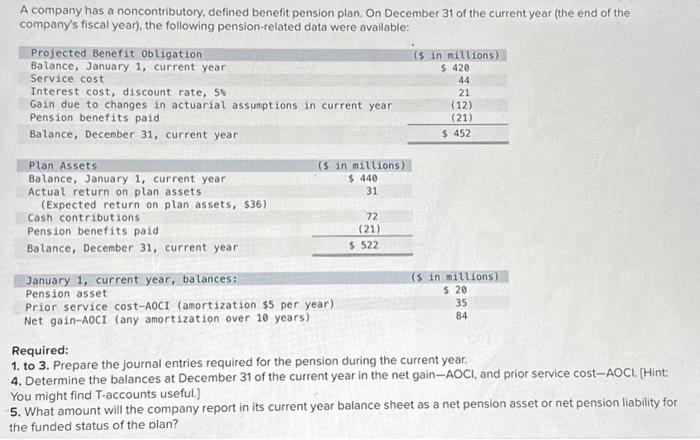

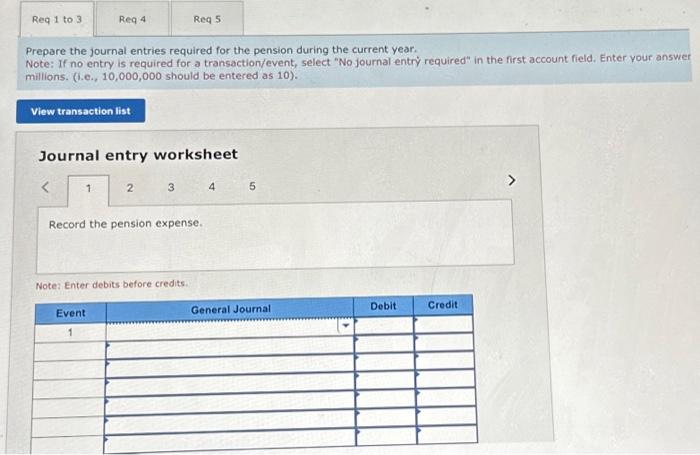

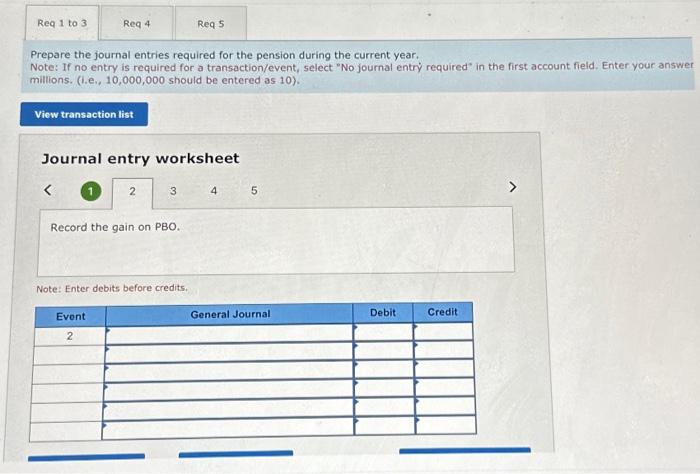

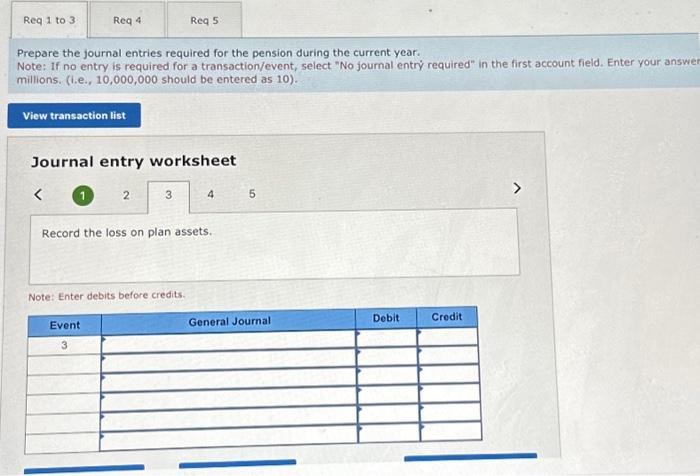

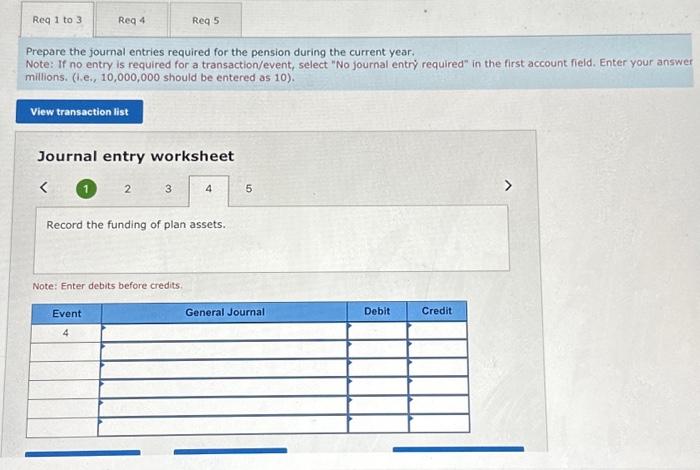

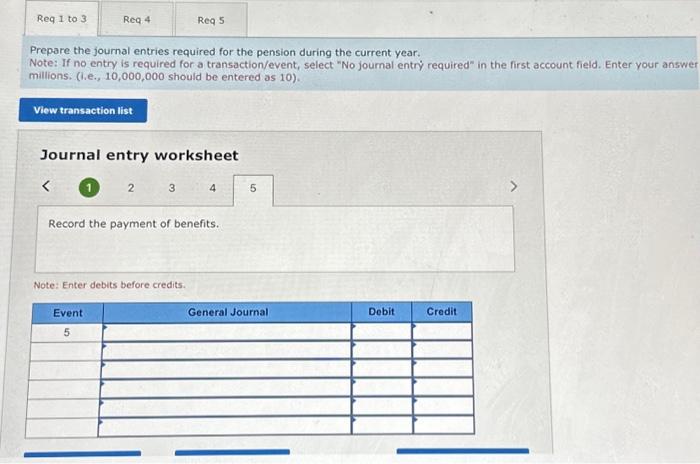

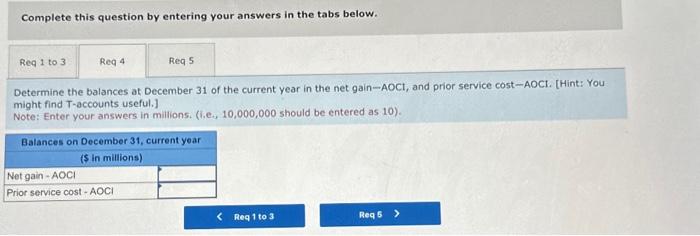

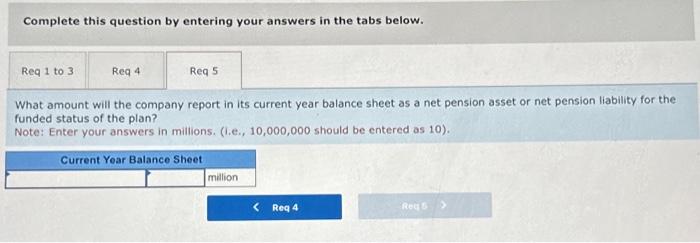

A company has a noncontributory, defined benefit pension plan. On December 31 of the current year (the end of the company's fiscal year), the following pension-related data were available: Required: 1. to 3. Prepare the journal entries required for the pension during the current year. 4. Determine the balances at December 31 of the current year in the net gain-AOCl, and prior service cost-AOCl. [Hint: You might find T-accounts useful.] 5. What amount will the company report in its current year balance sheet as a net pension asset or net pension liability for the funded status of the olan? Prepare the journal entries required for the pension during the current year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter your answer millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet 45 Record the pension expense. Note: Enter debits before credits. Prepare the journal entries required for the pension during the current year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answe millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Note: Enter debits before credits. Prepare the journal entries required for the pension during the current year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answe millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Note: Enter debits before credits. Prepare the joumal entries required for the pension during the current year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answer millions. (i.e, 10,000,000 should be entered as 10). Journal entry worksheet Note: Enter debits before credits. Prepare the journal entries required for the pension during the current year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answe millions. (i.e., 10,000,000 should be entered as 10 ). Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Determine the balances at December 31 of the current year in the net gain-AOCl, and prior service cost-AOCl. [Hint: You might find T-accounts useful.] Note: Enter your answers in milions. (i,e, 10,000,000 should be entered as 10). Complete this question by entering your answers in the tabs below. What amount will the company report in its current year balance sheet as a net pension asset or net pension liability for the funded status of the plan? Note: Enter your answers in millions. (i.e., 10,000,000 should be entered as 10 )