Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is doing an IPO underwritten by an investment bank. The company plans to issue 500,000 ordinary shares. The investment bank offers stand-by underwriting

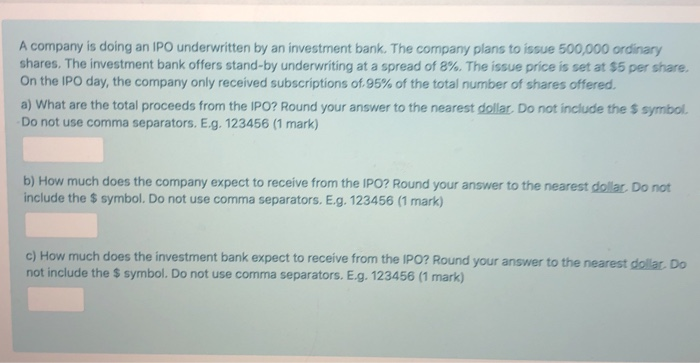

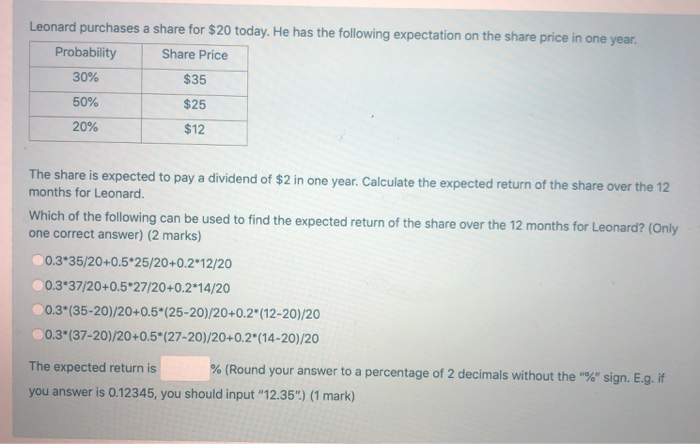

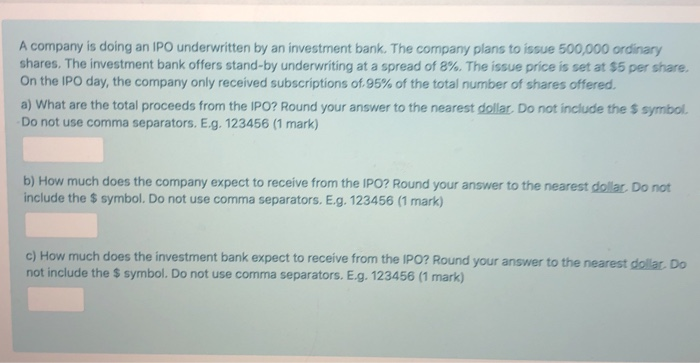

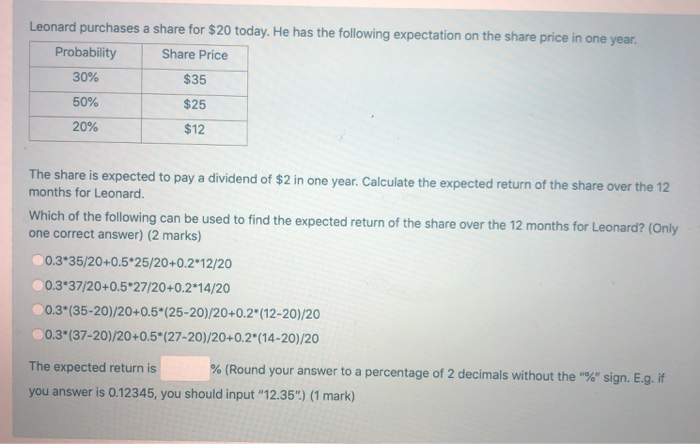

A company is doing an IPO underwritten by an investment bank. The company plans to issue 500,000 ordinary shares. The investment bank offers stand-by underwriting at a spread of 8%. The issue price is set at $5 per share. On the IPO day, the company only received subscriptions of 95% of the total number of shares offered. a) What are the total proceeds from the IPO? Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark) b) How much does the company expect to receive from the IPO? Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators, E.g. 123456 (1 mark) c) How much does the investment bank expect to receive from the IPO? Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark) Leonard purchases a share for $20 today. He has the following expectation on the share price in one year. Probability Share Price 30% $35 50% $25 20% $12 The share is expected to pay a dividend of $2 in one year. Calculate the expected return of the share over the 12 months for Leonard Which of the following can be used to find the expected return of the share over the 12 months for Leonard? (Only one correct answer) (2 marks) 0.3*35/20+0.5*25/20+0.2*12/20 0.3*37/20+0.5*27/20+0.2*14/20 0.3+(35-20)/20+0.5*(25-20)/20+0.2"12-20)/20 0.3* (37-20)/20+0.5*(27-20)/20+0.2*(14-20)/20 The expected return is % (Round your answer to a percentage of 2 decimals without the "%" sign. E.g. if you answer is 0.12345, you should input "12.35") (1 mark)

A company is doing an IPO underwritten by an investment bank. The company plans to issue 500,000 ordinary shares. The investment bank offers stand-by underwriting at a spread of 8%. The issue price is set at $5 per share. On the IPO day, the company only received subscriptions of 95% of the total number of shares offered. a) What are the total proceeds from the IPO? Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark) b) How much does the company expect to receive from the IPO? Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators, E.g. 123456 (1 mark) c) How much does the investment bank expect to receive from the IPO? Round your answer to the nearest dollar. Do not include the $ symbol. Do not use comma separators. E.g. 123456 (1 mark) Leonard purchases a share for $20 today. He has the following expectation on the share price in one year. Probability Share Price 30% $35 50% $25 20% $12 The share is expected to pay a dividend of $2 in one year. Calculate the expected return of the share over the 12 months for Leonard Which of the following can be used to find the expected return of the share over the 12 months for Leonard? (Only one correct answer) (2 marks) 0.3*35/20+0.5*25/20+0.2*12/20 0.3*37/20+0.5*27/20+0.2*14/20 0.3+(35-20)/20+0.5*(25-20)/20+0.2"12-20)/20 0.3* (37-20)/20+0.5*(27-20)/20+0.2*(14-20)/20 The expected return is % (Round your answer to a percentage of 2 decimals without the "%" sign. E.g. if you answer is 0.12345, you should input "12.35") (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started