Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is evaluating the following initiative. It will require $550,000 cash outlay at the beginning. The initiative is expected to last 8 years and

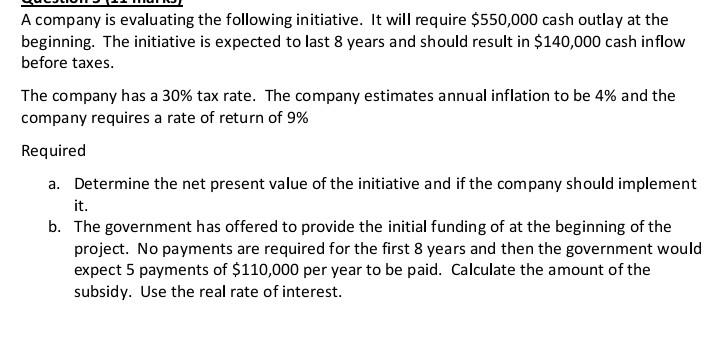

A company is evaluating the following initiative. It will require $550,000 cash outlay at the beginning. The initiative is expected to last 8 years and should result in $140,000 cash inflow before taxes. The company has a 30% tax rate. The company estimates annual inflation to be 4% and the company requires a rate of return of 9% Required a. Determine the net present value of the initiative and if the company should implement it. b. The government has offered to provide the initial funding of at the beginning of the project. No payments are required for the first 8 years and then the government would expect 5 payments of $110,000 per year to be paid. Calculate the amount of the subsidy. Use the real rate of interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started