Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company has Total Assets of $27,393 million and Total Liabilities of $8,140. The company has made a Net Income of $1,513 million for the

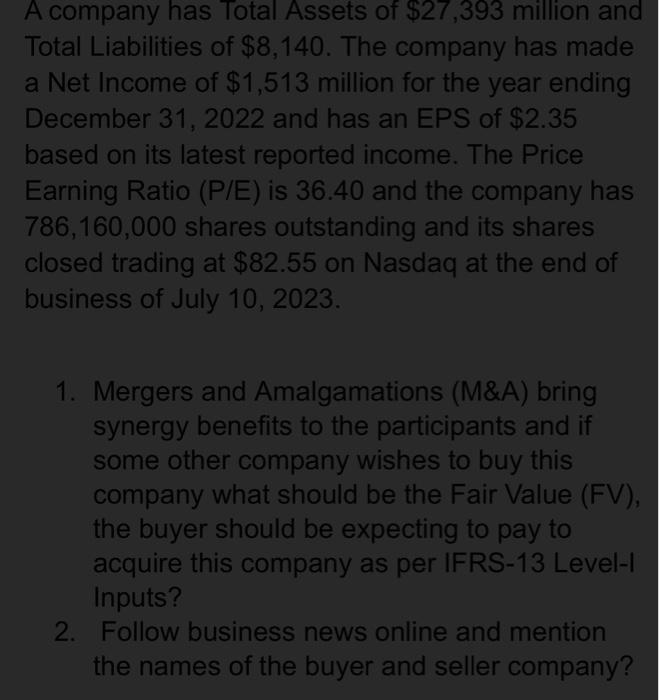

A company has Total Assets of $27,393 million and Total Liabilities of $8,140. The company has made a Net Income of $1,513 million for the year ending December 31, 2022 and has an EPS of $2.35 based on its latest reported income. The Price Earning Ratio (P/E) is 36.40 and the company has 786,160,000 shares outstanding and its shares closed trading at $82.55 on Nasdaq at the end of business of July 10, 2023. 1. Mergers and Amalgamations (M&A) bring synergy benefits to the participants and if some other company wishes to buy this company what should be the Fair Value (FV), the buyer should be expecting to pay to acquire this company as per IFRS-13 Level-l Inputs? 2. Follow business news online and mention the names of the buyer and seller company?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started