Question

A company is considering an 8-year project to expand into a new geographical area. The project requires a new machine, which would cost $230,000

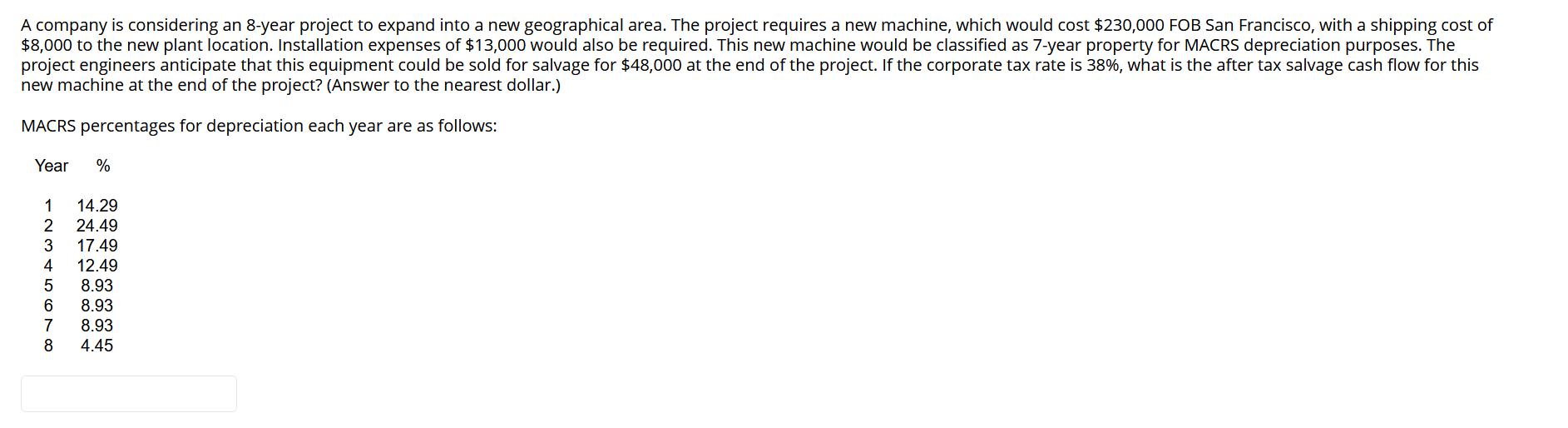

A company is considering an 8-year project to expand into a new geographical area. The project requires a new machine, which would cost $230,000 FOB San Francisco, with a shipping cost of $8,000 to the new plant location. Installation expenses of $13,000 would also be required. This new machine would be classified as 7-year property for MACRS depreciation purposes. The project engineers anticipate that this equipment could be sold for salvage for $48,000 at the end of the project. If the corporate tax rate is 38%, what is the after tax salvage cash flow for this new machine at the end of the project? (Answer to the nearest dollar.) MACRS percentages for depreciation each year are as follows: Year % 1 14.29 2 24.49 3 17.49 45678 12.49 8.93 8.93 8.93 4.45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Data Analysis And Decision Making

Authors: Christian Albright, Wayne Winston, Christopher Zappe

4th Edition

538476125, 978-0538476126

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App