Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is looking at setting up a new manufacturing plant. This will be a four-year project. The company bought some land one years ago

A company is looking at setting up a new manufacturing plant.

- This will be a four-year project.

- The company bought some land one years ago for $5 million.

- The land was appraised last month for $5.2 million. In four years, the aftertax value of the land will be $6.2 million, but the company expects to keep the land for a future project.

- The company wants to build its new manufacturing plant on this land; the plant and equipment will cost $3,600,000 to build.

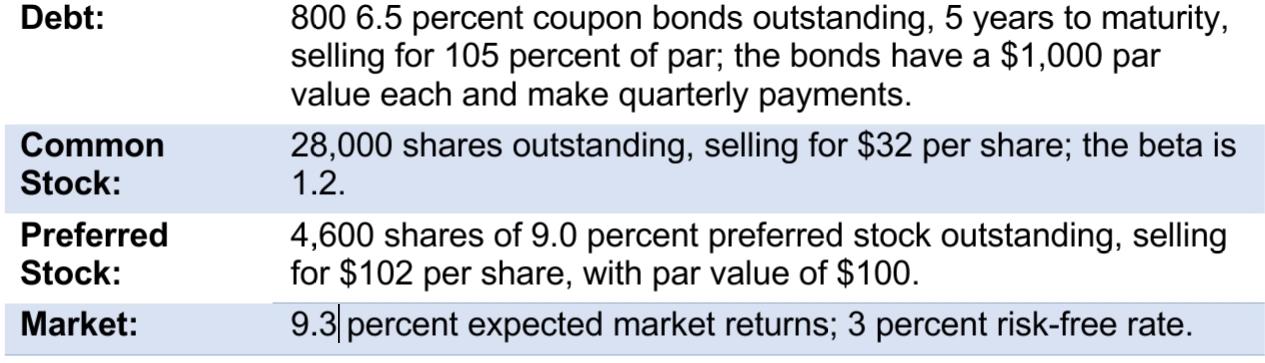

- The following is the current market structure:

- Underwriter charges the company spreads of 6 percent on new common stock issues, 4 percent on new preferred stock issues, and 5 percent on new debt issues.

- The company raise the funds needed to build the plant by using common stock, preferred stock, and debt based on the current capital structure.

- The tax rate is 22 percent.

- The project requires $220,000 in initial net working capital investment to get operational.

- Calculate the projects initial Time 0 cash flow.

- The new project is somewhat riskier than a typical project for the company. Management has told you to use an adjustment factor of +1 percent to account for this increased riskiness. Calculate the appropriate discount rate to use when evaluating this new project.

- The manufacturing plant has a five-year tax life, and the company uses straight-line depreciation. At the end of the project, the plant and equipment can be scrapped for $300,000. What is the aftertax salvage value of this plant and equipment? (3 marks)

- The company will incur $3,300,000 in annual fixed costs. The plan is to manufacture 15,000 products per year and sell them at $1,300 per machine; the variable production costs are $981 per product. What is the annual operating cash flow (OCF) from this project? (3 marks)

- What is the cash flow in each year? Will you accept the project?

- If the project is financed solely by debt, would you change your decision in part e? Please explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started