Question

A company has just installed a machine Model A for the manufacture of a new product at a capital cost of Rs. 1,00,000. The annual

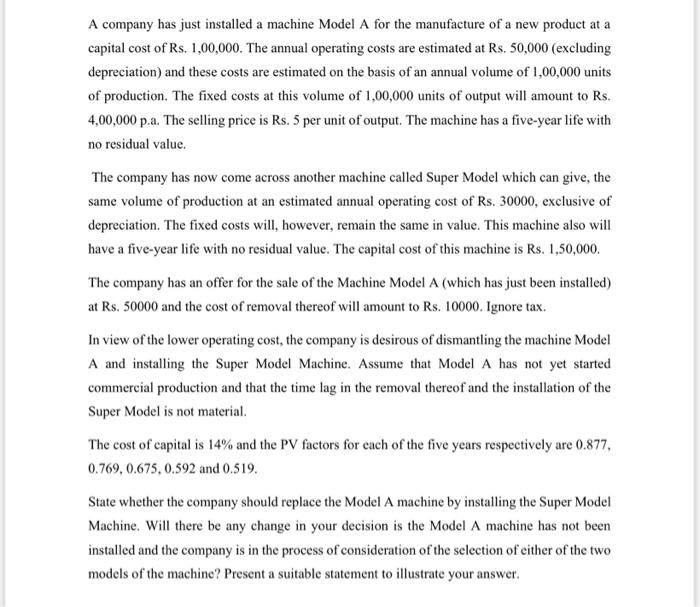

A company has just installed a machine Model A for the manufacture of a new product at a capital cost of Rs. 1,00,000. The annual operating costs are estimated at Rs. 50,000 (excluding depreciation) and these costs are estimated on the basis of an annual volume of 1,00,000 units of production. The fixed costs at this volume of 1,00,000 units of output will amount to Rs.

4,00,000 p.a. The selling price is Rs. 5 per unit of output. The machine has a five-year life with no residual value.

The company has now come across another machine called Super Model which can give, the same volume of production at an estimated annual operating cost of Rs. 30000, exclusive of depreciation. The fixed costs will, however, remain the same in value. This machine also will have a five-year life with no residual value. The capital cost of this machine is Rs. 1,50,000.

The company has an offer for the sale of the Machine Model A (which has just been installed) at Rs. 50000 and the cost of removal thereof will amount to Rs. 10000. Ignore tax.

In view of the lower operating cost, the company is desirous of dismantling the machine Model A and installing the Super Model Machine. Assume that Model A has not yet started commercial production and that the time lag in the removal thereof and the installation of the Super Model is not material.

The cost of capital is 14% and the PV factors for each of the five years respectively are 0.877, 0.769, 0.675, 0.592 and 0.519.

A)State whether the company should replace the Model A machine by installing the Super Model Machine.

B)Will there be any change in your decision is the Model A machine has not been installed and the company is in the process of consideration of the selection of either of the two models of the machine?

C)Present a suitable statement to illustrate your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started