Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering investing in a project. If the market condition is good, the project payoff is 32,000, with probability 0.3. If the

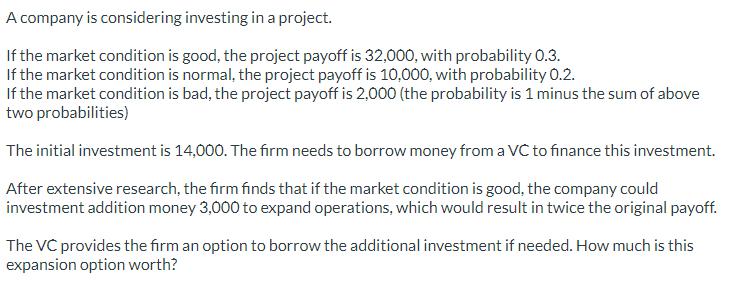

A company is considering investing in a project. If the market condition is good, the project payoff is 32,000, with probability 0.3. If the market condition is normal, the project payoff is 10,000, with probability 0.2. If the market condition is bad, the project payoff is 2,000 (the probability is 1 minus the sum of above two probabilities) The initial investment is 14,000. The firm needs to borrow money from a VC to finance this investment. After extensive research, the firm finds that if the market condition is good, the company could investment addition money 3,000 to expand operations, which would result in twice the original payoff. The VC provides the firm an option to borrow the additional investment if needed. How much is this expansion option worth?

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To evaluate the expansion option we need to calculate the expected val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started