Question

A company is considering investing $1.2M in a facility to manufacture a new product. The product will have a five year life, after which the

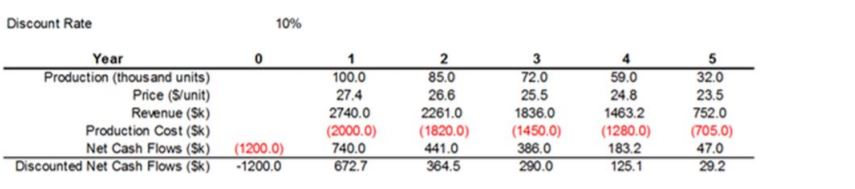

A company is considering investing $1.2M in a facility to manufacture a new product. The product will have a five year life, after which the facility will be shut down. A pro forma cash flow sheet for this project, with forecasted production levels, unit prices, and production costs, is shown below:

1) What is the deterministic net present value (NPV) of the project, including the required investment, assuming a 10% discount rate?

a. $281,500

b. $290,000

c. $311,000

d. $275,000

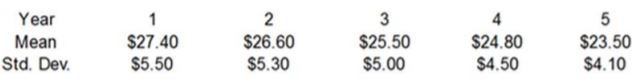

Refer to the model given above, assume that the forecasted price levels shown in the pro forma cash flow sheet are not deterministic, but rather are expected to fluctuate due to market forces. The prices are expected to be normally distributed in each year, with the following means and standard deviations:

2) Using the appropriate @RISK functions in the pro forma, what is the expected NPV?

a. $290,000

b. $270,000

c. $282,000

d. $305,000

3) In the model above , what is the standard deviation of the NPV?

a. $500,000

b. $650,000

c. $707,000

d. $70,000

4) Given your answers in 2-3, would you invest in this project if your risk appetite is low, that is you are essentially risk averse?

a. Yes I would.

b. No I would not.

Discount Rate 1096 2 85.0 26.6 2261.0 Year 00.0 27.4 2740.0 Production (thous and units) Price (S/unit) Revenue (Sk) Production Cost (Sk) 59.0 24.8 1463.2 1450.0 1280.0) (705.0) 183.2 125.1 72.0 25.5 836.0 32.0 23.5 752.0 (2000.0)(1820.0) Net Cash Flows (Sk) (1200.0) Discounted Net Cash Flows (Sk) 1200.0 740.0 672.7 441.0 364.5 386.0 290.0 47.0 29.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started