Answered step by step

Verified Expert Solution

Question

1 Approved Answer

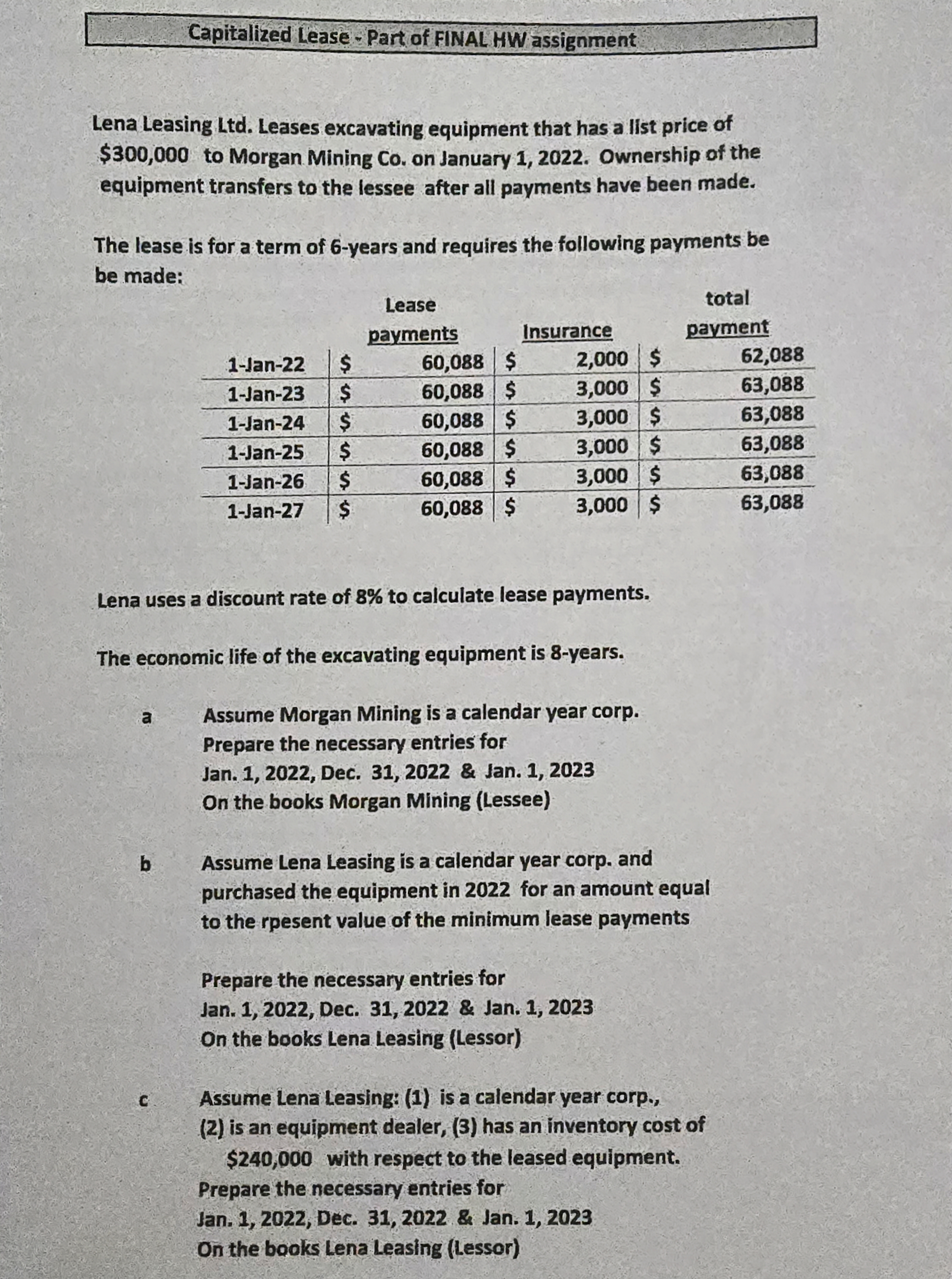

Capitalized Lease - Part of FINAL HW assignment Lena Leasing Ltd. Leases excavating equipment that has a list price of $300,000 to Morgan Mining

Capitalized Lease - Part of FINAL HW assignment Lena Leasing Ltd. Leases excavating equipment that has a list price of $300,000 to Morgan Mining Co. on January 1, 2022. Ownership of the equipment transfers to the lessee after all payments have been made. The lease is for a term of 6-years and requires the following payments be be made: Lease payments total Insurance payment 1-Jan-22 1-Jan-23 $ 1-Jan-24 1-Jan-25 $ 5555 $ 60,088 $ 2,000 $ 62,088 60,088 $ 3,000 $ 63,088 $ 60,088 $ 3,000 $ 63,088 60,088 $ 3,000 $ 63,088 1-Jan-26 $ 60,088 $ 3,000 $ 63,088 1-Jan-27 $ 60,088 $ 3,000 $ 63,088 Lena uses a discount rate of 8% to calculate lease payments. The economic life of the excavating equipment is 8-years. a Assume Morgan Mining is a calendar year corp. Prepare the necessary entries for Jan. 1, 2022, Dec. 31, 2022 & Jan. 1, 2023 On the books Morgan Mining (Lessee) b Assume Lena Leasing is a calendar year corp. and purchased the equipment in 2022 for an amount equal to the rpesent value of the minimum lease payments Prepare the necessary entries for Jan. 1, 2022, Dec. 31, 2022 & Jan. 1, 2023 On the books Lena Leasing (Lessor) Assume Lena Leasing: (1) is a calendar year corp., (2) is an equipment dealer, (3) has an inventory cost of $240,000 with respect to the leased equipment. Prepare the necessary entries for Jan. 1, 2022, Dec. 31, 2022 & Jan. 1, 2023 On the books Lena Leasing (Lessor)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started