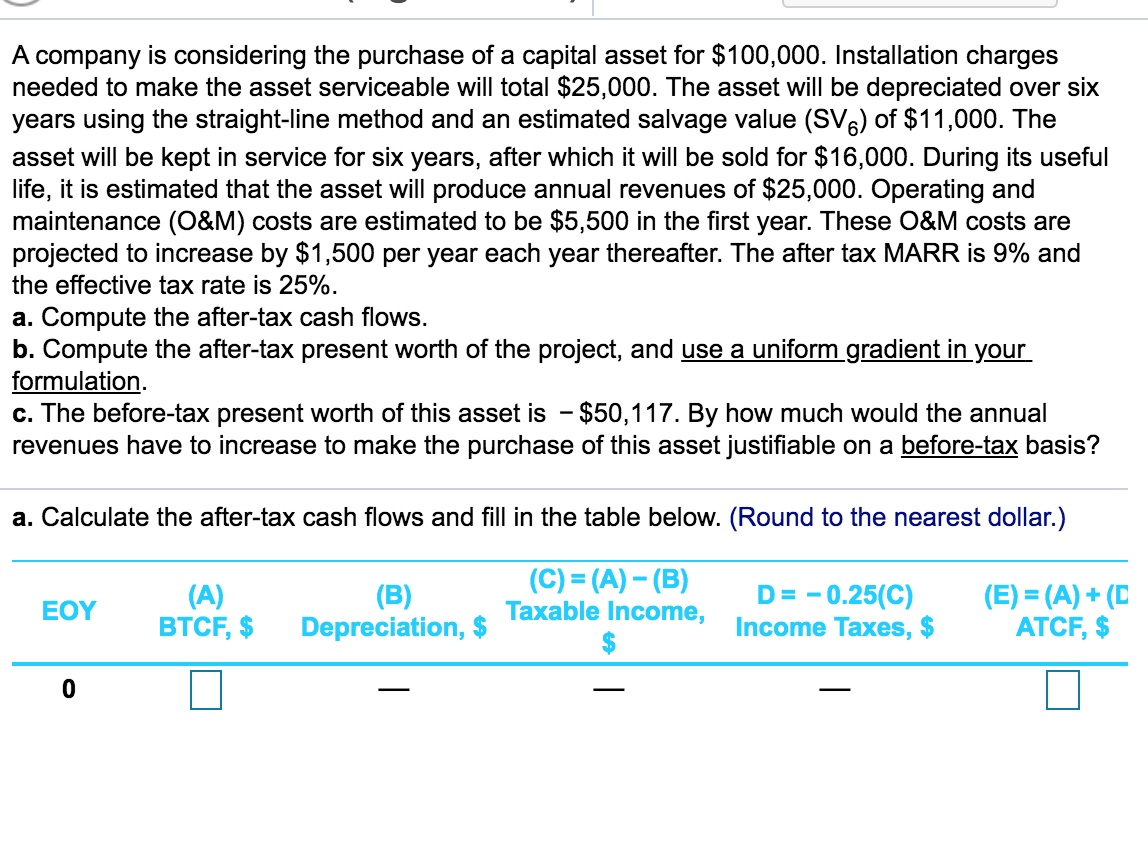

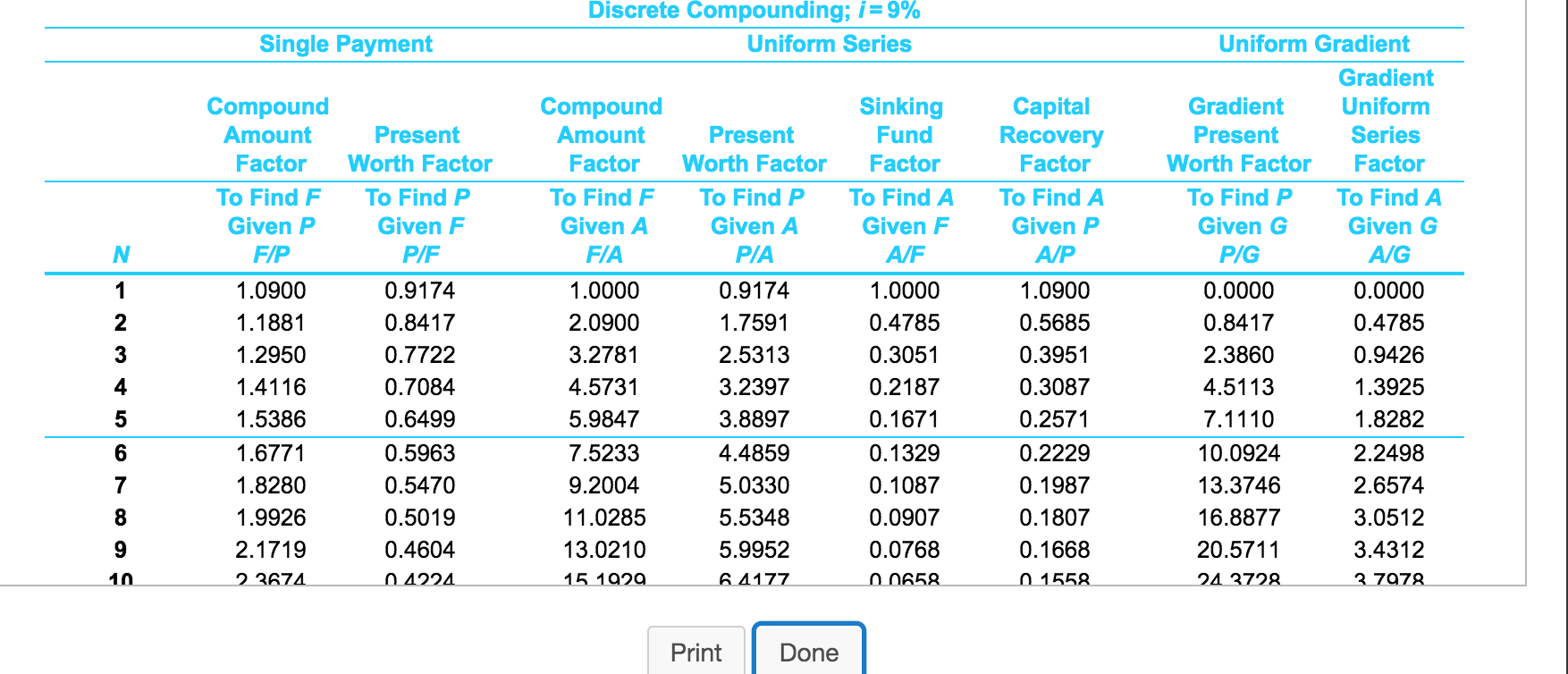

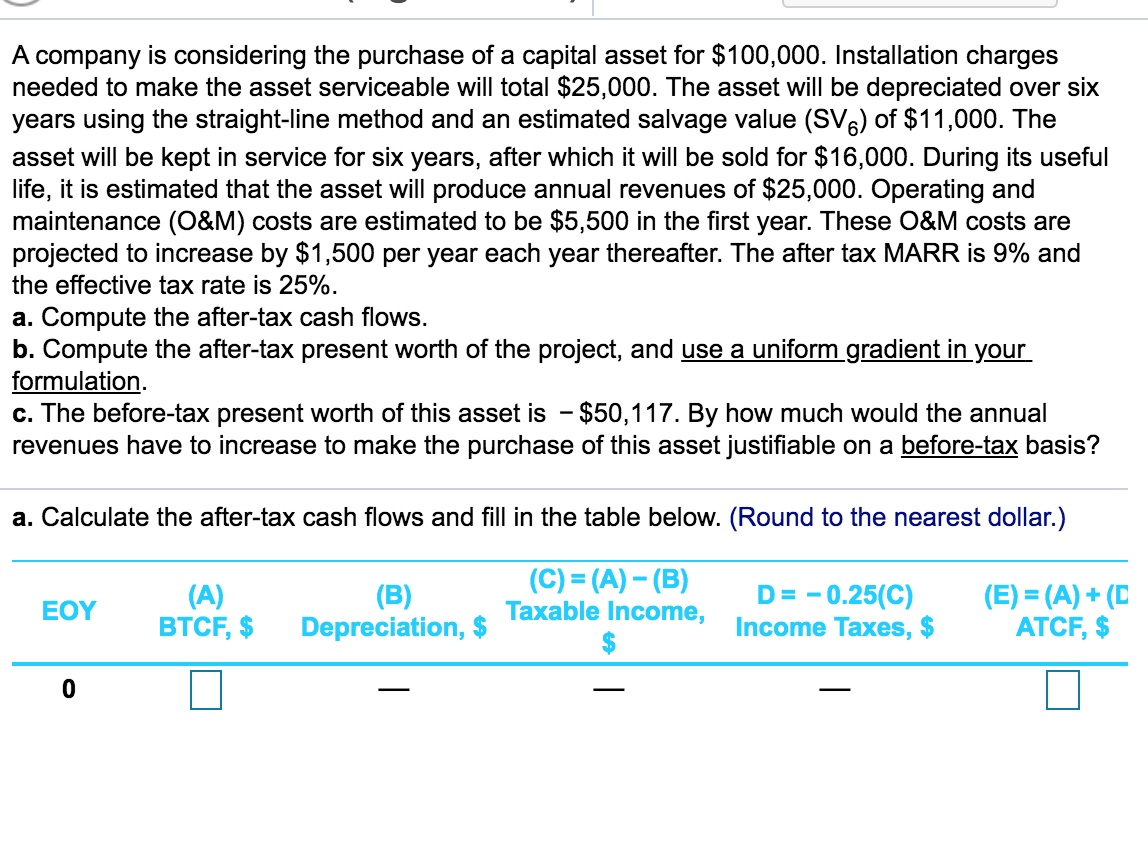

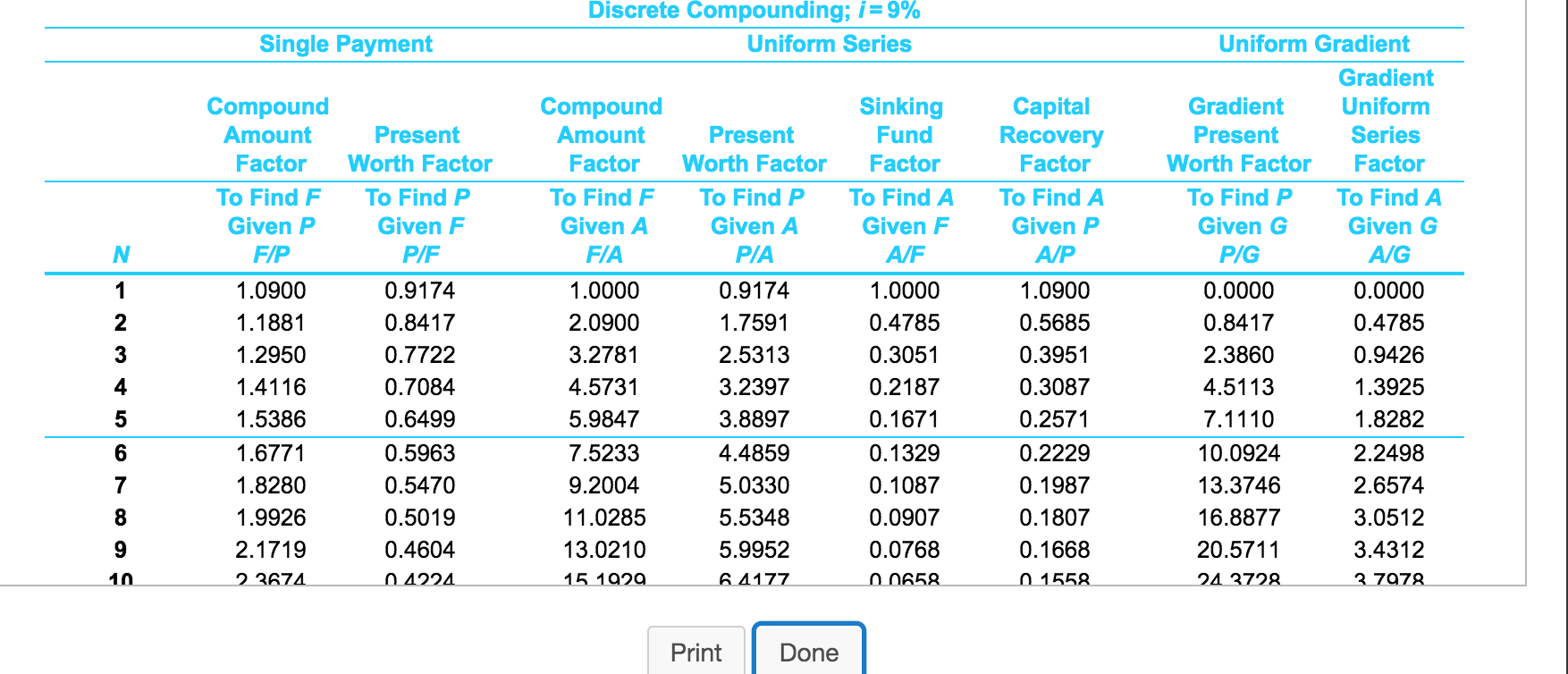

A company is considering the purchase of a capital asset for $100,000. Installation charges needed to make the asset serviceable will total $25,000. The asset will be depreciated over six years using the straight-line method and an estimated salvage value (SV6) of $11,000. The asset will be kept in service for six years, after which it will be sold for $16,000. During its useful life, it is estimated that the asset will produce annual revenues of $25,000. Operating and maintenance (O&M) costs are estimated to be $5,500 in the first year. These O&M costs are projected to increase by $1,500 per year each year thereafter. The after tax MARR is 9% and the effective tax rate is 25%. a. Compute the after-tax cash flows. b. Compute the after-tax present worth of the project, and use a uniform gradient in your formulation c. The before-tax present worth of this asset is - $50,117. By how much would the annual revenues have to increase to make the purchase of this asset justifiable on a before-tax