Answered step by step

Verified Expert Solution

Question

1 Approved Answer

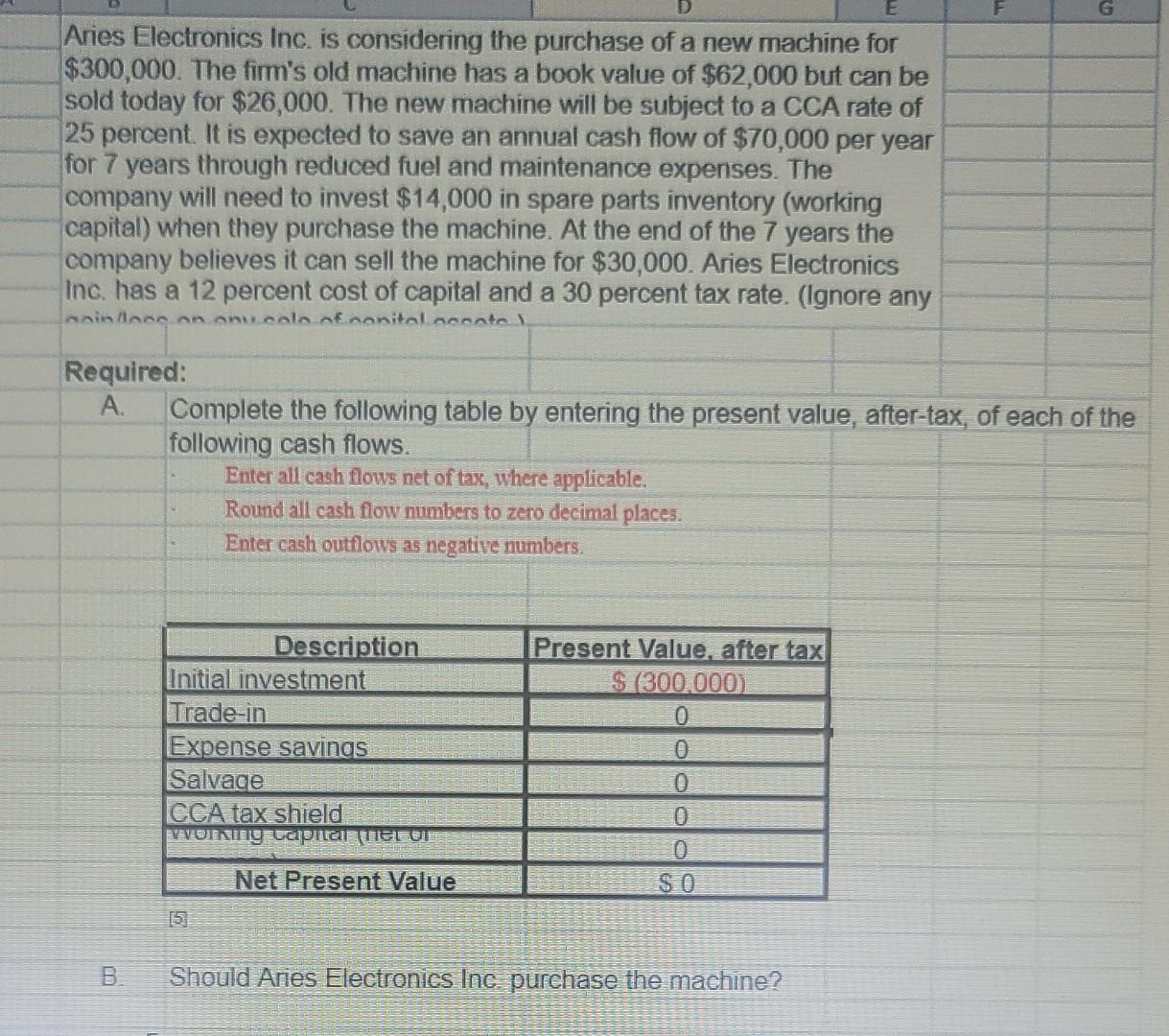

A. Complete the following table by entering the present value, after-tax, of each of the following cash flows. B. Should Aries Electronics Inc. purchase the

A. Complete the following table by entering the present value, after-tax, of each of the following cash flows.

B. Should Aries Electronics Inc. purchase the machine.

I will need step by step explanation plus answers thanks.

Aries Electronics Inc. is considering the purchase of a new machine for $300,000. The firm's old machine has a book value of $62,000 but can be sold today for $26,000. The new machine will be subject to a CCA rate of 25 percent. It is expected to save an annual cash flow of $70,000 per year for 7 years through reduced fuel and maintenance expenses. The company will need to invest $14,000 in spare parts inventory (working capital) when they purchase the machine. At the end of the 7 years the company believes it can sell the machine for $30,000. Aries Electronics Inc. has a 12 percent cost of capital and a 30 percent tax rate. (Ignore any Required: A. Complete the following table by entering the present value, after-tax, of each of the following cash flows. Enter all cash flows net of tax, where applicable. Round all cash flow numbers to zero decimal places. Enter cash outflows as negative numbers. B. Should Aries Electronics Inc purchase the machineStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started