Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering expanding in LATAM or US, considering the following initial investments and expected future cash flows: The discount rate over 5 years

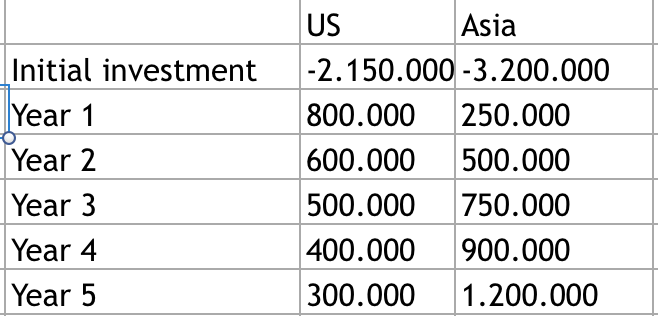

A company is considering expanding in LATAM or US, considering the following initial investments and expected future cash flows: The discount rate over 5 years is 5%

find 5. Calculate the present value of the sum of future cash flows, the net present value (NPV), Benefit cost ratio (BCR) and the internal rate of return (IRR)

Advise on where it would be more profitable for the company to expand.

Initial investment Year 1 Year 2 Year 3 Year 4 Year 5 US Asia -2.150.000 -3.200.000 800.000 250.000 600.000 500.000 500.000 750.000 400.000 900.000 300.000 1.200.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started