Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is a collection of projects that collectively over the years provides for the production of the products we consume. When we look at

A company is a collection of projects that collectively over the years provides for the production of the products we consume. When we look at the balance sheet of an existing company, we are observing the average for the company, as it exists today a historical record of their financial position.

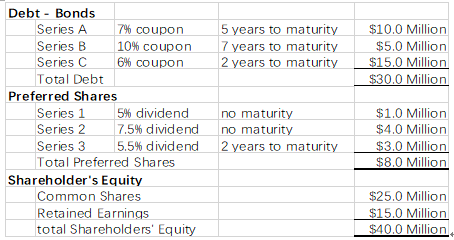

Consider the following information for MAC&CHEESE:

- Calculate the weighted average cost of financing using debt for the existing company.

(3 marks)

- Calculate the weighted average cost of financing using preferred shares for the existing company. (3 marks)

- Shareholders require a 14% return on the equity of the firm and the firm has a tax rate of 40%. Calculate the WACC for MAC&CHEESE. Show your work. (3 marks)

Please show the calculation.

5 years to maturity 7 years to maturity 2 years to maturity $10.0 Million $5.0 Million $15.0 Million $30.0 Million Debt - Bonds Series A 7% coupon Series B 10% coupon Series C 6% coupon Total Debt Preferred Shares Series 1 54 dividend Series 2 7.5% dividend Series 3 5.5% dividend Total Preferred Shares Shareholder's Equity Common Shares Retained Earnings total Shareholders' Equity no maturity no maturity 2 years to maturity $1.0 Million $4.0 Million $3.0 Million $8.0 Million $25.0 Million $15.0 Million $40.0 MillionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started