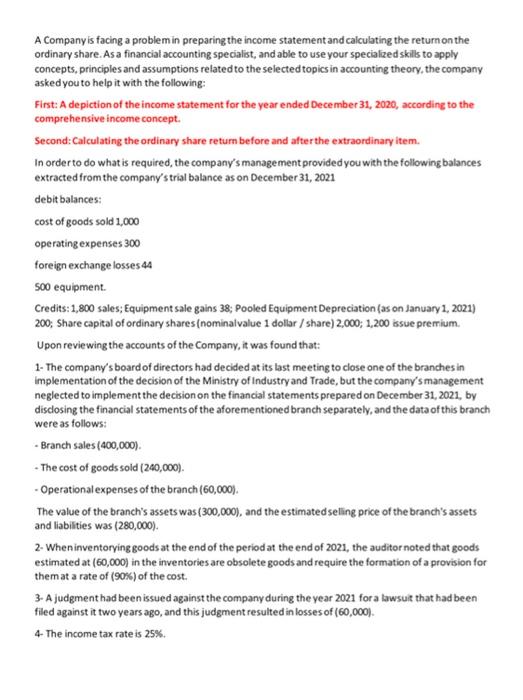

A Company is facing a problem in preparing the income statement and calculating the return on the ordinary share. As a financial accounting specialist, and able to use your specialized skills to apply concepts, principles and assumptions related to the selected topics in accounting theory, the company asked you to help it with the following: First: A depiction of the income statement for the year ended December 31, 2020, according to the comprehensive income concept. Second: Calculating the ordinary share return before and after the extraordinary item. In order to do what is required, the company's management provided you with the following balances extracted from the company's trial balance as on December 31, 2021 debit balances: cost of goods sold 1,000 operating expenses 300 foreign exchange losses 44 500 equipment. Credits: 1,800 sales; Equipment sale gains 38; Pooled Equipment Depreciation (as on January 1, 2021) 200; Share capital of ordinary shares (nominalvalue 1 dollar / share) 2,000; 1,200 issue premium. Upon reviewing the accounts of the Company, it was found that: 1- The company's board of directors had decided at its last meeting to close one of the branches in implementation of the decision of the Ministry of Industryand Trade, but the company'smanagement neglected to implement the decision on the financial statements prepared on December 31, 2021, by disclosing the financial statements of the aforementioned branch separately, and the data of this branch were as follows: - Branch sales (400,000). - The cost of goods sold (240,000). - Operational expenses of the branch (60,000). The value of the branch's assets was (300,000), and the estimated seling price of the branch's assets and liabilities was (280,000). 2. When inventorying goods at the end of the period at the end of 2021, the auditor noted that goods estimated at (60,000) in the inventories are obsolete goods and require the formation of a provision for them at a rate of (9056) of the cost. 3- A judgment had been issued against the company during the year 2021 for a lawsuit that had been filed against it two years ago, and this judgment resulted in losses of (60,000). 4. The income tax rate is 25%