basis? a. Calculate the after-tax cash flows and fill in the table below. (Round to the nearest dollar.) (C) (A)-(B) Taxable Income, D= -0.25(C) Income Taxes, $ (A) CF, $ (B) Depreciation, $ (E)= (A) (D ATCF, $ EOY 0 Discrete Compounding; i=9% Single Payment Uniform Series Uniform Gradient Gradient Compound Sinking Capital Recovery Gradient Compound Uniform Present Series Amount Amount Present Fund Present Worth Factor Worth Factor Factor Factor Worth Factor Factor Factor Factor To Find P To Find F To Find A To Find A To Find P To Find A To Find F To Find P Given P Given F Given A Given A Given F Given P Given G Given G F/P A/F A/P P/G A/G P/F F/A P/A 0.9174 1.0000 1 1.0900 0.9174 1.0000 1.0900 0.0000 0.0000 2 1.1881 0.8417 2.0900 1.7591 0.4785 0.5685 0.8417 0.4785 1.2950 0.3051 0.3951 0.7722 3.2781 2.5313 2.3860 0.9426 4 1.4116 0.7084 4.5731 3.2397 0.2187 0.3087 4.5113 1.3925 0.2571 7.1110 5 1.5386 0.6499 5.9847 3.8897 0.1671 1.8282 4.4859 6 1.6771 0.5963 7.5233 0.1329 0.2229 10.0924 2.2498 1.8280 0.1087 0.1987 13.3746 7 0.5470 9.2004 5.0330 2.6574 1.9926 0.5019 11.0285 5.5348 0.0907 0.1807 16.8877 3.0512 2.1719 0.4604 13.0210 5.9952 0.0768 0.1668 20.5711 3.4312 2 3674 0 0658. 