Answered step by step

Verified Expert Solution

Question

1 Approved Answer

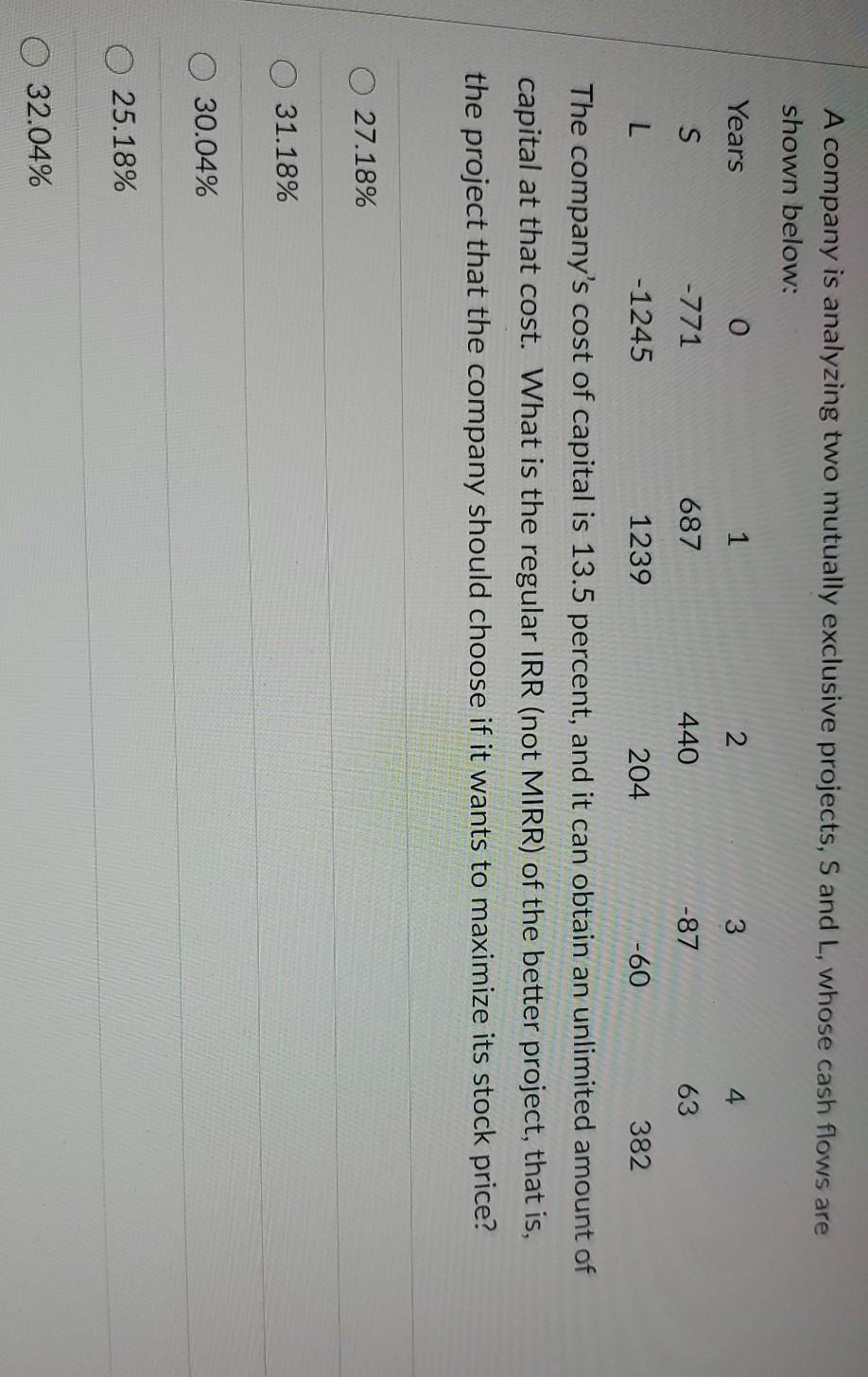

A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: Years o 1 2 3 4 S -771

A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: Years o 1 2 3 4 S -771 687 440 -87 63 L -1245 1239 204 -60 382 The company's cost of capital is 13.5 percent, and it can obtain an unlimited amount of capital at that cost. What is the regular IRR (not MIRR) of the better project, that is, the project that the company should choose if it wants to maximize its stock price? 27.18% 31.18% 30.04% 25.18% O 32.04% Which of the following is the best measure to evaluate capital budgeting projects? Although it may not be the most widely used measure, it provides the most accurate accept/reject decision and should be used as the default method to evaluate projects. NPV O Discounted Payback Payback IRR MIRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started