Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company has determined its year - end inventory on a LIFO basis to be $ 6 0 8 , 0 0 0 . Information

A company has determined its yearend inventory on a LIFO basis to be $ Information pertaining to that inventory is as follows:

What should be the reported amount of the company's inventory?

Multiple Choice

$

$

$

$

A company using the LIFO retail method has the following information for the current year's operations:

To convert ending inventory to cost management calculates the costtoretail percentage as cost of $$$ divided by retail

of $$ Which of the following statements is correct?

Multiple Choice

The retail amount used to calculate the costtoretail percentage should be $$$$

Only net purchases during the year are used to calculate the costtoretail percentage to convert ending inventory to cost

The calculation of the costtoretail percentage is correct.

Separate costtoretail percentages for beginning inventory and net purchases are needed to convert ending inventory to cost

A company has the following information for the current year's operations:

Management calculates the costtoretail percentage as equal to cost of divided by retail of

$$$$ Which application of the retail inventory method is the company using?

Multiple Choice

LIFO

Average cost

Dollarvalue LIFO

Conventional

Altira Corporation provides the following information related to its inventory during the month of August :

August Inventory on hand units; cost $ each.

August Purchased units for $ each.

August Sold units for $ each.

August Purchased units for $ each.

August Sold units for $ each.

August Purchased units for $ each.

August Inventory on hand units.

Required:

Using calculations based on a periodic inventory system, determine the inventory balance Altira would report in its August

balance sheet and the cost of goods sold it would report in its August income statement using each of the following cost flow

methods.

Complete this question by entering your answers in the tabs below.

Average Cost

Determine the inventory balance Altira would report in its August balance sheet and the cost of goods sold it would report in its August income statemen

method.

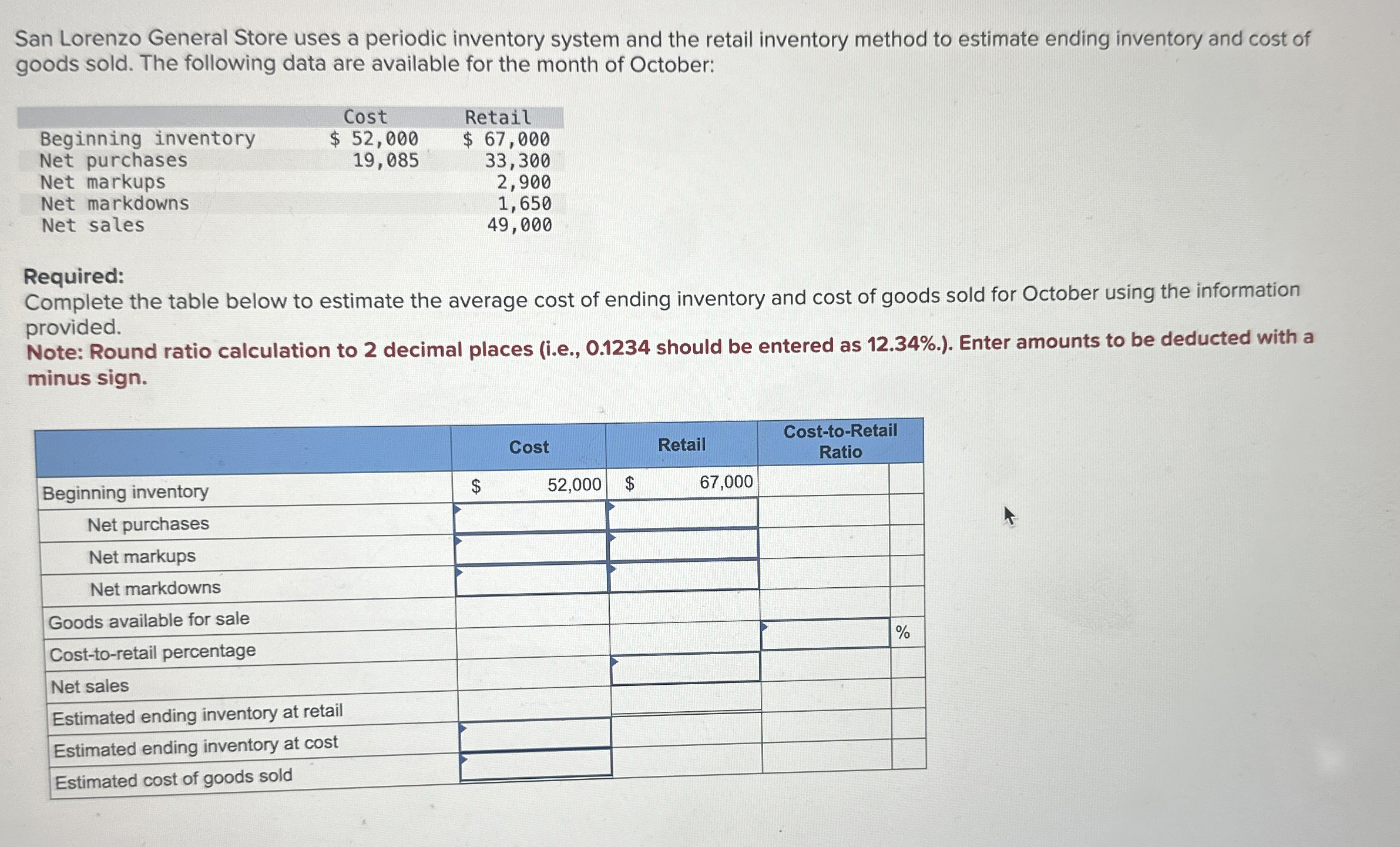

San Lorenzo General Store uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of

goods sold. The following data are available for the month of October:

Required:

Complete the table below to estimate the average cost of ending inventory and cost of goods sold for October using the information

provided.

Note: Round ratio calculation to decimal places ie should be entered as Enter amounts to be deducted with a

minus sign.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started