0 4224 0 1558. 15 1929 10 64177 24 3728. 3 7978 Print Done A company is considering the purchase of a capital asset for $100,000. Installation charges needed to make the asset serviceable will total $25,000. The asset will be depreciated over six years using the straight-line method and an estimated salvage value (SV6) of $11,000. The asset will be kept in service for six years, after which it will be sold for $16,000. During its useful life, it is estimated that the asset will produce annual revenues of $25,000. Operating and maintenance (O&M) costs are estimated to be $5,500 in the first year. These O&M costs are projected to increase by $1,500 per year each year thereafter. The after tax MARR is 9% and the effective tax rate is 25%. a. Compute the after-tax cash flows. b. Compute the after-tax present worth of the project, and use a uniform gradient in your formulation c. The before-tax present worth of this asset is - $50,117. By how much would the annual revenues have to increase to make the purchase of this asset justifiable on a before-tax basis? a. Calculate the after-tax cash flows and fill in the table below. (Round to the nearest dollar.) (C) (A)-(B) Taxable Income, D= -0.25(C) Income Taxes, $ (A) CF, $ (B) Depreciation, $ (E)= (A) (D ATCF, $ EOY 0 Discrete Compounding; i=9% Single Payment Uniform Series Uniform Gradient Gradient Compound Sinking Capital Recovery Gradient Compound Uniform Present Series Amount Amount Present Fund Present Worth Factor Worth Factor Factor Factor Worth Factor Factor Factor Factor To Find P To Find F To Find A To Find A To Find P To Find A To Find F To Find P Given P Given F Given A Given A Given F Given P Given G Given G F/P A/F A/P P/G A/G P/F F/A P/A 0.9174 1.0000 1 1.0900 0.9174 1.0000 1.0900 0.0000 0.0000 2 1.1881 0.8417 2.0900 1.7591 0.4785 0.5685 0.8417 0.4785 1.2950 0.3051 0.3951 0.7722 3.2781 2.5313 2.3860 0.9426 4 1.4116 0.7084 4.5731 3.2397 0.2187 0.3087 4.5113 1.3925 0.2571 7.1110 5 1.5386 0.6499 5.9847 3.8897 0.1671 1.8282 4.4859 6 1.6771 0.5963 7.5233 0.1329 0.2229 10.0924 2.2498 1.8280 0.1087 0.1987 13.3746 7 0.5470 9.2004 5.0330 2.6574 1.9926 0.5019 11.0285 5.5348 0.0907 0.1807 16.8877 3.0512 2.1719 0.4604 13.0210 5.9952 0.0768 0.1668 20.5711 3.4312 2 3674 0 0658. 0 4224 0 1558. 15 1929 10 64177 24 3728. 3 7978 Print Done