Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering buying a new piece of equipment for four years which will improve its production efficiency. Buying the new equipment would cost

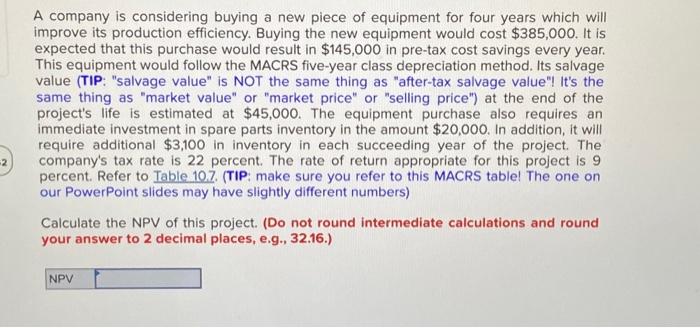

A company is considering buying a new piece of equipment for four years which will improve its production efficiency. Buying the new equipment would cost $385,000. It is expected that this purchase would result in $145,000 in pre-tax cost savings every year. This equipment would follow the MACRS five-year class depreciation method. Its salvage value (TIP: "salvage value" is NOT the same thing as "after-tax salvage value"! It's the same thing as "market value" or "market price" or "selling price") at the end of the project's life is estimated at $45,000. The equipment purchase also requires an immediate investment in spare parts inventory in the amount $20,000. In addition, it will require additional $3,100 in inventory in each succeeding year of the project. The company's tax rate is 22 percent. The rate of return appropriate for this project is 9 percent. Refer to Table 10.7. (TIP: make sure you refer to this MACRS table! The one on our PowerPoint slides may have slightly different numbers) Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started