Question

A company imports machine form the US. It wants to buy machines worth $250,000 from the US in 6 months. Usually, it takes another 6

A company imports machine form the US. It wants to buy machines worth $250,000 from the US in 6 months. Usually, it takes another 6 months for the machine to arrive. The company intends to borrow $250,000 from the Bank @8% for 6 months- until they manage to sell the machine to Jordanian customers. The companys customers usually pay in Jordanian Dinars... The company hired you as a financial consultant. 1. What is the value of the transaction in Jordanian Dinar in 6 months? 2. How much money the company will have to return to the bank in one year- Give the value in Jordanian Dinars 3. How much would be the company total losses or profit ( in JD)

4. The company hired you as a financial consultant to manage the currency risk. You expect that the US rate will increase by 500 base points on the 6-month rate. You convince the company to sign a forward contract with The Bank:

a. What kind of forward exchange rate should the company sign with the bank? Which currency would you choose to belong and which currency short? Explain why

b. Suppose when you called the bank, they told you that the 6-month forward rate is 0.74J/$. If the rate is wrong, explain how would you take advantage of this mistake? Explain How it works- draw a clear draft.

c. How much would be your profit/Loss given that your expectation materialized- the US gov increase the rate by 500 points?

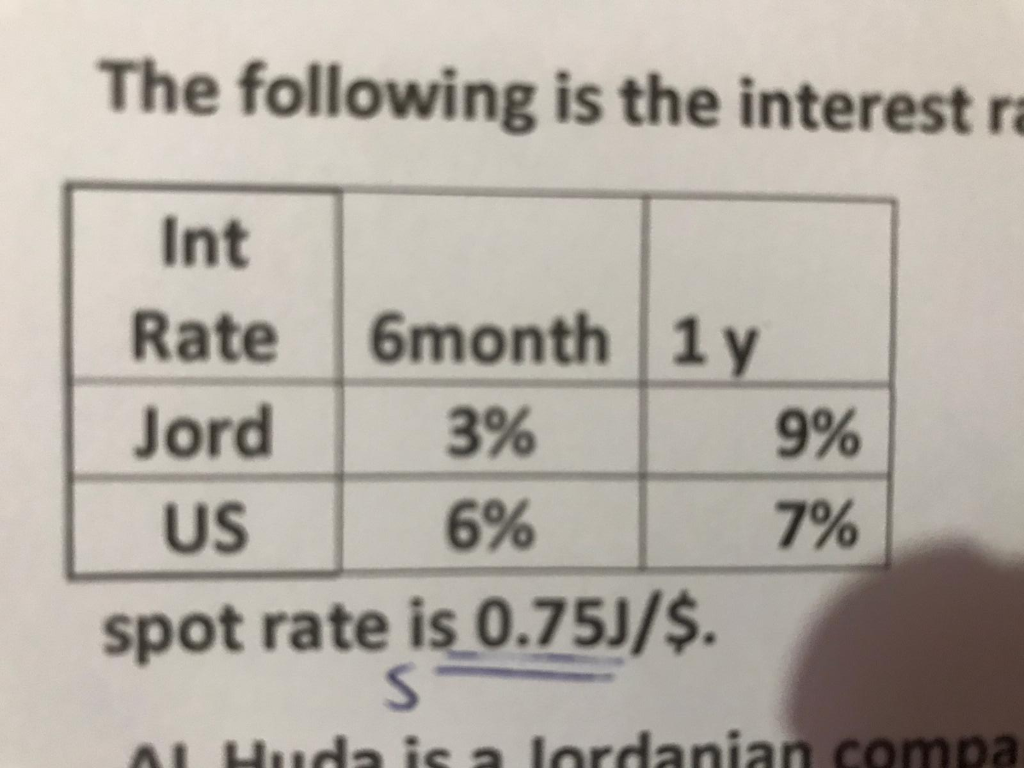

The following is the interest ra Int Rate 6month 1 y Jord 3% 9% US 6% 7% spot rate is 0.75J/$. S ALudo is Jordanian compaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started