Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company initially has no debt. Its operations will generate a free cash flow in one year that will be either $100 million (with

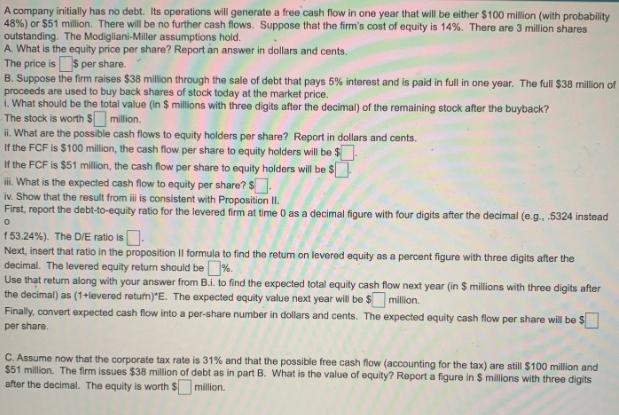

A company initially has no debt. Its operations will generate a free cash flow in one year that will be either $100 million (with probability 48%) or $51 million. There will be no further cash flows. Suppose that the firm's cost of equity is 14%. There are 3 million shares outstanding. The Modigliani-Miller assumptions hold. A. What is the equity price per share? Report an answer in dollars and cents. The price is $ per share. B. Suppose the firm raises $38 million through the sale of debt that pays 5% interest and is paid in full in one year. The full $38 million of proceeds are used to buy back shares of stock today at the market price. 1. What should be the total value (in $ millions with three digits after the decimal) of the remaining stock after the buyback? The stock is worth $ million. ii. What are the possible cash flows to equity holders per share? Report in dollars and cents. If the FCF is $100 million, the cash flow per share to equity holders will be $ If the FCF is $51 million, the cash flow per share to equity holders will be $ iii. What is the expected cash flow to equity per share? S iv. Show that the result from iii is consistent with Proposition II. First, report the debt-to-equity ratio for the levered firm at time 0 as a decimal figure with four digits after the decimal (e.g.. .5324 instead 0 153.24%). The D/E ratio is Next, insert that ratio in the proposition II formula to find the return on levered equity as a percent figure with three digits after the decimal. The levered equity return should be %. Use that return along with your answer from B.i. to find the expected total equity cash flow next year (in $5 millions with three digits after the decimal) as (1+levered return) "E. The expected equity value next year will be $ million. Finally, convert expected cash flow into a per-share number in dollars and cents. The expected equity cash flow per share will be $ per share. C. Assume now that the corporate tax rate is 31% and that the possible free cash flow (accounting for the tax) are still $100 million and $51 million. The firm issues $38 million of debt as in part B. What is the value of equity? Report a figure in $ millions with three digits after the decimal. The equity is worth $ million.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A Initially the company has no debt and the equity price per share can be calculated using the expected free cash flow to equity FCFE and the cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started