Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. In one of the meetings, the CEO of your organization commented: We should not be drilling the oil well because there is a

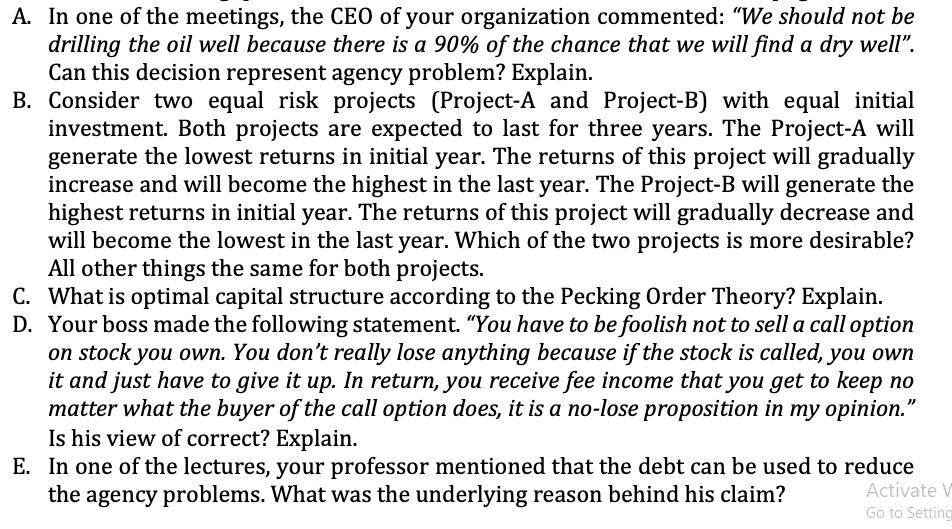

A. In one of the meetings, the CEO of your organization commented: "We should not be drilling the oil well because there is a 90% of the chance that we will find a dry well". Can this decision represent agency problem? Explain. B. Consider two equal risk projects (Project-A and Project-B) with equal initial investment. Both projects are expected to last for three years. The Project-A will generate the lowest returns in initial year. The returns of this project will gradually increase and will become the highest in the last year. The Project-B will generate the highest returns in initial year. The returns of this project will gradually decrease and will become the lowest in the last year. Which of the two projects is more desirable? All other things the same for both projects. C. What is optimal capital structure according to the Pecking Order Theory? Explain. D. Your boss made the following statement. "You have to be foolish not to sell a call option on stock you own. You don't really lose anything because if the stock is called, you own it and just have to give it up. In return, you receive fee income that you get to keep no matter what the buyer of the call option does, it is a no-lose proposition in my opinion." Is his view of correct? Explain. E. In one of the lectures, your professor mentioned that the debt can be used to reduce the agency problems. What was the underlying reason behind his claim? Activate V Go to Setting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Yes the CEOs comment about not drilling the oil well due to a 90 chance of finding a dry well can represent an agency problem An agency problem arises when there is a conflict of interest between th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started