Answered step by step

Verified Expert Solution

Question

1 Approved Answer

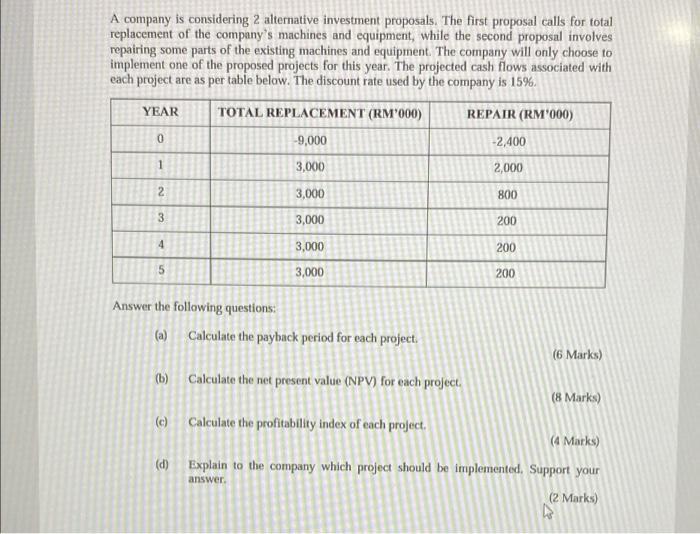

A company is considering 2 alternative investment proposals. The first proposal calls for total replacement of the company's machines and equipment, while the second

A company is considering 2 alternative investment proposals. The first proposal calls for total replacement of the company's machines and equipment, while the second proposal involves repairing some parts of the existing machines and equipment. The company will only choose to implement one of the proposed projects for this year. The projected cash flows associated with each project are as per table below. The discount rate used by the company is 15%. TOTAL REPLACEMENT (RM'000) REPAIR (RM'000) YEAR 0 -9,000 -2,400 1 3,000 2,000 2 3,000 800 3 3,000 200 4 3,000 200 5 3,000 200 Answer the following questions: (a) Calculate the payback period for each project. (6 Marks) (b) Calculate the net present value (NPV) for each project. (8 Marks) (c) Calculate the profitability index of each project. (4 Marks) (d) Explain to the company which project should be implemented. Support your answer. (2 Marks)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the investment proposals for the company considering total replacement and repair of mach...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started