Answered step by step

Verified Expert Solution

Question

1 Approved Answer

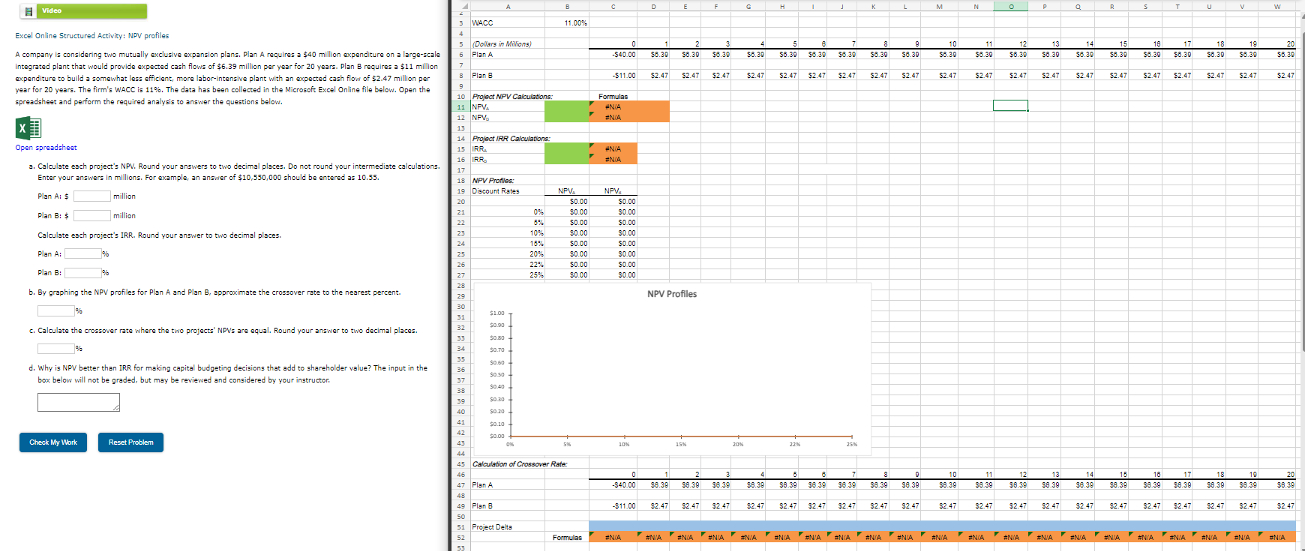

A company is considering two mutually exclusive expanaion plans. Plan A requires a $ 4 0 m . lion expenditure on a large - acale

A company is considering two mutually exclusive expanaion plans. Plan A requires a $ lion expenditure on a largeacale

intograted plant that would provide expocted cath flowa of $ million par yoar for yoars. Plan B requires a $ millor

year for years. The firm's WACC is The data has been collected in the Microscft Excel Online file below. Open the

spreadshest and perform the required analys's to answer the questions below.

Open spreadshost

a Caloulste esch project's NPW Round your arswers to two decimal places. Do not round your intermediate calculations.

Enter your answers in milions. For oxample, an anawer of $ should be entersd as

Plan $

million

Plan B: $

million

Caloulate esch project's IRR, Round your answer to two decimal plsces.

Plan A;

Plan B: is

b By graphing the NPV profiles for Plan A and Plan B approximate the crossover rate to the nearest percent:

c Caloulate the creasover rate where the two projects' NPV: are equal, Round your anawor to two decimal place:

d Why is NPV better then IRR for making capital budpeting decisions that add to shareholder value?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started