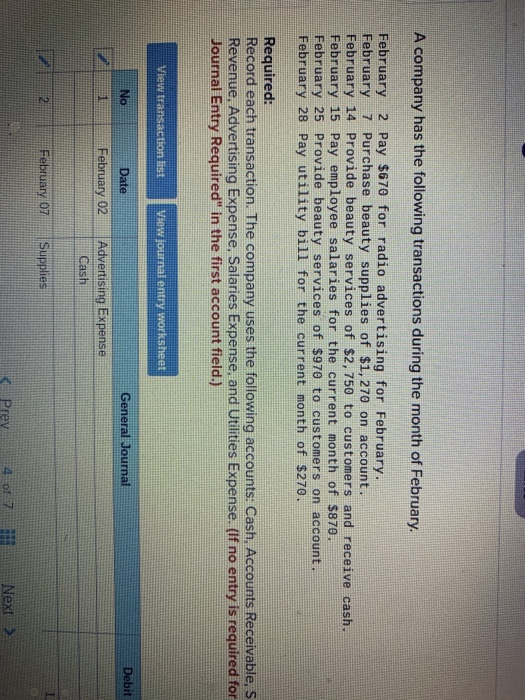

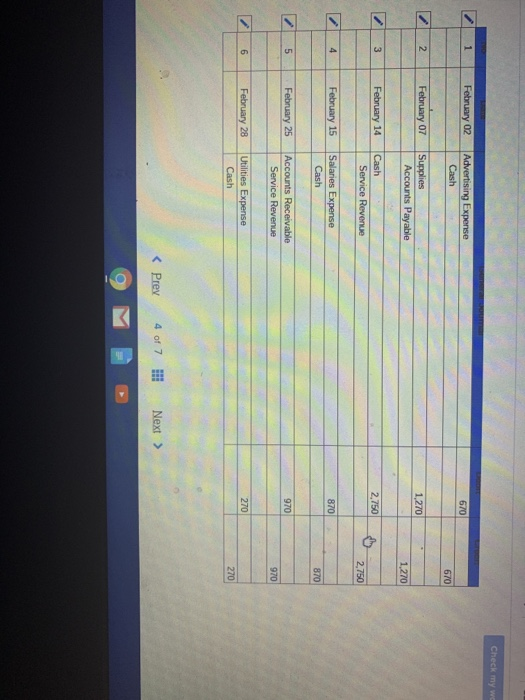

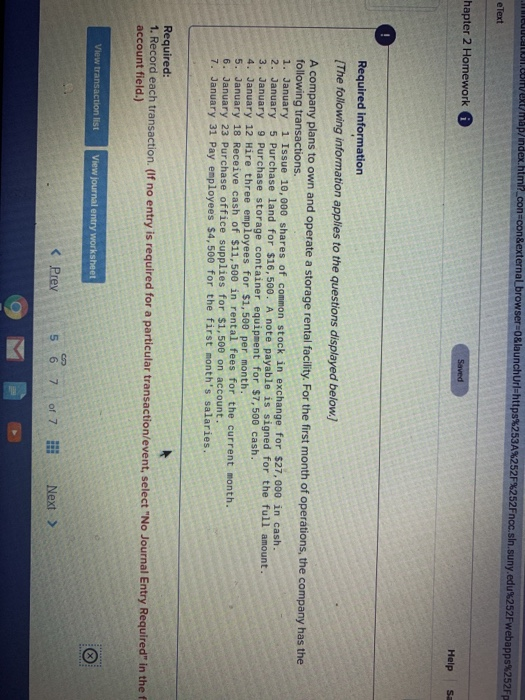

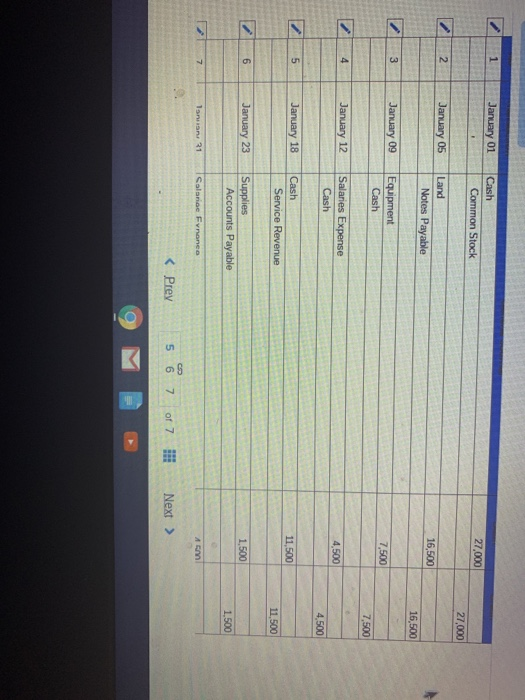

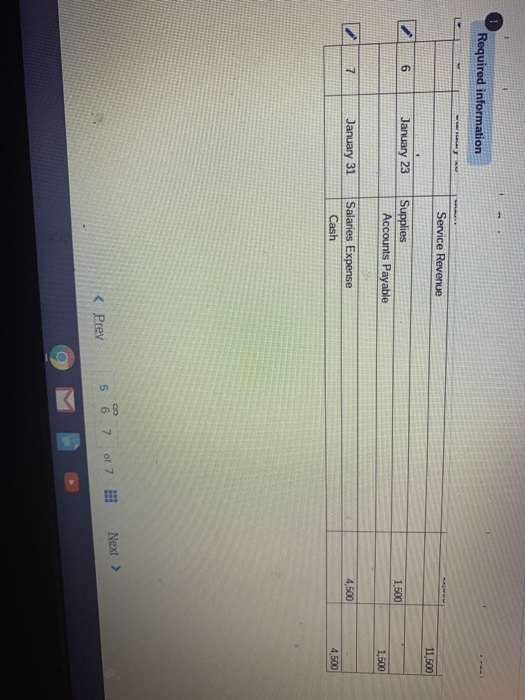

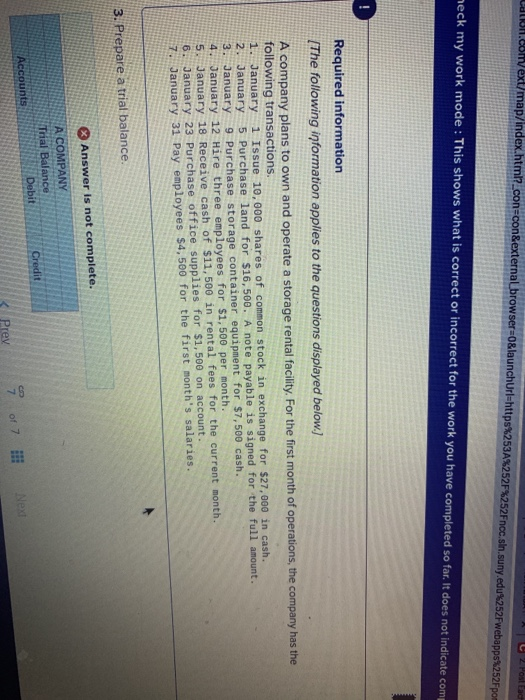

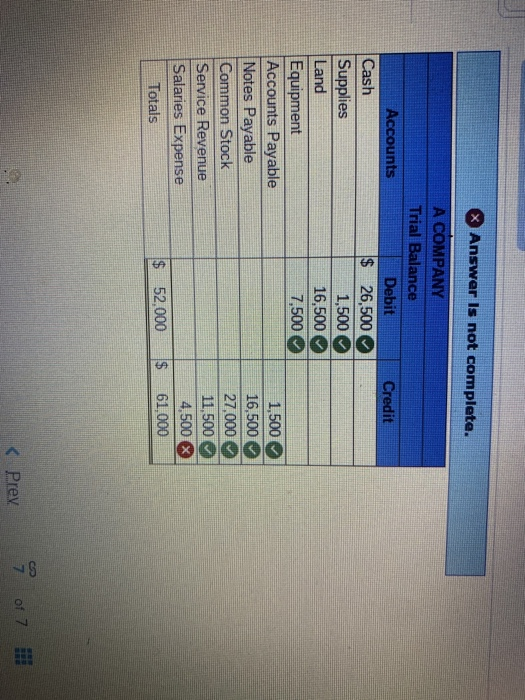

A company has the following transactions during the month of February February 2 Pay $670 for radio advertising for February. February 7 Purchase beauty supplies of $1,270 on account. February 14 Provide beauty services of $2,750 to customers and receive cash. February 15 Pay employee salaries for the current month of $870. February 25 Provide beauty services of $970 to customers on account. February 28 Pay utility bill for the current month of $270. Required: Record each transaction. The company uses the following accounts: Cash, Accounts Receivable, S Revenue, Advertising Expense, Salaries Expense, and Utilities Expense. (If no entry is required for Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No General Journal Debit Date February 02 1 Advertising Expense Cash 2 February 07 Supplies Prev 4 or Next > Check my w 1 February 02 Advertising Expense Cash 670 670 2. February 07 Supplies Accounts Payable 1,270 1,270 3 February 14 Cash Service Revenue 2,750 2,750 4 N February 15 870 Salaries Expense Cash 870 5 February 25 970 Accounts Receivable Service Revenue 970 6 February 28 270 Utilities Expense Cash 270 ca.com/ext/map/index.html?