Answered step by step

Verified Expert Solution

Question

1 Approved Answer

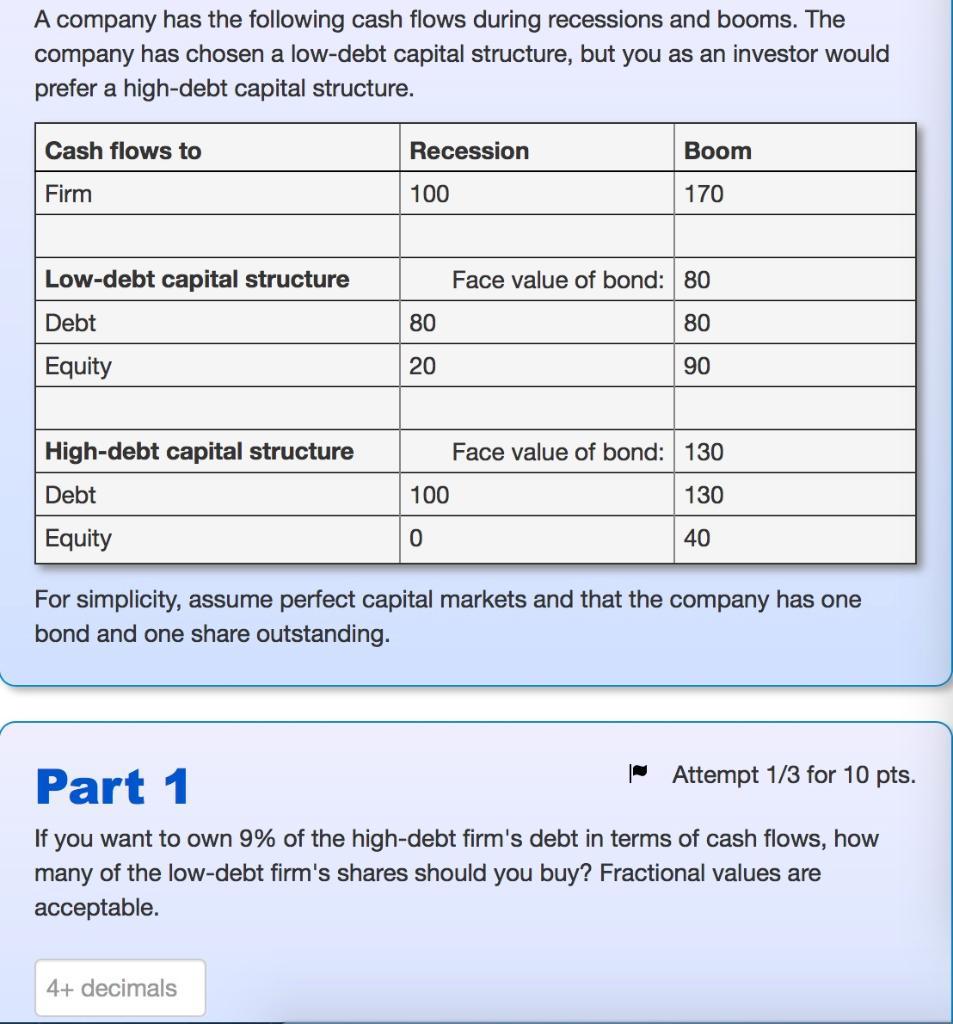

A company has the following cash flows during recessions and booms. The company has chosen a low-debt capital structure, but you as an investor

A company has the following cash flows during recessions and booms. The company has chosen a low-debt capital structure, but you as an investor would prefer a high-debt capital structure. Cash flows to Firm Low-debt capital structure Debt Equity High-debt capital structure Debt Equity Recession 100 Boom 170 Face value of bond: 80 80 80 20 20 90 Face value of bond: 130 100 130 0 40 For simplicity, assume perfect capital markets and that the company has one bond and one share outstanding. Part 1 Attempt 1/3 for 10 pts. If you want to own 9% of the high-debt firm's debt in terms of cash flows, how many of the low-debt firm's shares should you buy? Fractional values are acceptable. 4+ decimals

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine the number of shares you should buy in the lowdebt firm in order to own 9 of the highd...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started