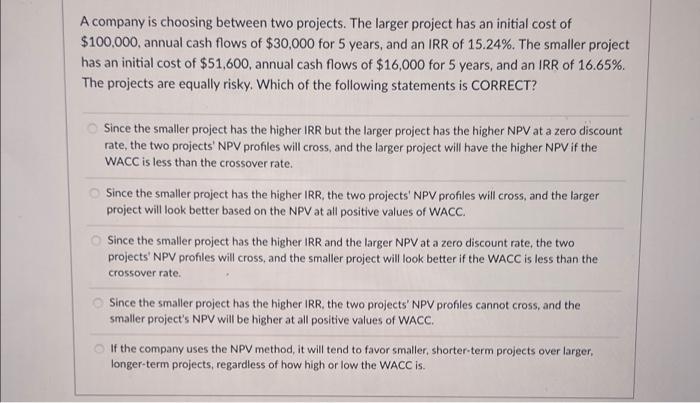

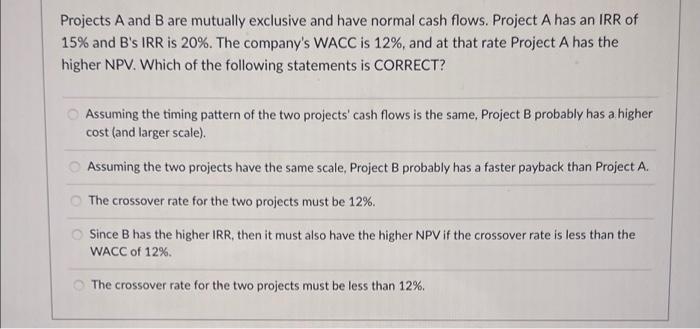

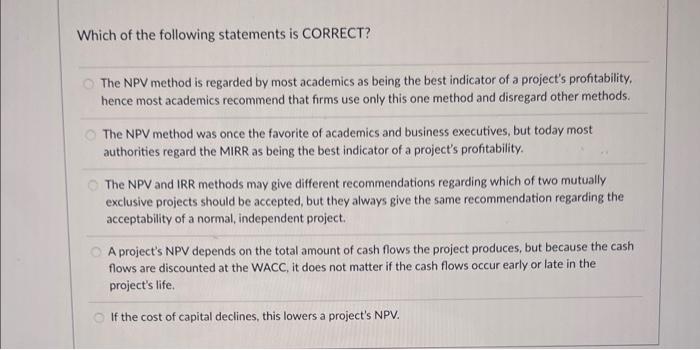

A company is choosing between two projects. The larger project has an initial cost of $100,000, annual cash flows of $30,000 for 5 years, and an IRR of 15.24%. The smaller project has an initial cost of $51,600, annual cash flows of $16,000 for 5 years, and an IRR of 16.65%. The projects are equally risky. Which of the following statements is CORRECT? Since the smaller project has the higher IRR but the larger project has the higher NPV at a zero discount rate, the two projects' NPV profiles will cross, and the larger project will have the higher NPV if the WACC is less than the crossover rate. Since the smaller project has the higher IRR, the two projects' NPV profiles will cross, and the larger project will look better based on the NPV at all positive values of WACC. Since the smaller project has the higher IRR and the larger NPV at a zero discount rate, the two projects' NPV profiles will cross, and the smaller project will look better if the WACC is less than the crossover rate. Since the smaller project has the higher IRR. the two projects' NPV prohles cannot cross, and the smaller project's NPV will be higher at all positive values of WACC. If the company uses the NPV method, it will tend to favor smaller, shorter-term projects over larger, longer-term projects, regardless of how high or low the WACC is. Projects A and B are mutually exclusive and have normal cash flows. Project A has an IRR of 15% and B's IRR is 20%. The company's WACC is 12%, and at that rate Project A has the higher NPV. Which of the following statements is CORRECT? Assuming the timing pattern of the two projects' cash flows is the same, Project B probably has a higher cost (and larger scale). Assuming the two projects have the same scale, Project B probably has a faster payback than Project A. The crossover rate for the two projects must be 12%. Since B has the higher IRR, then it must also have the higher NPV if the crossover rate is less than the WACC of 12% The crossover rate for the two projects must be less than 12% Which of the following statements is CORRECT? The NPV method is regarded by most academics as being the best indicator of a project's profitability, hence most academics recommend that firms use only this one method and disregard other methods. The NPV method was once the favorite of academics and business executives, but today most authorities regard the MIRR as being the best indicator of a project's profitability. The NPV and IRR methods may give different recommendations regarding which of two mutually exclusive projects should be accepted, but they always give the same recommendation regarding the acceptability of a normal, independent project. A project's NPV depends on the total amount of cash flows the project produces, but because the cash flows are discounted at the WACC, it does not matter if the cash flows occur early or late in the project's life. If the cost of capital declines, this lowers a project's NPV