Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering either buying a new machine or overhauling an old machine. Information about the alternative machines follows. The company requires a

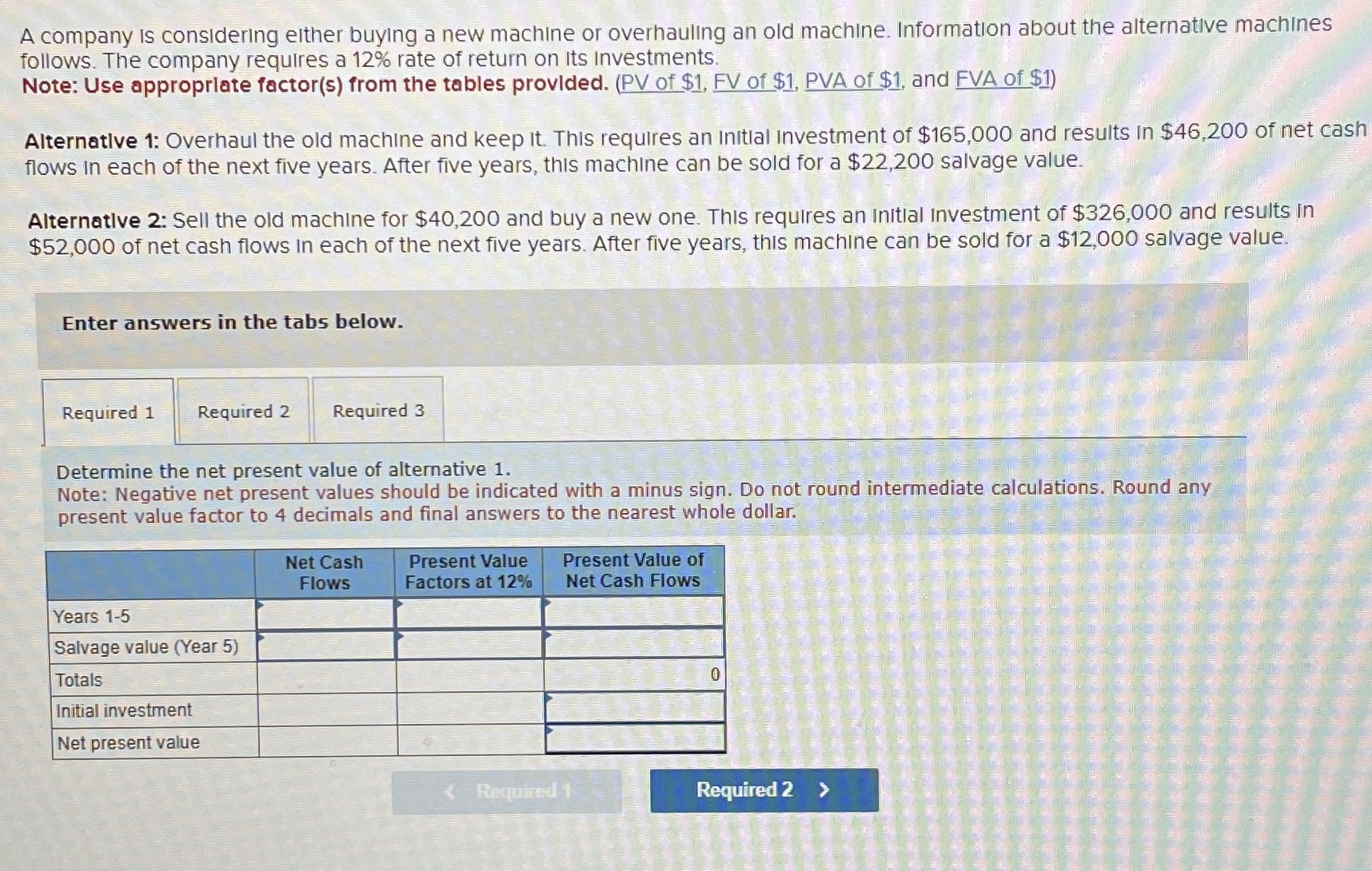

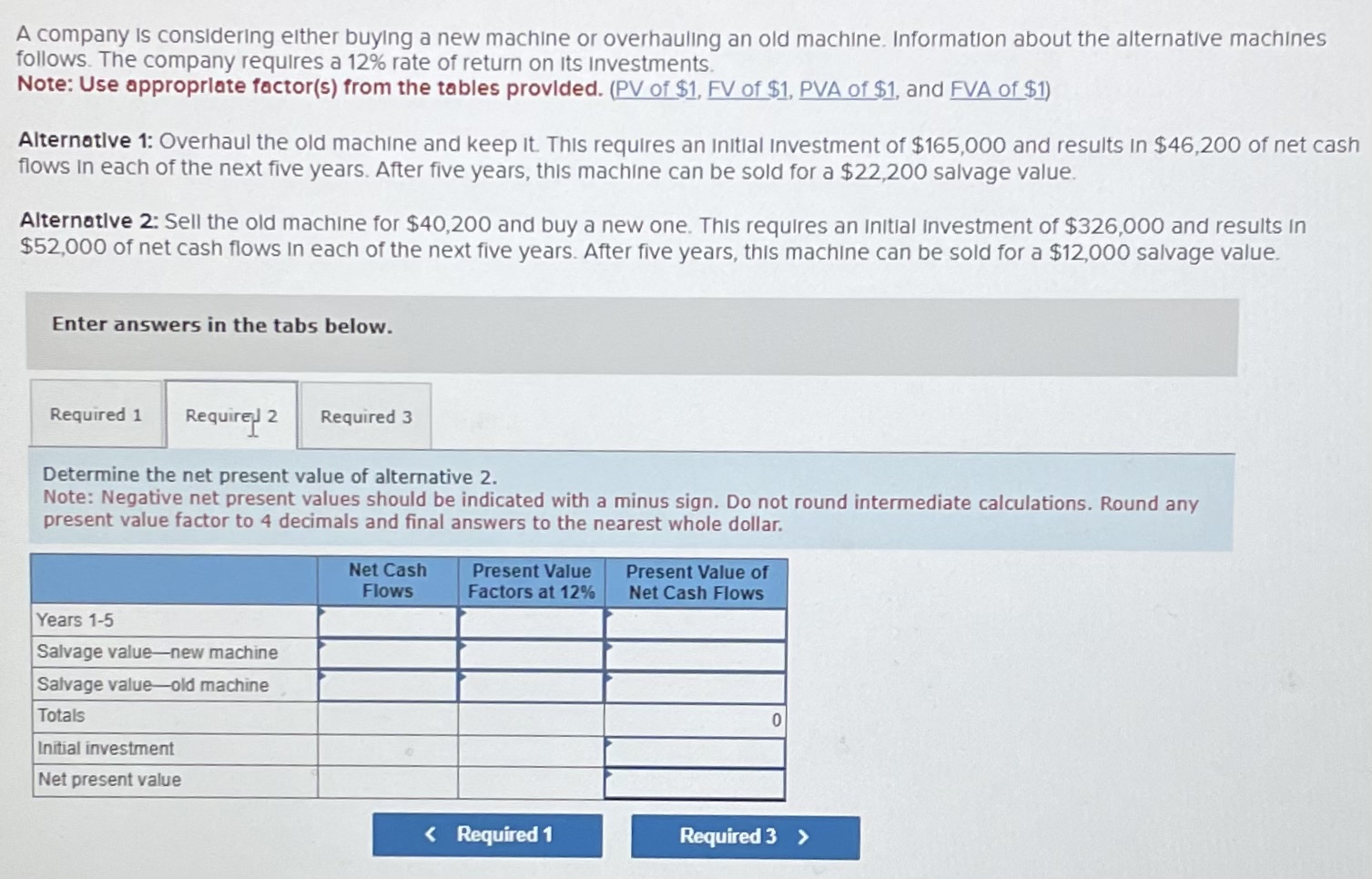

A company is considering either buying a new machine or overhauling an old machine. Information about the alternative machines follows. The company requires a 12% rate of return on its Investments. Note: Use appropriate factor(s) from the tables provided. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Alternative 1: Overhaul the old machine and keep it. This requires an initial Investment of $165,000 and results in $46,200 of net cash flows in each of the next five years. After five years, this machine can be sold for a $22,200 salvage value. Alternative 2: Sell the old machine for $40,200 and buy a new one. This requires an Initial Investment of $326,000 and results in $52,000 of net cash flows in each of the next five years. After five years, this machine can be sold for a $12,000 salvage value. Enter answers in the tabs below. Required 1 Required 2 Required 3 Determine the net present value of alternative 1. Note: Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round any present value factor to 4 decimals and final answers to the nearest whole dollar. Years 1-5 Salvage value (Year 5) Totals Initial investment Net present value Net Cash Flows Present Value Factors at 12% Present Value of Net Cash Flows 0 *Required 1 Required 2 > A company is considering either buying a new machine or overhauling an old machine. Information about the alternative machines follows. The company requires a 12% rate of return on its Investments. Note: Use appropriate factor(s) from the tables provided. