Question

A company is planning to install a new automated plastic-molding press. Two different presses are available. The initial capital investments and annual expenses for these

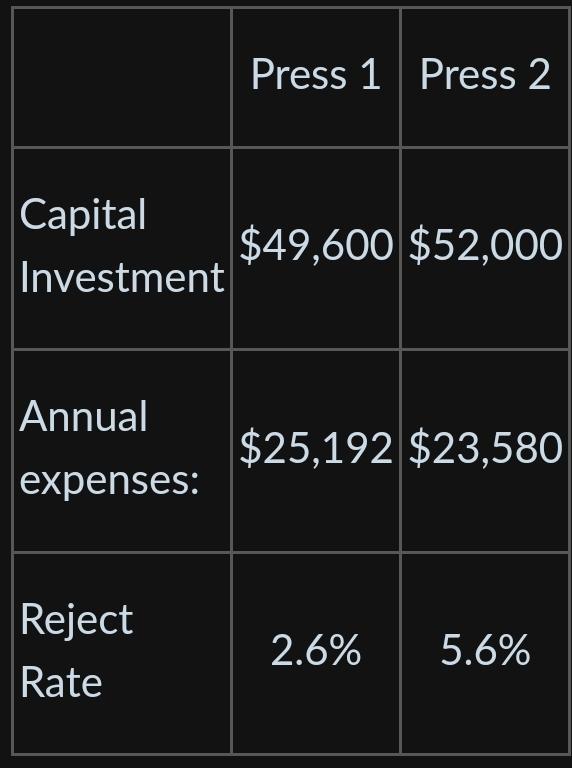

A company is planning to install a new automated plastic-molding press. Two different presses are available. The initial capital investments and annual expenses for these two mutually exclusive alternatives are as follows:

Assume that each press can produce 120,000 units per year (but the given percentage can't be sold) and has no market value at the end of its useful life; the selected analysis period is five years; and any additional capital invested is expected to earn at least 10% per year. Nondefective units can be sold for $0.375 per unit.

Assume that each press can produce 120,000 units per year (but the given percentage can't be sold) and has no market value at the end of its useful life; the selected analysis period is five years; and any additional capital invested is expected to earn at least 10% per year. Nondefective units can be sold for $0.375 per unit.

Question 1

What is the PW of Press 1? Round your answer to the nearest dollar.

Question 2

What is the PW of Press 2? Round your answer to the nearest dollar.

Question 3

Which press should be recommended?

Press 1

Press 2

Question 4

What does your recommendation tell you about the incremental IRR of the extra $2,400 investment needed for Press 2?

\begin{tabular}{|l|c|c|} \hline & Press 1 & Press 2 \\ \hline Capital Investment & $49,600 & $52,000 \\ \hline Annual expenses: & $25,192 & $23,580 \\ \hline Reject & 2.6% & 5.6% \\ \hline Rate & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started