Question

A company is considering introducing a new product in 2020. The product is expected to be in production for two years after it is expected

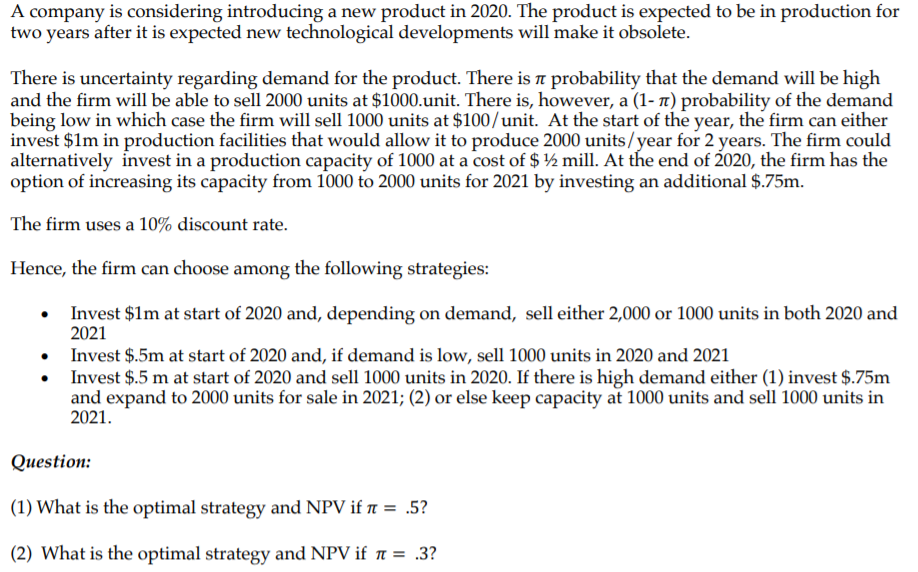

A company is considering introducing a new product in 2020. The product is expected to be in production for two years after it is expected new technological developments will make it obsolete. There is uncertainty regarding demand for the product. There is probability that the demand will be high and the firm will be able to sell 2000 units at $1000.unit. There is, however, a (1- ) probability of the demand being low in which case the firm will sell 1000 units at $100/unit. At the start of the year, the firm can either invest $1m in production facilities that would allow it to produce 2000 units/year for 2 years. The firm could alternatively invest in a production capacity of 1000 at a cost of $ mill. At the end of 2020, the firm has the option of increasing its capacity from 1000 to 2000 units for 2021 by investing an additional $.75m. The firm uses a 10% discount rate. Hence, the firm can choose among the following strategies: Invest $1m at start of 2020 and, depending on demand, sell either 2,000 or 1000 units in both 2020 and 2021 Invest $.5m at start of 2020 and, if demand is low, sell 1000 units in 2020 and 2021 Invest $.5 m at start of 2020 and sell 1000 units in 2020. If there is high demand either (1) invest $.75m and expand to 2000 units for sale in 2021; (2) or else keep capacity at 1000 units and sell 1000 units in 2021. Question: (1) What is the optimal strategy and NPV if = .5? (2) What is the optimal strategy and NPV if = .3? Amount per unit = $1000

A company is considering introducing a new product in 2020. The product is expected to be in production for two years after it is expected new technological developments will make it obsolete. There is uncertainty regarding demand for the product. There is a probability that the demand will be high and the firm will be able to sell 2000 units at $1000.unit. There is, however, a (1- tt) probability of the demand being low in which case the firm will sell 1000 units at $100/unit. At the start of the year, the firm can either invest $1m in production facilities that would allow it to produce 2000 units/year for 2 years. The firm could alternatively invest in a production capacity of 1000 at a cost of $ 12 mill. At the end of 2020, the firm has the option of increasing its capacity from 1000 to 2000 units for 2021 by investing an additional $.75m. The firm uses a 10% discount rate. Hence, the firm can choose among the following strategies: Invest $1m at start of 2020 and, depending on demand, sell either 2,000 or 1000 units in both 2020 and 2021 Invest $.5m at start of 2020 and, if demand is low, sell 1000 units in 2020 and 2021 Invest $.5 m at start of 2020 and sell 1000 units in 2020. If there is high demand either (1) invest $.75m and expand to 2000 units for sale in 2021; (2) or else keep capacity at 1000 units and sell 1000 units in 2021. Question: (1) What is the optimal strategy and NPV if t = .5? (2) What is the optimal strategy and NPV if n = .3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started