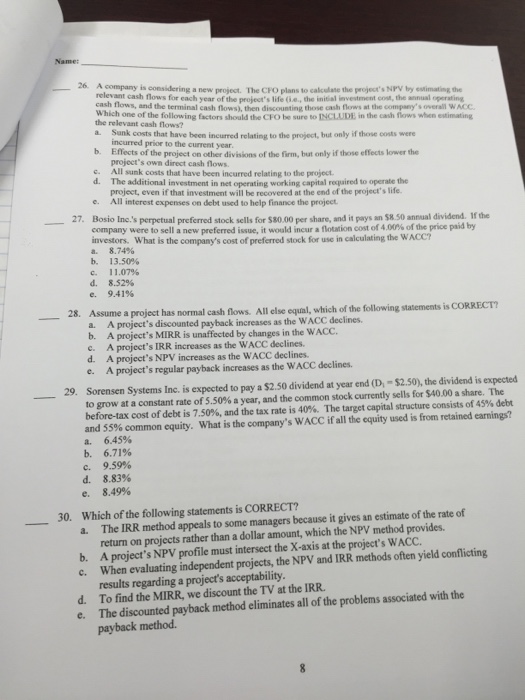

A company is considering a new project. The CFO plans to calculate the project's NPV by estimating the relevant cash flows for each year of the project's life (i.e., the initial investment cost, the annual operating cash flows, and the terminal cash flows), then discounting those cash flows at the company's overall WAOC. Which one of the following factors should the CFO be sure to INCLUDE in the cash flows when estimating the relevant cash flows? Sank costs that have been incurred relating to the project, but only if those costs were incurred prior to the current year. Effects of the project on other divisions of the firm, but only if those effects lower the project's own direct cash flows. All sunk costs that have been incurred relating to the project. The additional investment in net operating working capital required to operate the project, even if that investment will be recovered at the end of the project's life. All interest expenses on debt used to help finance the project. Basic Inc.'s perpetual preferred stock sells for $80.00 per share, and it pays an $8.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? 8.74% 13.50% 11.07% 8.52% 9.41% Assume a project has normal cash flows. All else equal, which of the following statements is CORRECT? A project's discounted payback increases as the WACC declines. A project's MIRR is unaffected by changes in the WACC. A project's IRR increases as the WACC declines. A project's NPV increases as the WACC declines. A project's regular payback increases as the WACC declines. Sorensen Systems Inc. is expected to pay a $2.50 divident at year end(D_1 = $2.50), the dividend is expected to grow at a constant rate of 5.50 % a year, and the common stock currently sells for $40,00 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital structure consists of 45% debt and 55% common equity. What is the company's WACC if all the equity used is from retained earnings? 6.45% 6.71% 9.69% 8.83% 8.49% Which of the following statements is CORRECT? The IRR method appeals to some managers because it gives an estimate of the rate of return on projects rather than a dollar amount, which the NPV method provides. A project's NPV profile must intersect the X-axis at the project's WACC. When evaluating independent projects, the NPV and IRR methods often yield conflicting results regarding a project's acceptability. To find the MIRR, we discount the TV at the IRR. The discounted payback method eliminates all of the problems associated with the payback method