Answered step by step

Verified Expert Solution

Question

1 Approved Answer

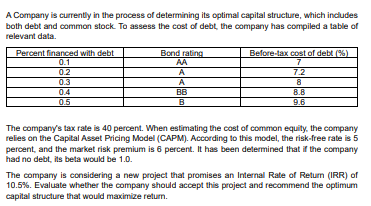

A Company is currently in the process of determining its optimal capital structure, which includes both debt and common stock. To assess the cost of

A Company is currently in the process of determining its optimal capital structure, which includes both debt and common stock. To assess the cost of debt, the company has compiled a table of relevant data. The company's tax rate is 40 percent. When estimating the cost of common equity, the company relies on the Capital Asset Pricing Model (CAPM). According to this model, the risk-free rate is 5 percent, and the market risk premium is 6 percent. It has been determined that if the company had no debt, its beta would be 1.0. The comparny is considering a new project that promises an Internal Rate of Retum (IRR) of 10.5\\%. Evaluate whether the company should accept this project and recommend the optimum capital structure that would maximize retum

A Company is currently in the process of determining its optimal capital structure, which includes both debt and common stock. To assess the cost of debt, the company has compiled a table of relevant data. The company's tax rate is 40 percent. When estimating the cost of common equity, the company relies on the Capital Asset Pricing Model (CAPM). According to this model, the risk-free rate is 5 percent, and the market risk premium is 6 percent. It has been determined that if the company had no debt, its beta would be 1.0. The comparny is considering a new project that promises an Internal Rate of Retum (IRR) of 10.5\\%. Evaluate whether the company should accept this project and recommend the optimum capital structure that would maximize retum Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started