_con=con&external browser=0&launch Url=https%253A%252F%252Fncc.sin.suny.edu%252Fwebapps%252Fp e Text hapter 2 Homework i Saved Help S. Required information The following information applies to the questions displayed below.] A company plans to own and operate a storage rental facility. For the first month of operations, the company has the following transactions. 1. January 1 Issue 10,000 shares of common stock in exchange for $27,000 in cash. 2. January 5 Purchase land for $16,500. A note payable is signed for the full amount. 3. January 9 Purchase storage container equipment for $7,500 cash. 4. January 12 Hire three employees for $1,500 per month. 5. January 18 Receive cash of $11,500 in rental fees for the current month. 6. January 23 Purchase office supplies for $1,500 on account. 7. January 31 Pay employees $4,500 for the first month's salaries. Required: 1. Record each transaction. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the f account field.) View transaction list View journal entry worksheet 1 January 01 Cash Common Stock 27,000 27,000 2 January 05 Land Notes Payable 16,500 16,500 3 January 09 Equipment Cash 7,500 7,500 4 January 12 Salaries Expense Cash 4,500 4,500 N 5 January 18 Cash Service Revenue 11,500 11,500 6 January 23 Supplies Accounts Payable 1,500 1,500 7 lanis: 31 Salance Finance Am Required information Service Revenue 11,500 6 January 23 Supplies Accounts Payable 1,500 1,500 7 January 31 Salaries Expense Cash 4,500 4,500 Next > or? 5 6 7