Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is deciding between two mutually exclusive approaches for providing a grid connection for a new electricity generation facility. One approach (Approach A)

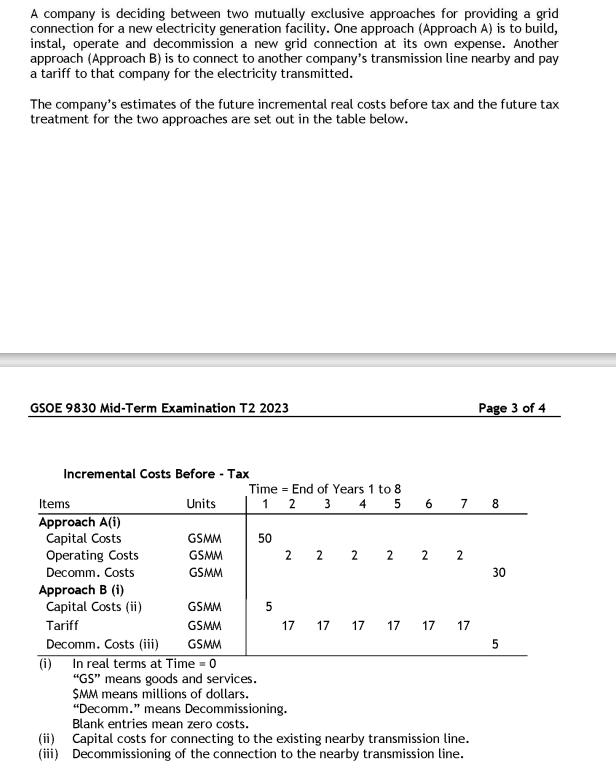

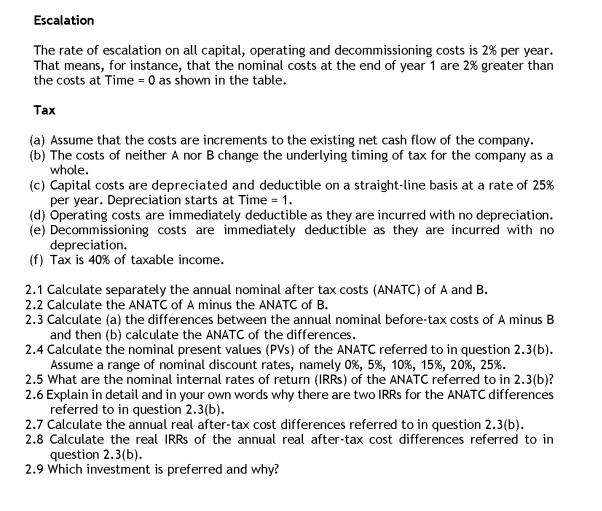

A company is deciding between two mutually exclusive approaches for providing a grid connection for a new electricity generation facility. One approach (Approach A) is to build, instal, operate and decommission a new grid connection at its own expense. Another approach (Approach B) is to connect to another company's transmission line nearby and pay a tariff to that company for the electricity transmitted. The company's estimates of the future incremental real costs before tax and the future tax treatment for the two approaches are set out in the table below. GSOE 9830 Mid-Term Examination T2 2023 Incremental Costs Before - Tax Units Items Approach A(i) Capital Costs Operating Costs Decomm. Costs Approach B (i) Capital Costs (ii) Tariff (ii) (iii) Decomm. Costs (iii) (i) GSMM GSMM GSMM Time 1 50 GSMM GSMM GSMM In real terms at Time = 0 "GS" means goods and services. SMM means millions of dollars. "Decomm." means Decommissioning. Blank entries mean zero costs. 5 End of Years 1 to 8 2 3 4 5 2 2 2 17 6 7 8 2 2 2 17 17 17 17 17 Page 3 of 4 Capital costs for connecting to the existing nearby transmission line. Decommissioning of the connection to the nearby transmission line. 30 5 Escalation The rate of escalation on all capital, operating and decommissioning costs is 2% per year. That means, for instance, that the nominal costs at the end of year 1 are 2% greater than the costs at Time= 0 as shown in the table. Tax (a) Assume that the costs are increments to the existing net cash flow of the company. (b) The costs of neither A nor B change the underlying timing of tax for the company as a whole. (c) Capital costs are depreciated and deductible on a straight-line basis at a rate of 25% per year. Depreciation starts at Time = 1. (d) Operating costs are immediately deductible as they are incurred with no depreciation. (e) Decommissioning costs are immediately deductible as they are incurred with no depreciation. (f) Tax is 40% of taxable income. 2.1 Calculate separately the annual nominal after tax costs (ANATC) of A and B. 2.2 Calculate the ANATC of A minus the ANATC of B. 2.3 Calculate (a) the differences between the annual nominal before-tax costs of A minus B and then (b) calculate the ANATC of the differences. 2.4 Calculate the nominal present values (PVS) of the ANATC referred to in question 2.3(b). Assume a range of nominal discount rates, namely 0%, 5 %, 10 %, 15%, 20 %, 25%. 2.5 What are the nominal internal rates of return (IRRS) of the ANATC referred to in 2.3(b)? 2.6 Explain in detail and in your own words why there are two IRRs for the ANATC differences referred to in question 2.3(b). 2.7 Calculate the annual real after-tax cost differences referred to in question 2.3(b). 2.8 Calculate the real IRRS of the annual real after-tax cost differences referred to in question 2.3(b). 2.9 Which investment is preferred and why?

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Question 21 Calculate the annual nominal aftertax costs ANATC of A and B To calculate the ANATC of A and B we need to calculate the total costs of each approach and then deduct the taxes The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started