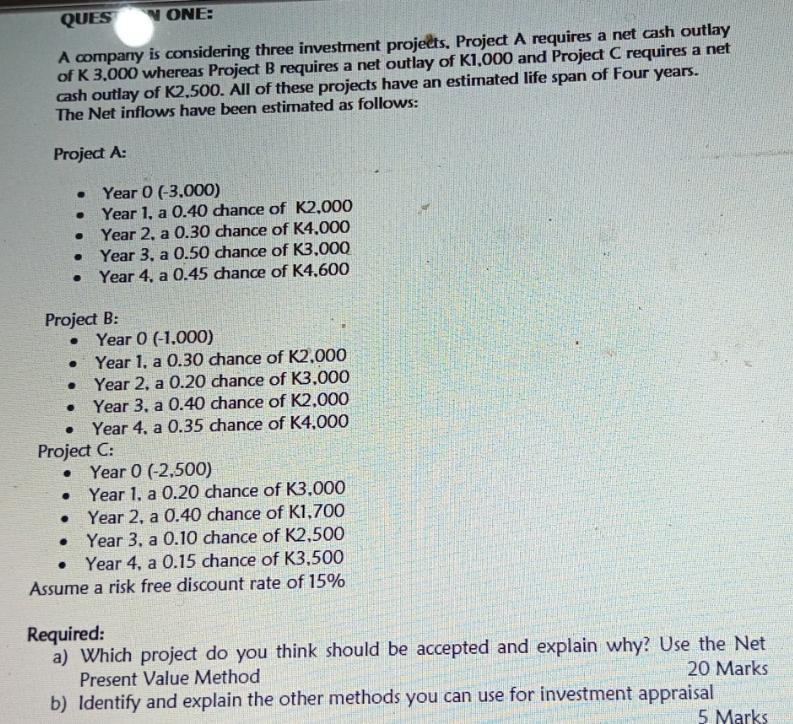

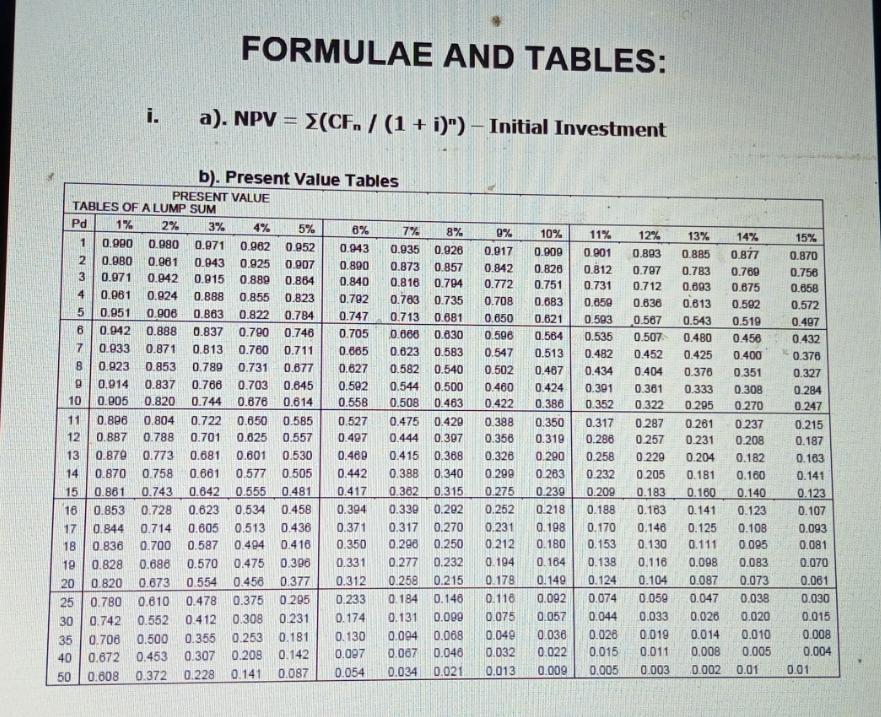

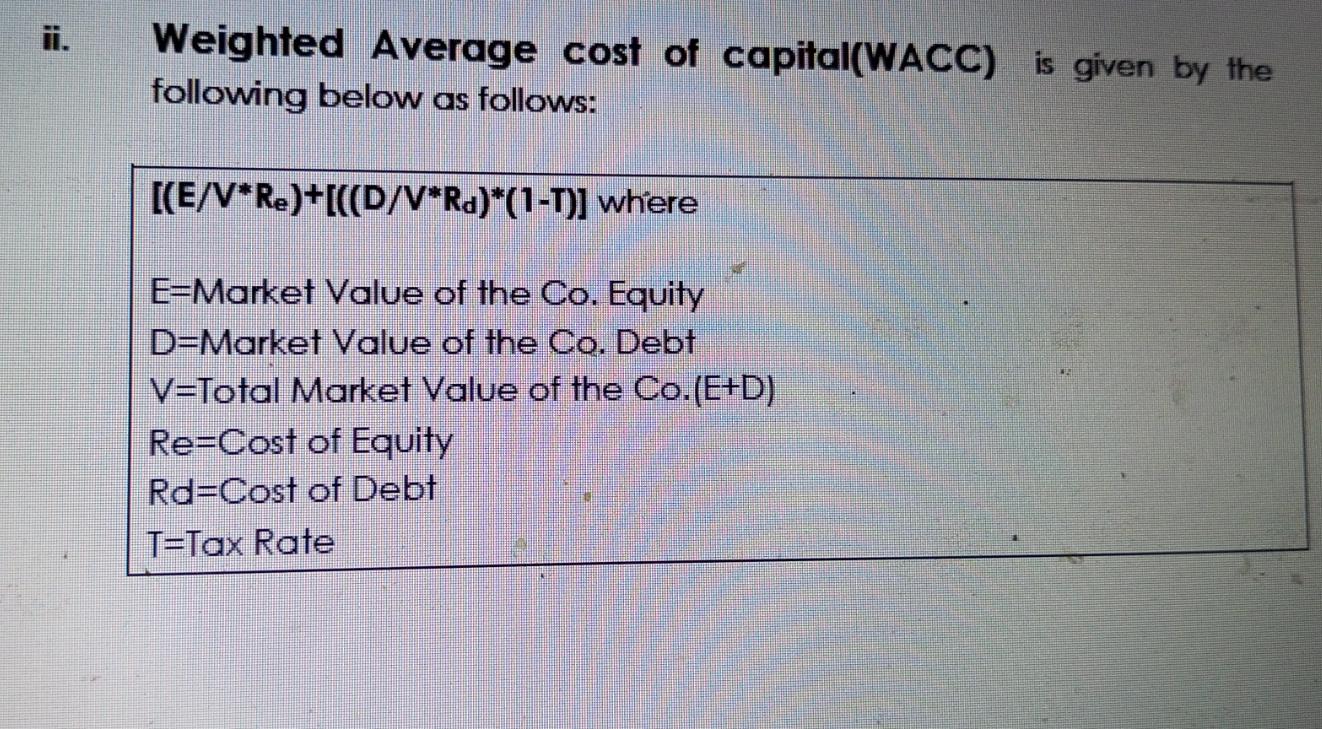

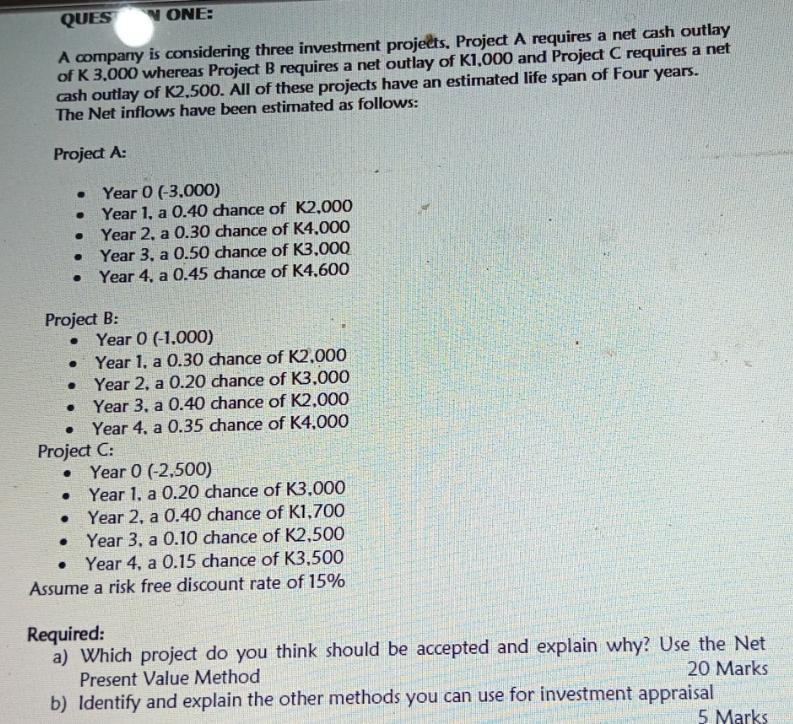

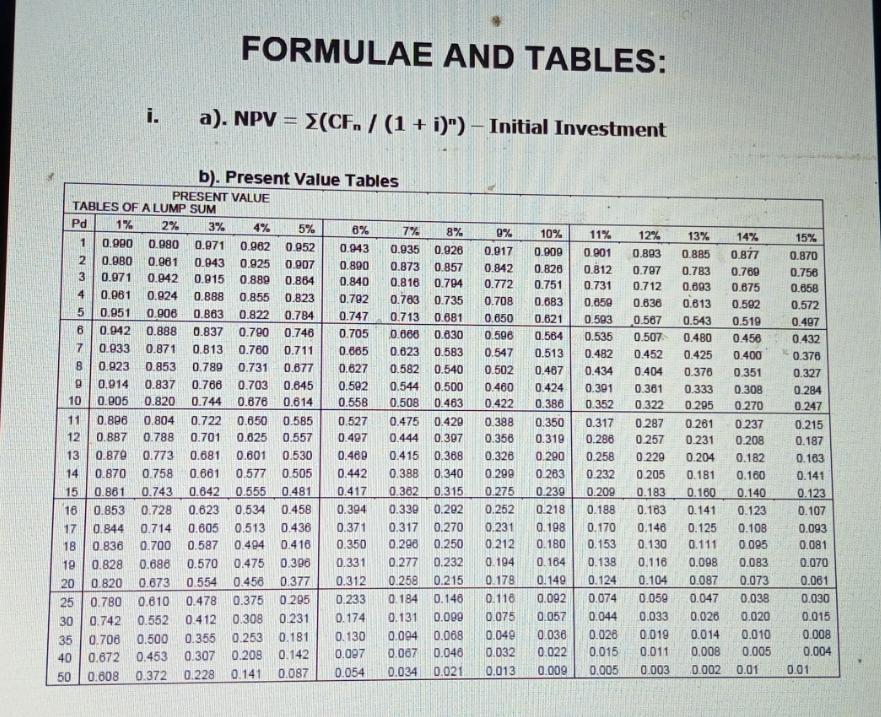

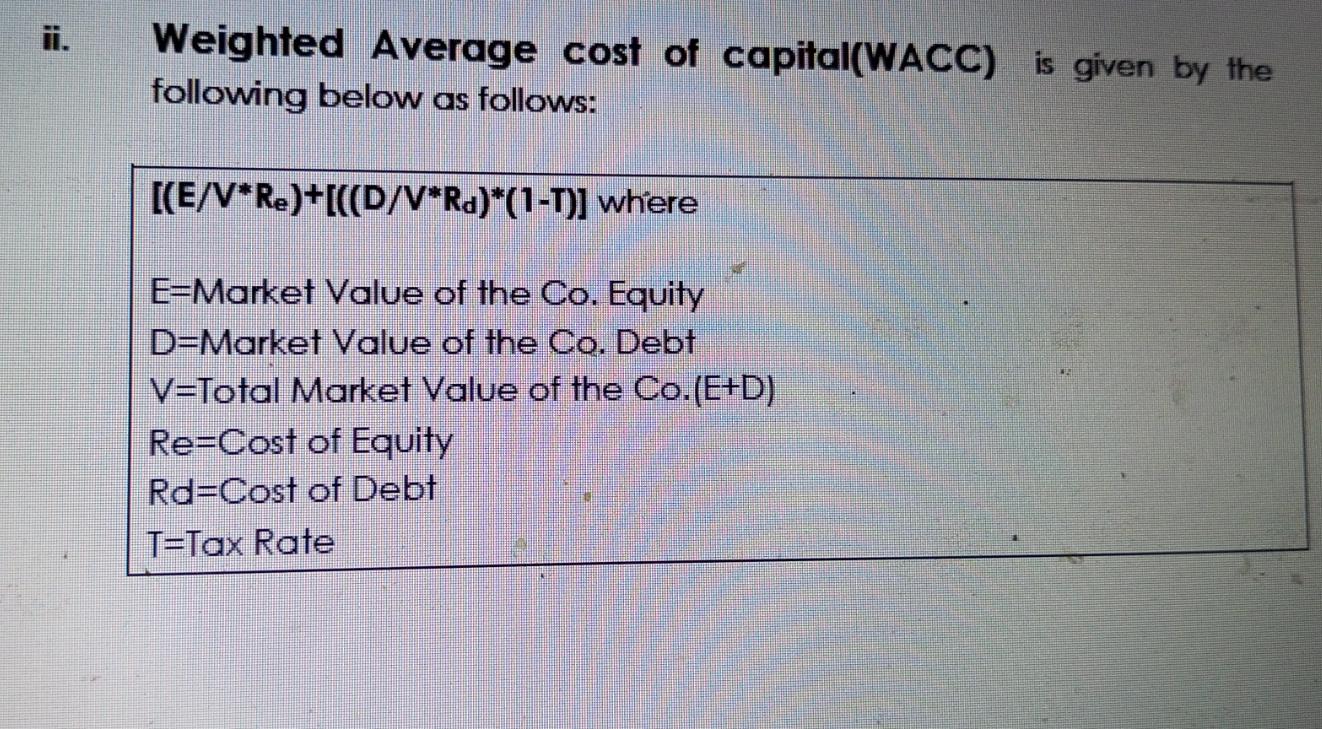

A company is considering three investment projeets. Project A requires a net cash outlay of K 3.000 whereas Project B requires a net outlay of K1.000 and Project C requires a net cash outlay of K2,500. All of these projects have an estimated life span of Four years. The Net inflows have been estimated as follows: Project A: - Year 0(3.000) - Year 1, a 0.40 chance of K2.000 - Year 2, a 0.30 chance of K4.000 - Year 3, a 0.50 chance of K3.000 - Year 4, a 0.45 chance of K4.600 Project B: - Year 