Answered step by step

Verified Expert Solution

Question

1 Approved Answer

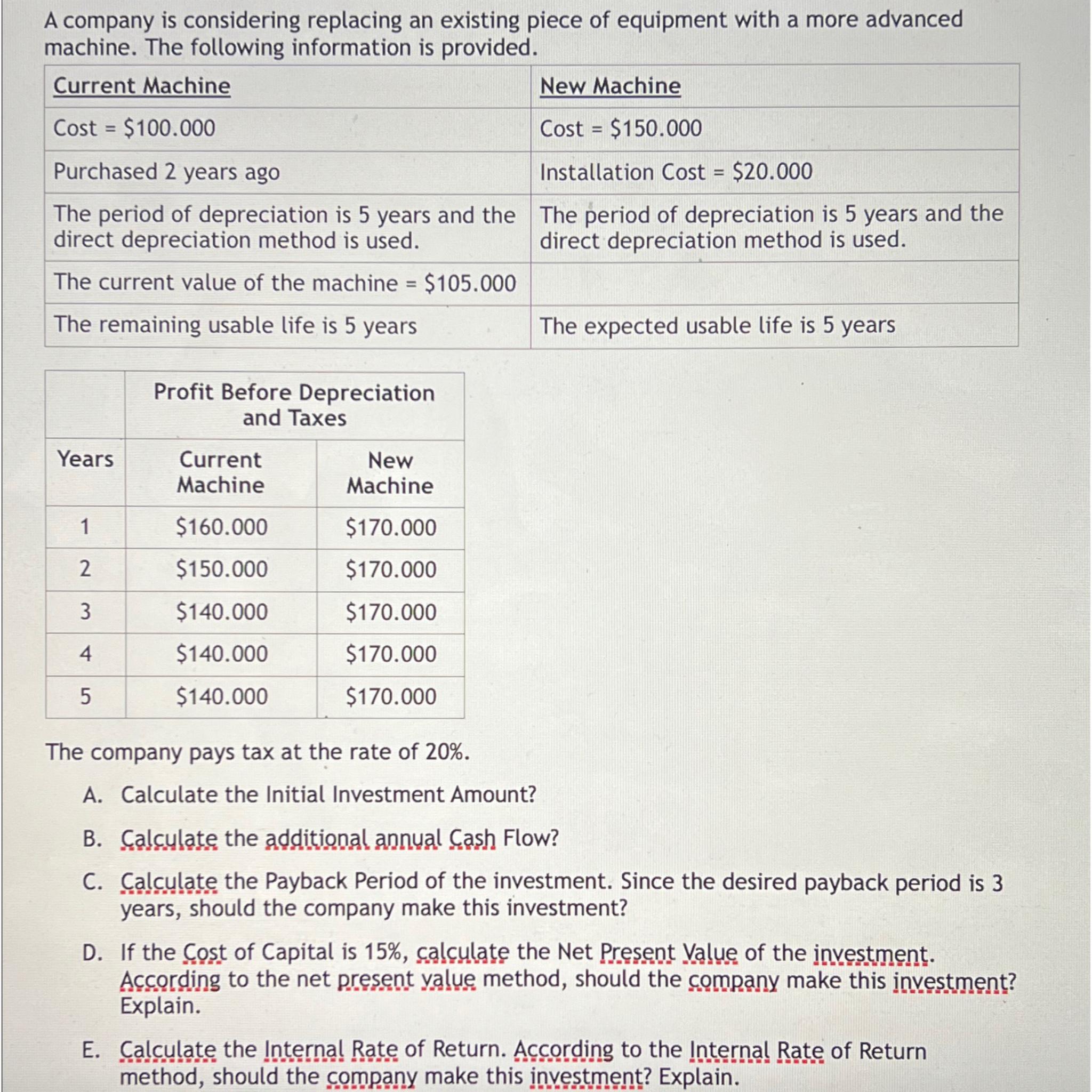

A company is considering replacing an existing piece of equipment with a more advanced machine. The following information is provided. Current Machine New Machine

A company is considering replacing an existing piece of equipment with a more advanced machine. The following information is provided. Current Machine New Machine Cost = $150.000 Purchased 2 years ago Installation Cost = $20.000 The period of depreciation is 5 years and the The period of depreciation is 5 years and the direct depreciation method is used. direct depreciation method is used. The current value of the machine = $105.000 The remaining usable life is 5 years Cost $100.000 = Years 1 2 3 4 5 Profit Before Depreciation and Taxes Current Machine $160.000 $150.000 $140.000 $140.000 $140.000 New Machine $170.000 $170.000 $170.000 $170.000 $170.000 The company pays tax at the rate of 20%. A. Calculate the Initial Investment Amount? The expected usable life is 5 years B. Calculate the additional annual Cash Flow? C. Calculate the Payback Period of the investment. Since the desired payback period is 3 years, should the company make this investment? D. If the Cost of Capital is 15%, calculate the Net Present Value of the investment. According to the net present value method, should the company make this investment? Explain. E. Calculate the Internal Rate of Return. According to the Internal Rate of Return method, should the company make this investment? Explain.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each part of the analysis step by step A Calculate the Initial Investment Amount Ini...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started