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Alternative 1: Overhaul the old machine and keep it. This requires an Initial Investment of $165,000 and results in $46,200 of net cash flows in each of the next five years. After five years, this machine can be sold for a $22,200 salvage value. Alternative 2: Sell the old machine for $40,200 and buy a new one. This requires an Initial Investment of $326,000 and results in $52,000 of net cash flows in each of the next five years. After five years, this machine can be sold for a $12,000 salvage value. Enter answers in the tabs below. Required 1 Required 2 Required 3 Determine the net present value of alternative 2. Note: Negative net present values should be indicated with a minus sign. Do not round intermediate calculations. Round any present value factor to 4 decimals and final answers to the nearest whole dollar. Years 1-5 Salvage value-new machine Salvage value-old machine Totals Initial investment Net present value Net Cash Flows Present Value Factors at 12% Present Value of Net Cash Flows 0 < Required 1 Required 3 > A company is considering either buying a new machine or overhauling an old machine. Information about the alternative machines follows. The company requires a 12% rate of return on its Investments. Note: Use appropriate factor(s) from the tables provided. (PV of $1, FV of $1. PVA of $1, and FVA of $1) Alternative 1: Overhaul the old machine and keep it. This requires an initial investment of $165,000 and results in $46,200 of net cash flows in each of the next five years. After five years, this machine can be sold for a $22,200 salvage value. Alternative 2: Sell the old machine for $40,200 and buy a new one. This requires an Initial Investment of $326,000 and results in $52,000 of net cash flows in each of the next five years. After five years, this machine can be sold for a $12,000 salvage value. Enter answers in the tabs below. Required 1 Required 2 Requir3 Which alternative should management select based on net present value? Management should select < Required 2 Reguld 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started