0(1.000) - Year 1, a 0.30 chance of K2,000 - Year 2, a 0.20 chance of K3.000 - Year 3, a 0.40 chance of K2.000 - Year 4, a 0.35 chance of K4,000 Project C: - Year 0(2,500) - Year 1, a 0.20 chance of K3.000 - Year 2, a 0.40 chance of K1,700 - Year 3, a 0.10 chance of K2,500 - Year 4, a 0.15 chance of K3.500 Assume a risk free discount rate of 15% Required: a) Which project do you think should be accepted and explain why? Use the Net Present Value Method b) Identify and explain the other methods you can use for investment appraisal FORMULAE AND TABLES: a). NPV=(CFn/(1+i)n) - Initial Investment b). Present Value Tables Weighted Average cost of capital(WACC) is given by the following below as follows: [(E/VRe)+[((D/VRd)(1T)] where E= Market Value of the Co. Equity D= Market Value of the Co. Debt V= Total Market Value of the Co. (E+D) Re = Cost of Equity Rd=Cost of Debt T=Tax Rate A company is considering three investment projeets. Project A requires a net cash outlay of K 3.000 whereas Project B requires a net outlay of K1.000 and Project C requires a net cash outlay of K2,500. All of these projects have an estimated life span of Four years. The Net inflows have been estimated as follows: Project A: - Year 0(3.000) - Year 1, a 0.40 chance of K2.000 - Year 2, a 0.30 chance of K4.000 - Year 3, a 0.50 chance of K3.000 - Year 4, a 0.45 chance of K4.600 Project B: - Year 0(1.000) - Year 1, a 0.30 chance of K2,000 - Year 2, a 0.20 chance of K3.000 - Year 3, a 0.40 chance of K2.000 - Year 4, a 0.35 chance of K4,000 Project C: - Year 0(2,500) - Year 1, a 0.20 chance of K3.000 - Year 2, a 0.40 chance of K1,700 - Year 3, a 0.10 chance of K2,500 - Year 4, a 0.15 chance of K3.500 Assume a risk free discount rate of 15% Required: a) Which project do you think should be accepted and explain why? Use the Net Present Value Method b) Identify and explain the other methods you can use for investment appraisal FORMULAE AND TABLES: a). NPV=(CFn/(1+i)n) - Initial Investment b). Present Value Tables Weighted Average cost of capital(WACC) is given by the following below as follows: [(E/VRe)+[((D/VRd)(1T)] where E= Market Value of the Co. Equity D= Market Value of the Co. Debt V= Total Market Value of the Co. (E+D) Re = Cost of Equity Rd=Cost of Debt T=Tax Rate