Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is about to invest in a joint venture research and development project with another company. The project is expected to last eight years,

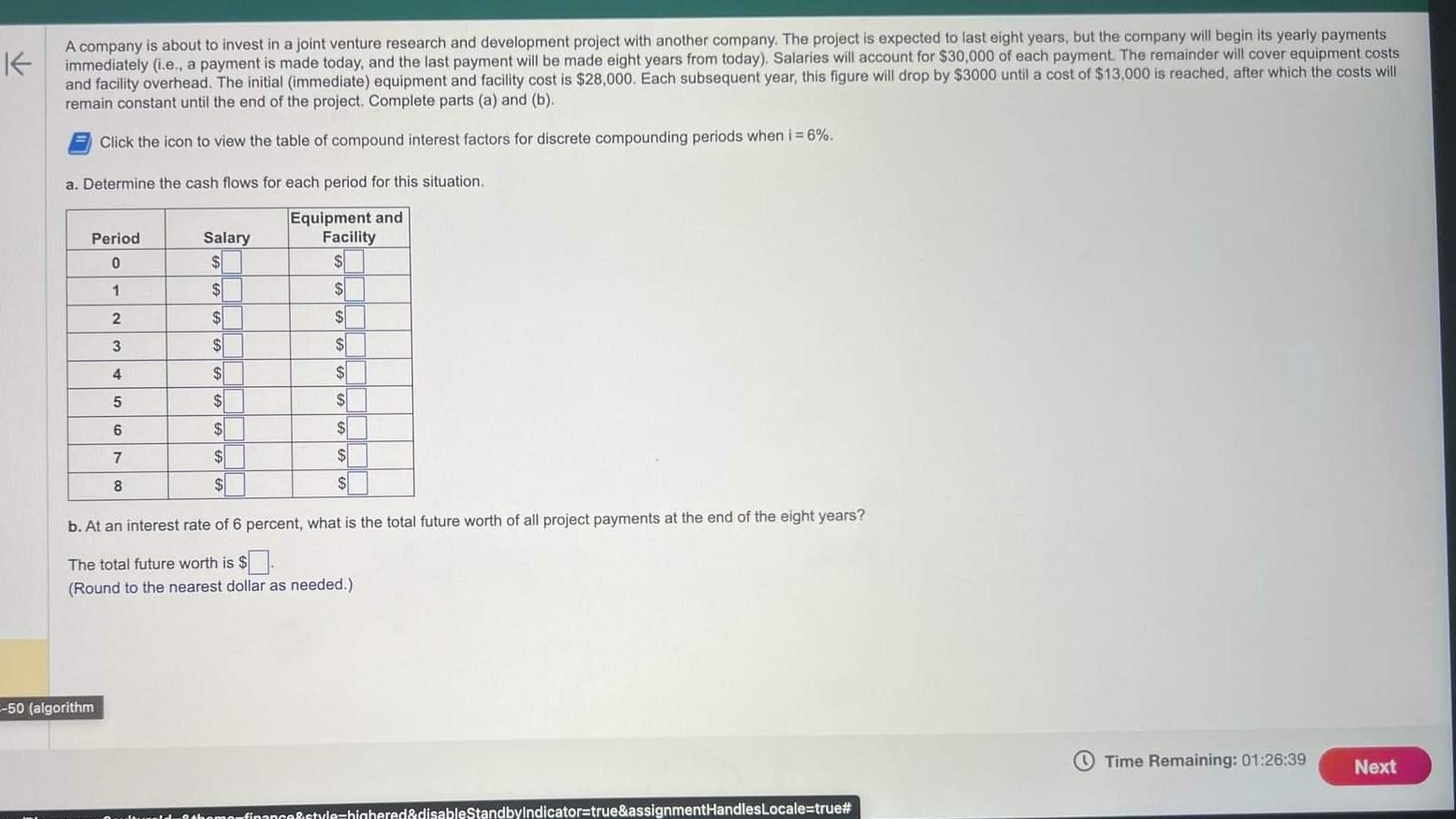

A company is about to invest in a joint venture research and development project with another company. The project is expected to last eight years, but the company will begin its yearly payments immediately (i.e., a payment is made today, and the last payment will be made eight years from today). Salaries will account for $30,000 of each payment. The remainder will cover equipment costs and facility overhead. The initial (immediate) equipment and facility cost is $28,000. Each subsequent year, this figure will drop by $3000 until a cost of $13,000 is reached, after which the costs will remain constant until the end of the project. Complete parts (a) and (b). Click the icon to view the table of compound interest factors for discrete compounding periods when i=6%. a. Determine the cash flows for each period for this situation. b. At an interest rate of 6 percent, what is the total future worth of all project payments at the end of the eight years? The total future worth is $ (Round to the nearest dollar as needed.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started