Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company has nearly 75 equipment among which through economies of scale evaluation 30 could be exchanged and rest needs to be modified in

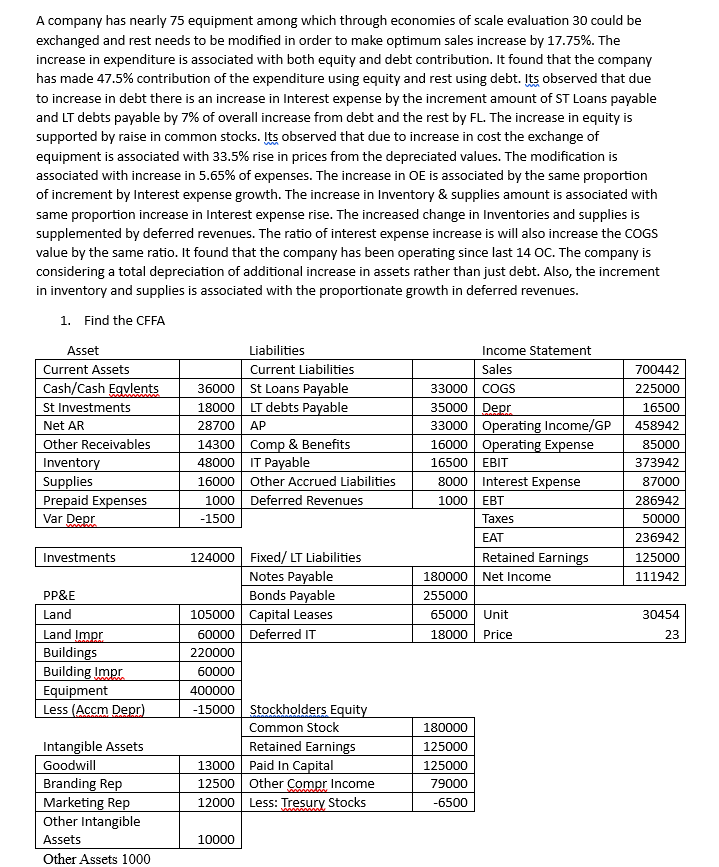

A company has nearly 75 equipment among which through economies of scale evaluation 30 could be exchanged and rest needs to be modified in order to make optimum sales increase by 17.75%. The increase in expenditure is associated with both equity and debt contribution. It found that the company has made 47.5% contribution of the expenditure using equity and rest using debt. Its observed that due to increase in debt there is an increase in Interest expense by the increment amount of ST Loans payable and LT debts payable by 7% of overall increase from debt and the rest by FL. The increase in equity is supported by raise in common stocks. Its observed that due to increase in cost the exchange of equipment is associated with 33.5% rise in prices from the depreciated values. The modification is associated with increase in 5.65% of expenses. The increase in OE is associated by the same proportion of increment by Interest expense growth. The increase in Inventory & supplies amount is associated with same proportion increase in Interest expense rise. The increased change in Inventories and supplies is supplemented by deferred revenues. The ratio of interest expense increase is will also increase the COGS value by the same ratio. It found that the company has been operating since last 14 OC. The company is considering a total depreciation of additional increase in assets rather than just debt. Also, the increment in inventory and supplies is associated with the proportionate growth in deferred revenues. 1. Find the CFFA Asset Current Assets Cash/Cash Eqvlents 36000 St Investments Net AR Liabilities Current Liabilities St Loans Payable 18000 LT debts Payable 28700 AP Income Statement Sales 700442 33000 COGS 225000 35000 Depr 16500 33000 Operating Income/GP 458942 Other Receivables 14300 Comp & Benefits 16000 Operating Expense 85000 Inventory 48000 IT Payable 16500 EBIT 373942 Supplies 16000 Prepaid Expenses 1000 Other Accrued Liabilities Deferred Revenues 8000 Interest Expense 87000 1000 EBT 286942 Var Depr -1500 Taxes 50000 EAT 236942 Investments 124000 Fixed/ LT Liabilities Retained Earnings 125000 Notes Payable 180000 Net Income 111942 PP&E Bonds Payable 255000 Land 105000 Capital Leases 65000 Unit Land Impr 60000 Deferred IT 18000 Price 30454 23 Buildings 220000 Building Impr 60000 Equipment 400000 Less (Accm Depr) -15000 Stockholders Equity Common Stock 180000 Intangible Assets Retained Earnings 125000 Goodwill 13000 Paid In Capital 125000 Branding Rep 12500 Other Compr Income 79000 Marketing Rep 12000 Less: Tresury Stocks -6500 Other Intangible Assets 10000 Other Assets 1000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started