Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(d) Aina just got her driver license, and she wants to buy a new car cost for RM70,000. She has RM3,000 to invest as

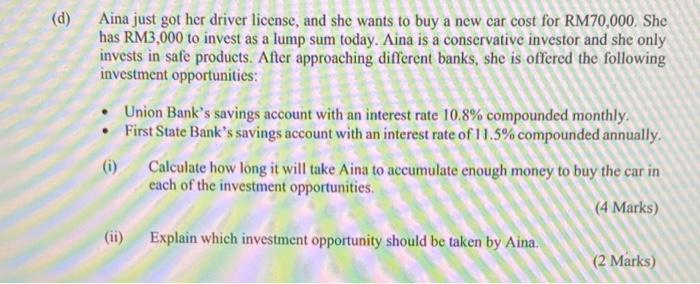

(d) Aina just got her driver license, and she wants to buy a new car cost for RM70,000. She has RM3,000 to invest as a lump sum today. Aina is a conservative investor and she only invests in safe products. After approaching different banks, she is offered the following investment opportunities: (i) Union Bank's savings account with an interest rate 10.8% compounded monthly. First State Bank's savings account with an interest rate of 11.5% compounded annually. Calculate how long it will take Aina to accumulate enough money to buy the car in each of the investment opportunities. (4 Marks) (ii) Explain which investment opportunity should be taken by Aina. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Calculating Time to Reach Target Amount Union Bank Monthly Compounding We can use the Future Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started