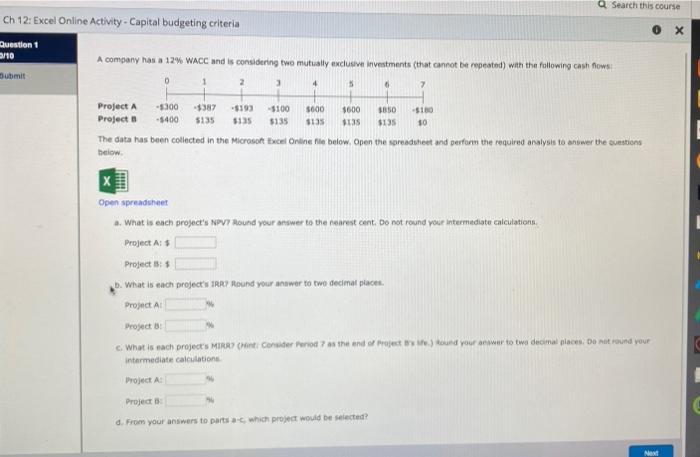

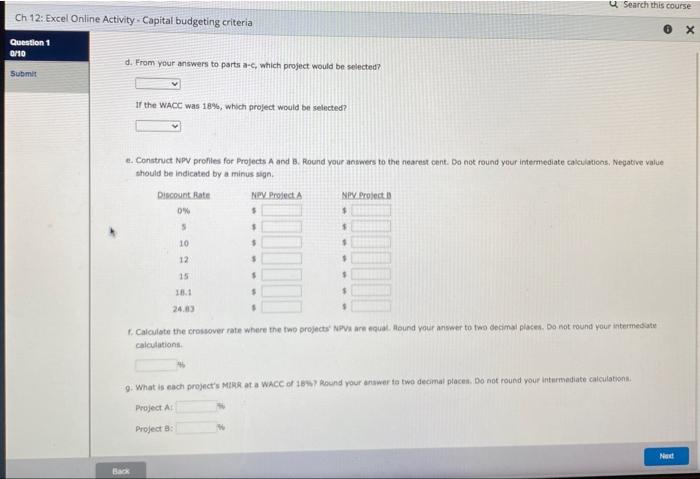

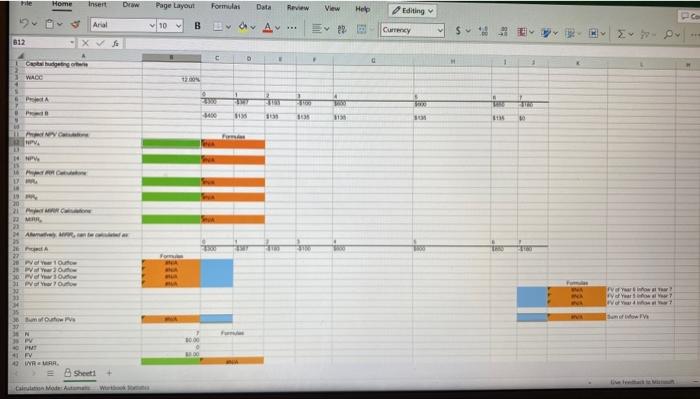

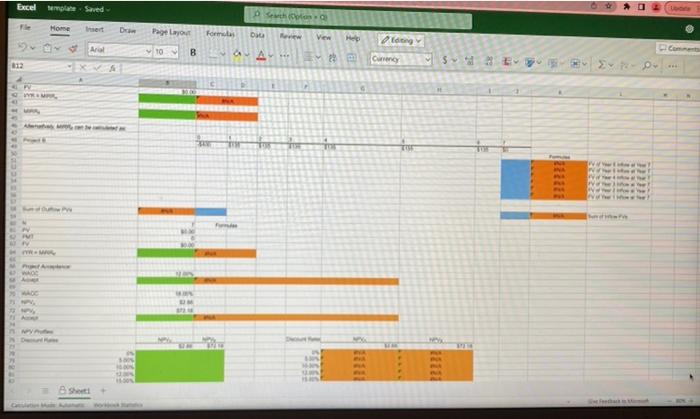

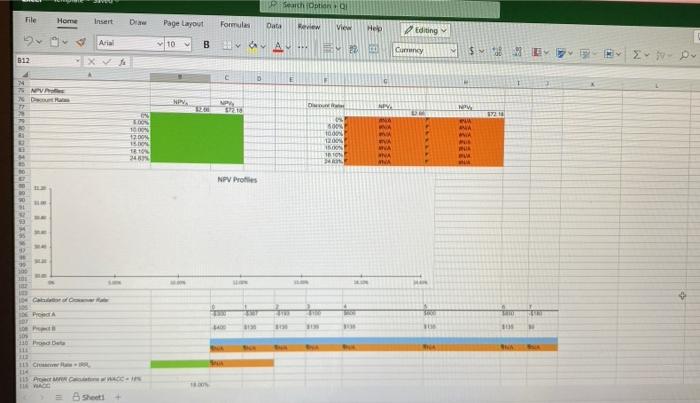

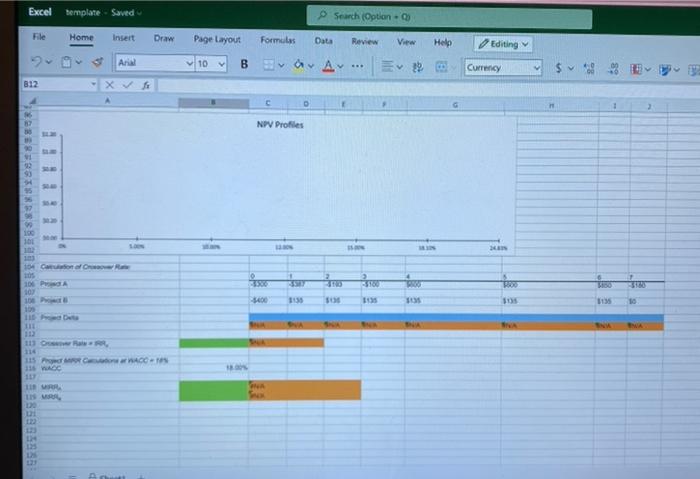

A company has a 12% WACC and is considering two mutially axclusiwi investments (that cannot bet mpeated) wath the following cash fows The data has been collected in the Micrasoft twcel Onitie file below. Open the sareadstieet and perform the required analysis to anfever the suestions heticw. Open spreadshaet a. What is each project's NPPn Round your answer ta the pearest cont. Do not round your intermediate calculations. Project A: 1 Project 3:1 b. What is each project's tRe: found your answer to two decimal piaces. Projec All Project 10! intarmediate calculatione Droject A Project b- a. Froen your answers to parts a-c, which project would be seiected? d. From your answers to psite a-c, which project would be selected? If the wacc was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate caicuiations, Negative value thouls be indicated by a minus sign. f. Calculate the crossover rate where the fano projects' Nova are equal. Aound your answer to tas decimal places. Do fot round your anteimedate calculations: 9. What is each projnct's Mirh at a WACC of 15w? Reund your anawer ta two decimal placel. Do riot round your intermediate calcuilationili. Prbject At Project 3 : A company has a 12% WACC and is considering two mutially axclusiwi investments (that cannot bet mpeated) wath the following cash fows The data has been collected in the Micrasoft twcel Onitie file below. Open the sareadstieet and perform the required analysis to anfever the suestions heticw. Open spreadshaet a. What is each project's NPPn Round your answer ta the pearest cont. Do not round your intermediate calculations. Project A: 1 Project 3:1 b. What is each project's tRe: found your answer to two decimal piaces. Projec All Project 10! intarmediate calculatione Droject A Project b- a. Froen your answers to parts a-c, which project would be seiected? d. From your answers to psite a-c, which project would be selected? If the wacc was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate caicuiations, Negative value thouls be indicated by a minus sign. f. Calculate the crossover rate where the fano projects' Nova are equal. Aound your answer to tas decimal places. Do fot round your anteimedate calculations: 9. What is each projnct's Mirh at a WACC of 15w? Reund your anawer ta two decimal placel. Do riot round your intermediate calcuilationili. Prbject At Project 3