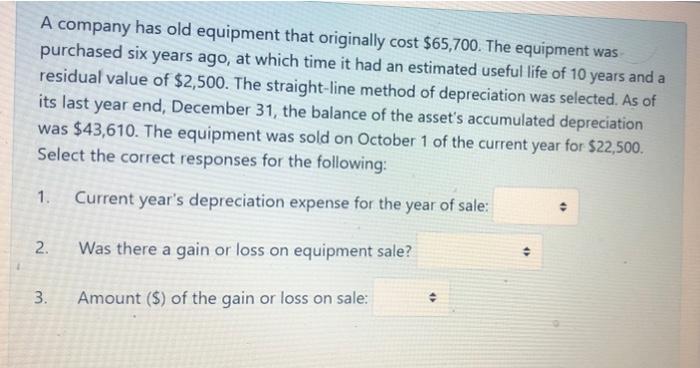

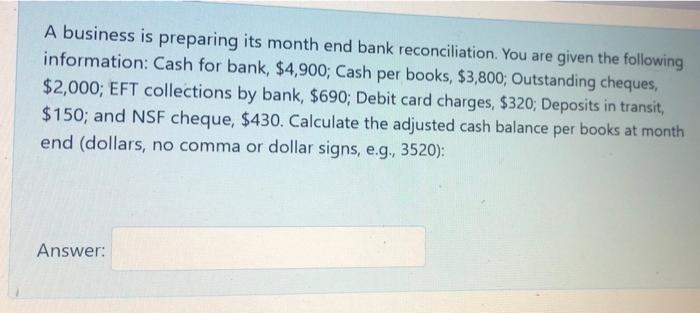

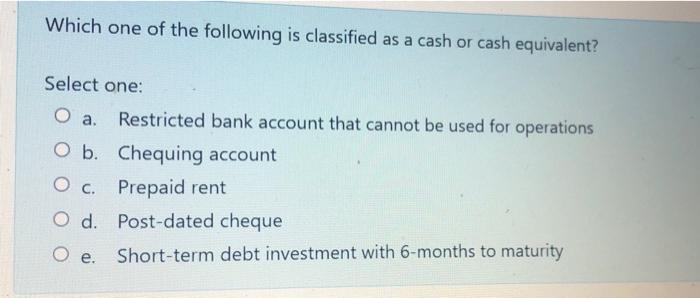

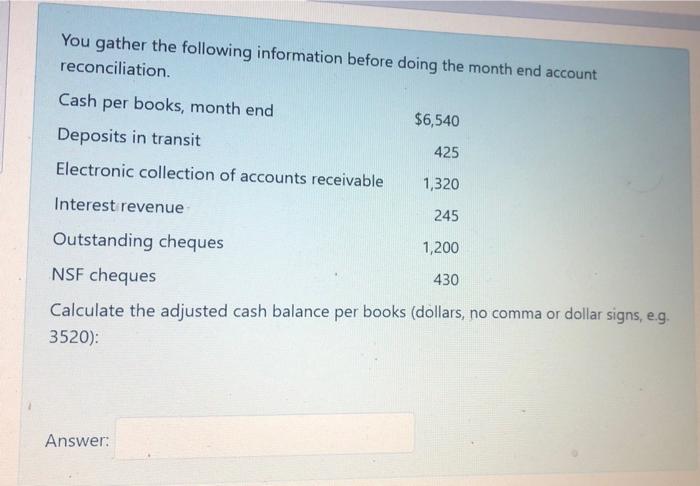

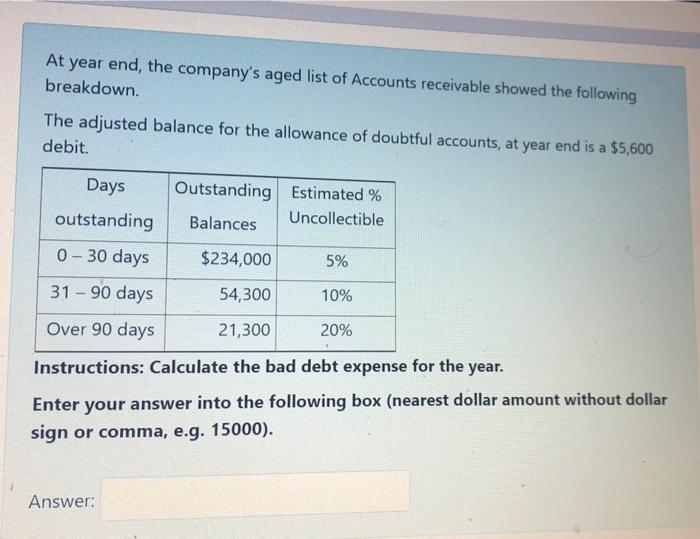

A company has old equipment that originally cost $65,700. The equipment was purchased six years ago, at which time it had an estimated useful life of 10 years and a residual value of $2,500. The straight-line method of depreciation was selected. As of its last year end, December 31, the balance of the asset's accumulated depreciation was $43,610. The equipment was sold on October 1 of the current year for $22,500. Select the correct responses for the following: 1. Current year's depreciation expense for the year of sale: 2. Was there a gain or loss on equipment sale? 3. Amount ($) of the gain or loss on sale: A business is preparing its month end bank reconciliation. You are given the following information: Cash for bank, $4,900; Cash per books, $3,800; Outstanding cheques, $2,000; EFT collections by bank, $690; Debit card charges, $320; Deposits in transit, $150; and NSF cheque, $430. Calculate the adjusted cash balance per books at month end (dollars, no comma or dollar signs, e.g., 3520): Answer: Which one of the following is classified as a cash or cash equivalent? . Select one: Restricted bank account that cannot be used for operations O b. Chequing account O c. Prepaid rent O d. Post-dated cheque e. Short-term debt investment with 6-months to maturity You gather the following information before doing the month end account reconciliation Cash per books, month end $6,540 Deposits in transit 425 Electronic collection of accounts receivable 1,320 Interest revenue 245 Outstanding cheques 1,200 NSF cheques 430 Calculate the adjusted cash balance per books (dollars, no comma or dollar signs, e.g. 3520): Answer: At year end, the company's aged list of Accounts receivable showed the following breakdown The adjusted balance for the allowance of doubtful accounts, at year end is a $5,600 debit. Outstanding Estimated % Balances Uncollectible Days outstanding 0 - 30 days 31 - 90 days $234,000 5% 54,300 10% Over 90 days 21,300 20% Instructions: Calculate the bad debt expense for the year. Enter your answer into the following box (nearest dollar amount without dollar sign or comma, e.g. 15000)