Answered step by step

Verified Expert Solution

Question

1 Approved Answer

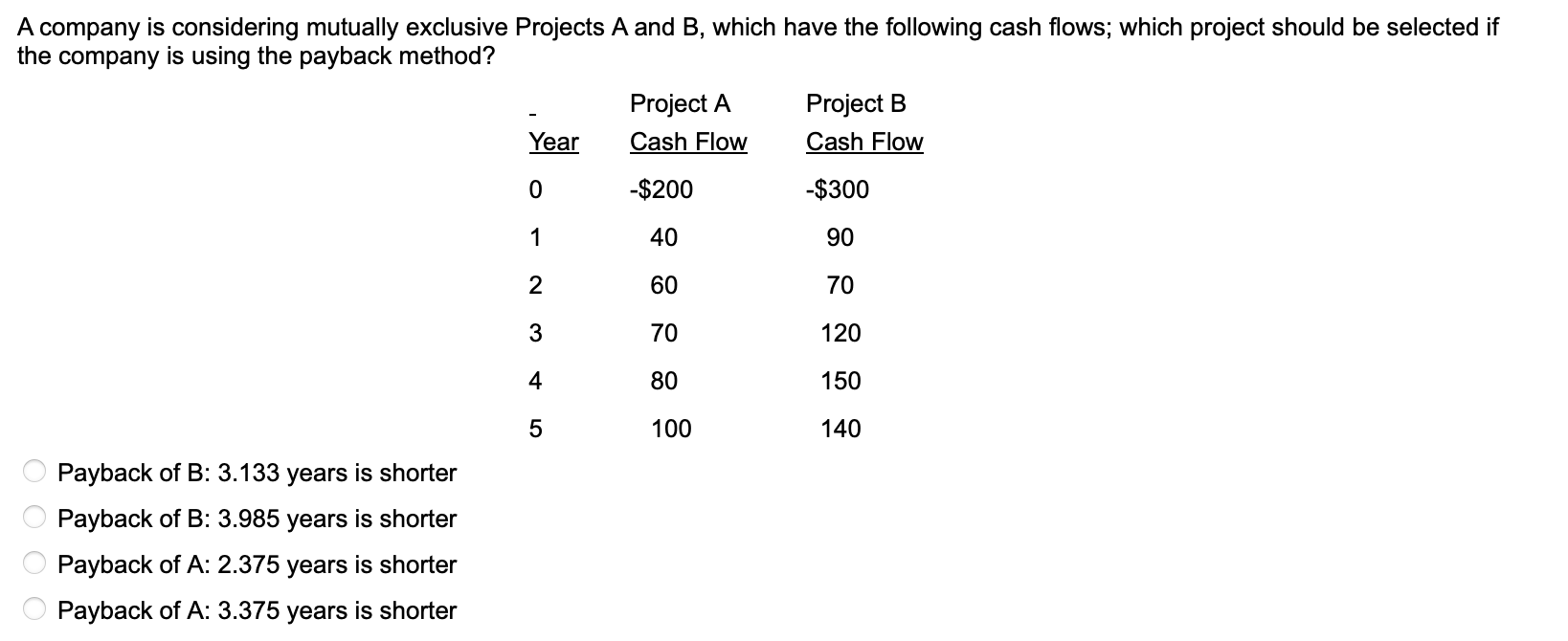

A company is considering mutually exclusive Projects A and B, which have the following cash flows; which project should be selected if the company is

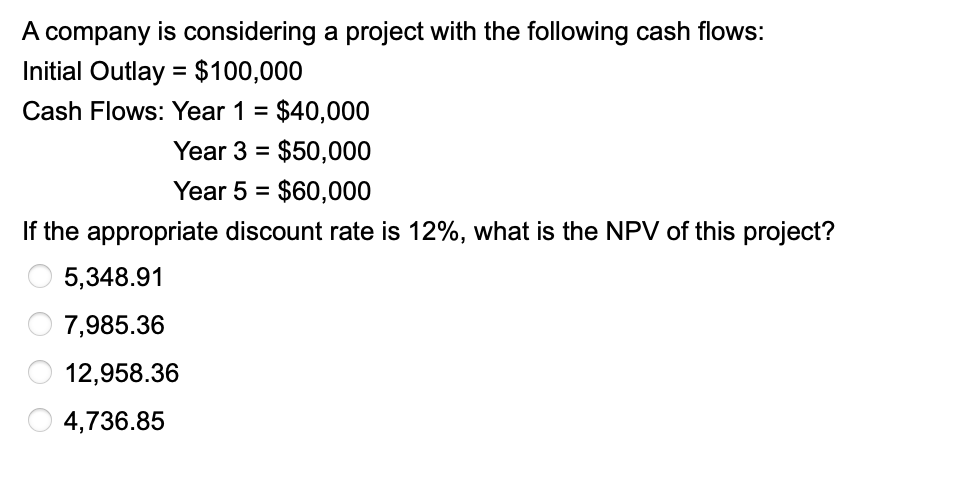

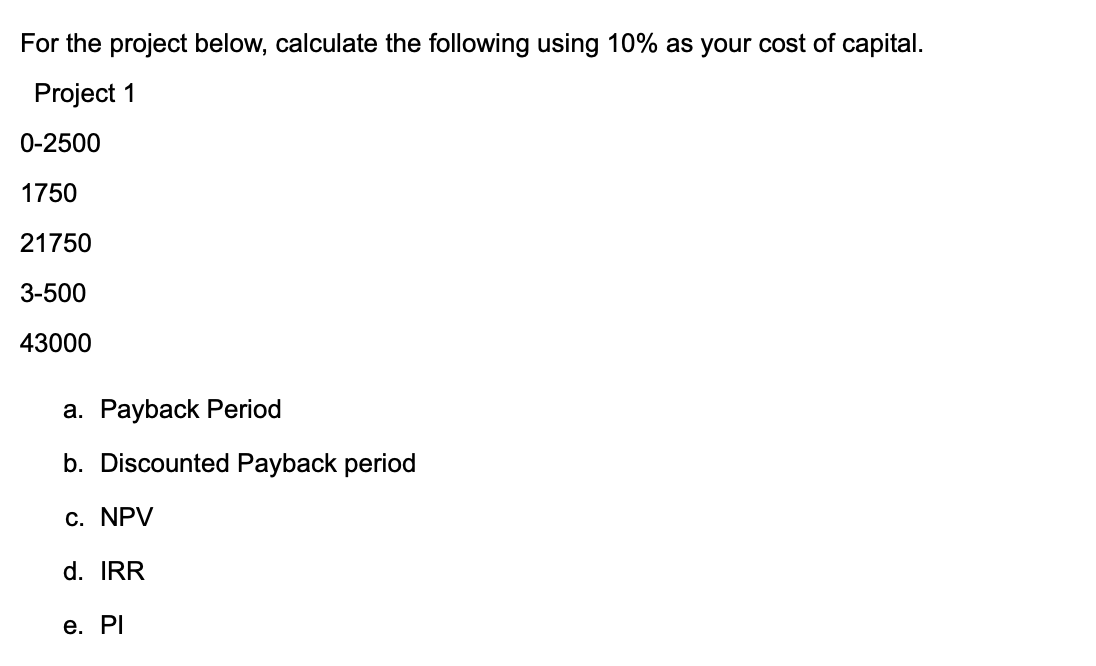

A company is considering mutually exclusive Projects A and B, which have the following cash flows; which project should be selected if the company is using the payback method? Payback of B:3.133 years is shorter Payback of B:3.985 years is shorter Payback of A:2.375 years is shorter Payback of A:3.375 years is shorter A company is considering a project with the following cash flows: Initial Outlay =$100,000 Cash Flows: Year 1=$40,000 Year 3=$50,000 Year 5=$60,000 If the appropriate discount rate is 12%, what is the NPV of this project? 5,348.917,985.3612,958.364,736.85 For the project below, calculate the following using 10% as your cost of capital. Project 1 02500 1750 21750 3500 43000 a. Payback Period b. Discounted Payback period c. NPV d. IRR e. PI

A company is considering mutually exclusive Projects A and B, which have the following cash flows; which project should be selected if the company is using the payback method? Payback of B:3.133 years is shorter Payback of B:3.985 years is shorter Payback of A:2.375 years is shorter Payback of A:3.375 years is shorter A company is considering a project with the following cash flows: Initial Outlay =$100,000 Cash Flows: Year 1=$40,000 Year 3=$50,000 Year 5=$60,000 If the appropriate discount rate is 12%, what is the NPV of this project? 5,348.917,985.3612,958.364,736.85 For the project below, calculate the following using 10% as your cost of capital. Project 1 02500 1750 21750 3500 43000 a. Payback Period b. Discounted Payback period c. NPV d. IRR e. PI Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started